In “Effective Strategies for Paying Off Credit Card Debt,” discover proven methods to manage and eliminate your credit card balances efficiently. Learn actionable tips to regain financial control and achieve debt freedom.

Understanding Credit Card Debt

Credit card debt is a type of revolving credit that allows you to borrow money from a lender and repay it over time, with interest. When you use a credit card, you’re essentially taking out a short-term loan. If you don’t pay off your balance in full each month, interest will be charged on the remaining amount. This interest can add up quickly, making it difficult to get out of debt.

Several factors contribute to credit card debt, including:

- Overspending: It’s easy to spend more than you can afford when you’re using a credit card, especially if you’re not closely tracking your spending.

- High-interest rates: Credit cards typically have high-interest rates, which can make it difficult to pay off your balance quickly.

- Minimum payments: Making only the minimum payment each month will keep you in debt for a long time and cost you a lot of money in interest.

- Unexpected expenses: Life is full of unexpected expenses, such as medical bills or car repairs. If you don’t have an emergency fund, you may need to use your credit card to cover these costs.

The Importance of Understanding Your Credit Card Statements

To effectively manage and pay off credit card debt, it is crucial to understand your credit card statements thoroughly. Your statement provides a detailed breakdown of your account activity, including:

- Previous balance: This shows the amount you owed at the beginning of the billing cycle.

- Purchases: All new purchases made during the billing cycle are listed here.

- Payments and credits: Any payments you made or credits received during the billing cycle are reflected here.

- Interest charged: The amount of interest accrued on your outstanding balance is shown.

- New balance: This reflects the total amount you owe after considering all transactions and interest charges.

Assessing Your Debt Situation

Before you can effectively tackle your credit card debt, it’s crucial to have a clear picture of your current financial standing. This involves understanding the scope of your debt and identifying the factors contributing to it.

1. Gather Your Credit Card Statements:

Collect all your credit card statements and note down the following information for each card:

- Outstanding balance

- Minimum payment due

- Interest rate (APR)

- Credit limit

2. Calculate Your Total Debt:

Add up the outstanding balances of all your credit cards to determine your total credit card debt. This figure will serve as the starting point for your debt payoff journey.

3. Analyze Your Spending Habits:

Review your past few months’ credit card statements and identify your spending patterns. Categorize your expenses (e.g., groceries, dining out, entertainment) to understand where your money is going. This analysis will help you pinpoint areas where you can potentially cut back on expenses and free up more cash flow for debt repayment.

4. Determine Your Debt-to-Income Ratio (DTI):

Your DTI is a key financial indicator that compares your monthly debt payments to your gross monthly income. Calculate it by dividing your total monthly debt payments (including credit cards, loans, etc.) by your gross monthly income. A lower DTI indicates better financial health and a greater ability to manage debt.

5. Identify Contributing Factors:

Reflect on the factors that have contributed to your current level of credit card debt. Was it due to overspending, unexpected expenses, or a lack of financial awareness? Understanding the root causes of your debt can help you make necessary lifestyle changes and prevent falling back into the same patterns.

Creating a Repayment Plan

A well-structured repayment plan is the cornerstone of effectively tackling credit card debt. It provides a roadmap to follow, helping you stay organized, motivated, and on track to achieve debt freedom. Here’s how to create an effective repayment plan:

1. List Out All Debts

Start by gathering information on all your credit cards. Note down the card name, outstanding balance, minimum payment, and interest rate. Organize this information in a spreadsheet or a simple notebook – clarity is key!

2. Prioritize Your Debts

There are two primary methods for prioritizing debt repayment:

- Debt Avalanche: Focus on paying down the card with the highest interest rate first. This approach saves you the most money on interest charges over time.

- Debt Snowball: Start by paying off the smallest debt first, regardless of the interest rate. This method provides a psychological boost as you see quick wins and gain momentum.

Choose the method that best aligns with your personality and financial goals.

3. Set Realistic Goals and Budget

Review your monthly income and expenses. Identify areas where you can cut back on spending to free up more cash flow for debt repayment. Be realistic – drastic cuts can be unsustainable. Aim for a balance between your current lifestyle and aggressive debt reduction.

4. Explore Debt Consolidation

If you have multiple credit cards with high interest rates, consider debt consolidation options:

- Balance Transfer Cards: Transfer high-interest balances to a card with a 0% introductory APR period. This can provide breathing room to make significant progress on your debt without accruing additional interest.

- Debt Consolidation Loan: Secure a personal loan at a lower interest rate than your credit cards, using it to pay off your existing balances. This simplifies your debt into one monthly payment.

5. Automate Payments

Schedule automatic payments to ensure you never miss a due date. Even if you can only afford slightly more than the minimum, consistent on-time payments contribute to a healthy credit score and help avoid late fees.

6. Track Progress and Stay Flexible

Regularly review your repayment plan and make adjustments as needed. Your financial situation can change, and your plan should adapt accordingly. Celebrate your milestones – every step closer to debt freedom is an achievement!

Debt Snowball vs. Debt Avalanche

When tackling credit card debt, choosing the right repayment strategy can significantly impact your success. Two popular methods are the debt snowball and the debt avalanche. Both approaches focus on paying off debts strategically, but they prioritize payments differently:

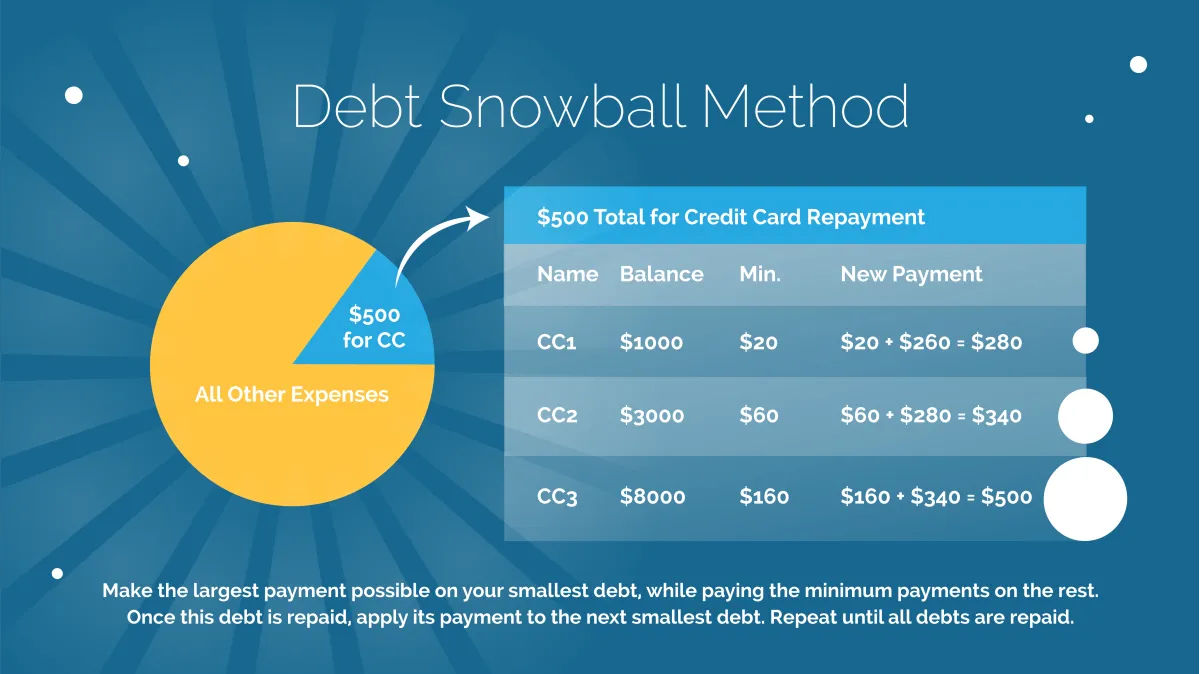

Debt Snowball

This method prioritizes motivation and building momentum. Here’s how it works:

- List all your debts from smallest to largest, regardless of interest rates.

- Make minimum payments on all debts except the smallest one.

- Put as much extra money as possible toward the smallest debt until it’s paid off.

- Once the smallest debt is gone, roll the amount you were paying on it (minimum payment plus extra) onto the next smallest debt.

- Repeat this process, gaining momentum as you “snowball” your payments toward larger debts.

Debt Avalanche

This method focuses on saving money by prioritizing high-interest debts. Here’s the breakdown:

- List all your debts from highest interest rate to lowest.

- Make minimum payments on all debts except the one with the highest interest rate.

- Contribute as much extra money as possible toward the debt with the highest interest rate.

- Once the highest-interest debt is paid off, allocate the extra funds toward the next highest-interest debt.

- Repeat this process, tackling high-interest debts first to minimize interest charges.

Which Method is Right for You?

The best method depends on your personality and financial goals. The debt snowball is great for those who need motivation and quick wins. The debt avalanche saves you money in the long run by reducing interest payments.

Tips for Reducing Interest Rates

High interest rates can make it feel like you’re drowning in credit card debt. Reducing your interest rate is a crucial step to paying off your balance faster and saving money on interest charges. Here are some effective strategies to help you lower your credit card interest rates:

1. Negotiate with Your Credit Card Issuer

Don’t be afraid to pick up the phone and negotiate a lower interest rate with your credit card company. Explain your payment history, your commitment to paying off the debt, and inquire about any potential hardship programs they offer.

2. Balance Transfer to a Lower-Interest Card

Explore balance transfer credit cards that offer a 0% introductory APR for a set period, typically 12-21 months. Transferring your balance to a lower-interest card can save you significant money on interest, giving you more breathing room to pay down the principal.

3. Consolidate Debt with a Personal Loan

Consider consolidating your credit card debt with a personal loan. Personal loans typically have lower interest rates than credit cards, especially if you have good credit. This can simplify your payments and potentially save you money on interest.

4. Improve Your Credit Score

Your credit score plays a significant role in the interest rates you qualify for. Focus on improving your credit score by paying your bills on time, reducing your credit utilization ratio, and disputing any errors on your credit report.

5. Look for Credit Card Offers with Low Ongoing APRs

If you’re not in a rush, take the time to research and compare credit card offers that feature low ongoing APRs. These cards can help you save money on interest over the long term.

Avoiding Common Debt Traps

While working towards credit card freedom, it’s crucial to be aware of and actively avoid common debt traps that can sabotage your progress. Here are some key pitfalls to watch out for:

1. Minimum Payments

Paying only the minimum amount due on your credit card bill might seem tempting, but it’s a surefire way to stay in debt longer and accrue significantly more interest. Always strive to pay as much as you can above the minimum to chip away at your principal balance faster.

2. Opening New Credit Cards for Bonuses or Rewards

While enticing, opening new credit cards while trying to pay off existing debt can lead to overspending and further financial strain. Focus on managing your current debt before taking on new lines of credit.

3. Cash Advances

Cash advances from credit cards come with high fees and often higher interest rates than regular purchases. Avoid them unless absolutely necessary, as they can quickly add to your debt burden.

4. Overspending to Earn Rewards

Don’t fall into the trap of spending more than you can afford simply to earn rewards points or cashback. If you’re not paying your balance in full each month, the interest charges will likely outweigh any rewards earned.

5. Emotional Spending

Be mindful of emotional spending, which can be triggered by stress, boredom, or social pressure. Before making a purchase, pause and consider whether you truly need the item or if it aligns with your debt payoff goals.

6. Lack of a Budget

Navigating credit card debt without a budget is like sailing without a compass. Create a detailed budget that tracks your income and expenses, allowing you to identify areas where you can cut back and redirect funds toward debt repayment.

7. Ignoring the Problem

Ignoring credit card debt won’t make it disappear. It’s crucial to face the problem head-on, create a plan for paying it off, and stick to your strategy. The longer you wait, the more interest will accumulate, making it even harder to become debt-free.

Using Balance Transfer Cards

A balance transfer card can be a powerful tool for paying down credit card debt faster and more effectively. This type of credit card allows you to transfer the balance from one or more existing credit cards to a new card with a lower interest rate. Often, balance transfer cards offer an introductory period with 0% APR, giving you a window of time to focus on paying down your debt without accruing additional interest charges.

Here’s how balance transfer cards can help you tackle your credit card debt:

- Reduce Interest Charges: The most significant advantage of balance transfer cards is the potential for substantial interest savings. By transferring your balance to a card with a lower APR, especially a 0% introductory rate, you can allocate more of your payments towards the principal balance rather than interest fees. This can significantly accelerate your debt payoff journey.

- Consolidate Debt: Juggling multiple credit card payments can be overwhelming. Balance transfer cards allow you to consolidate multiple balances onto a single card, simplifying your finances and potentially lowering your monthly payments.

- Establish a Clear Repayment Timeline: Many balance transfer cards offer introductory periods ranging from 6 to 21 months. This set timeframe can provide a clear deadline for paying off your transferred balance, encouraging you to stay on track with your repayment goals.

However, it’s crucial to consider these factors before using a balance transfer card:

- Balance Transfer Fees: Most balance transfer cards charge a fee for transferring your balance, typically a percentage of the total amount transferred (usually between 3% to 5%). Factor in this fee when calculating potential savings to ensure the transfer is financially beneficial.

- Credit Score Requirements: Qualifying for a balance transfer card with a favorable interest rate generally requires a good to excellent credit score. If your credit score is low, you might encounter higher interest rates or might not qualify for the most competitive offers.

- Post-Introductory APR: Pay close attention to the APR that takes effect after the introductory period ends. Ensure you have a plan to pay off the remaining balance before the regular APR kicks in to avoid accruing high interest charges.

Staying Debt-Free

Congratulations on paying off your credit card debt! That’s a huge accomplishment that takes dedication and discipline. But the journey isn’t over yet. Now, the key is to stay debt-free and avoid falling back into old habits.

Here are some tips to help you stay on track:

1. Create a Realistic Budget and Stick to It

Having a budget is essential for managing your money and avoiding overspending. Track your income and expenses carefully, and identify areas where you can cut back. Look for areas where you might be tempted to overspend and find ways to mitigate that.

2. Build an Emergency Fund

Unexpected expenses can pop up at any time. A healthy emergency fund can help you cover these costs without relying on credit cards. Aim to save at least three to six months’ worth of living expenses.

3. Use Credit Cards Responsibly (If at All)

If you choose to use credit cards, do so responsibly. Pay your balance in full and on time every month to avoid interest charges. Consider using a debit card or cash for purchases to avoid the temptation of overspending.

4. Set Financial Goals

Having financial goals can keep you motivated to stay debt-free. Whether it’s saving for a down payment on a house, a dream vacation, or retirement, having specific goals will help you stay focused on your financial future.

5. Track Your Progress and Celebrate Milestones

Regularly review your budget and track your progress towards your financial goals. Celebrate your successes along the way to stay motivated and reinforce positive financial habits. Remember, staying debt-free is an ongoing process that requires commitment and effort.

Conclusion

In conclusion, implementing a budget, consolidating debts, and negotiating lower interest rates are effective strategies for successfully paying off credit card debt.