Choosing the best investment strategy can be overwhelming. This article will guide you through the process of evaluating your financial goals and risk tolerance to help you make informed decisions.

Understanding Different Investment Strategies

Investing your money wisely is crucial for building wealth and achieving your financial goals. However, the world of investing can seem complex and overwhelming, especially with the wide range of investment strategies available. Understanding these strategies is the first step towards making informed investment decisions that align with your risk tolerance, time horizon, and financial objectives.

1. Value Investing

Value investing involves seeking out undervalued companies whose stock prices are believed to be trading below their intrinsic value. This strategy focuses on fundamental analysis, examining a company’s financial statements, industry trends, and management quality to identify hidden gems in the market. Value investors aim to buy these undervalued stocks and hold them for the long term, anticipating that the market will eventually recognize their true worth, leading to potential capital appreciation and dividend income.

2. Growth Investing

Growth investing centers around identifying companies with above-average growth potential. These companies may operate in rapidly expanding industries, invest heavily in research and development, or demonstrate a track record of strong revenue and earnings growth. Growth investors are willing to pay a premium for companies with promising futures, expecting their stock prices to outperform the broader market over time. However, growth investing often carries higher volatility and risk compared to value investing.

3. Income Investing

Income investing prioritizes generating a steady stream of passive income from investments. This strategy commonly involves investing in assets that pay regular dividends or interest payments, such as dividend-paying stocks, bonds, real estate investment trusts (REITs), or preferred stocks. Income investors seek to create a consistent cash flow from their portfolio, which can be particularly beneficial during retirement or for individuals seeking supplemental income.

4. Passive Investing

Passive investing aims to match the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. This is typically achieved through investing in index funds or exchange-traded funds (ETFs) that track these indices. Passive investors prioritize diversification and low costs, as index funds tend to have lower expense ratios compared to actively managed mutual funds. This strategy is suitable for investors seeking broad market exposure without the need for active stock picking.

5. Active Investing

In contrast to passive investing, active investing involves actively selecting and managing individual stocks or other assets within a portfolio. Active investors conduct in-depth research, analyze market trends, and make investment decisions based on their findings. They aim to outperform the market by identifying mispriced securities or capitalizing on short-term market fluctuations. However, active investing requires significant time, effort, and expertise, and it comes with no guarantee of outperforming the market.

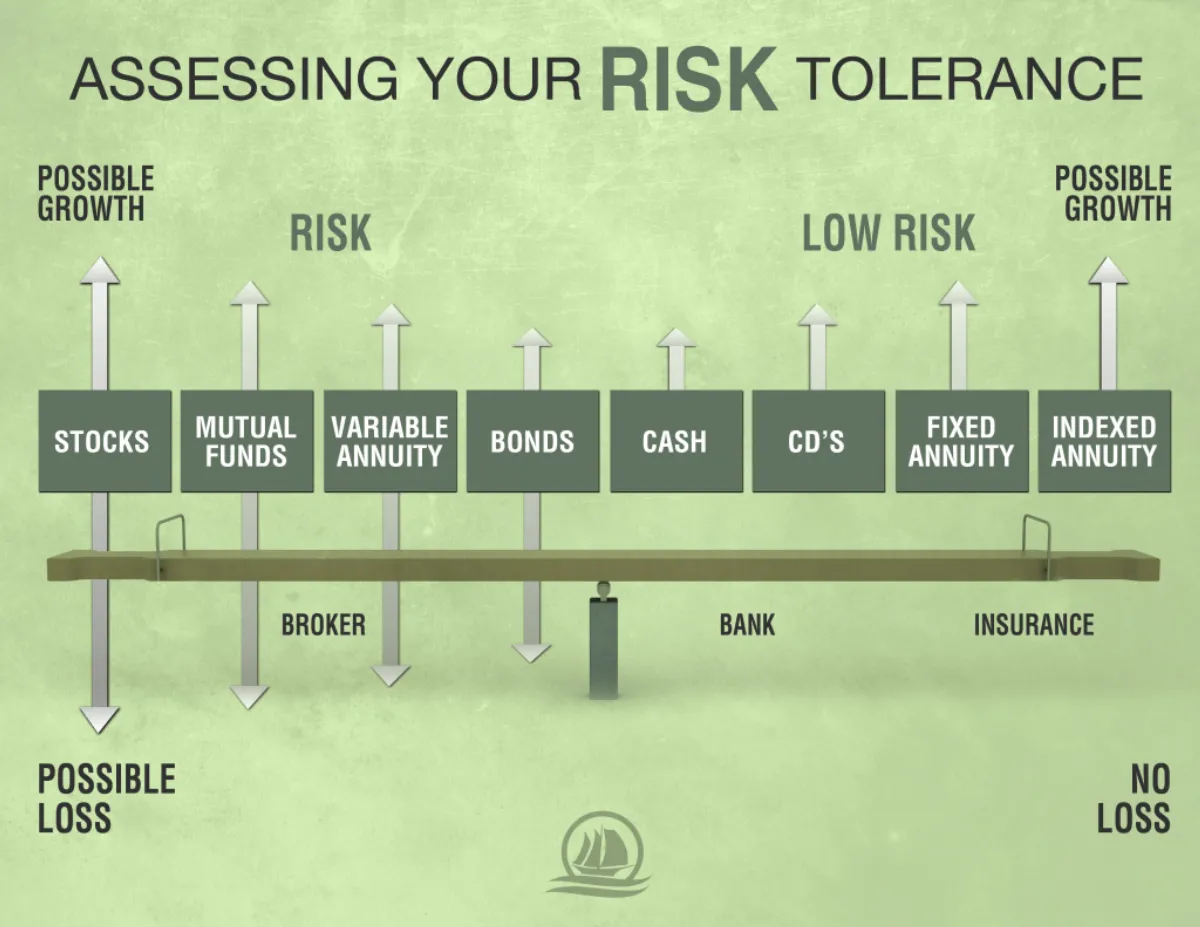

Assessing Your Risk Tolerance

Before diving into investment strategies, it’s crucial to understand your risk tolerance. This refers to your capacity and willingness to handle potential investment losses in pursuit of returns. Here’s a breakdown:

Risk Capacity vs. Risk Willingness

Risk Capacity: This is the objective measure of how much risk you *can* afford to take. It considers factors like:

- Time horizon: Longer time horizons generally allow for higher risk.

- Financial stability: A secure financial foundation enables greater risk-taking.

- Income level: Higher income often correlates with a greater ability to absorb losses.

Risk Willingness: This is the subjective measure of how much risk you are *comfortable* taking. It’s about your emotional response to market fluctuations. Do stomach-churning drops keep you up at night, or do you see them as buying opportunities?

Determining Your Risk Tolerance

There are various questionnaires and tools available online to help you assess your risk tolerance. However, honestly reflecting on the following can provide valuable insights:

- Past experiences with investments: How have you reacted to market downturns in the past?

- Financial goals: Are you aiming for aggressive growth or preserving capital?

- Sleep quality: Would the thought of potential investment losses disrupt your sleep?

Setting Investment Goals

Before you even think about specific investments, you need to define your investment goals. What are you trying to achieve with your money? This is deeply personal and will vary greatly from person to person. Here are some key questions to ask yourself:

What are you saving for?

Are you investing for retirement, a down payment on a house, your child’s education, or something else entirely? Having a specific goal in mind will help you determine your time horizon and risk tolerance.

What is your time horizon?

This refers to how long you plan to invest your money before you need to access it. A longer time horizon generally allows for riskier investments, as you have more time to recover from any potential losses. Shorter time horizons typically call for more conservative investments.

What is your risk tolerance?

This refers to how comfortable you are with the possibility of losing money on your investments. Generally speaking, higher potential returns come with higher risk, and vice versa. Your risk tolerance will be influenced by factors like your age, income, and overall financial situation.

How much can you realistically invest?

Be honest with yourself about how much money you can comfortably put towards investments on a regular basis. Even small, consistent contributions can add up to significant growth over time thanks to the power of compounding.

By clearly defining your investment goals, time horizon, risk tolerance, and investment capacity, you create a solid foundation for building a personalized investment strategy that aligns with your financial aspirations.

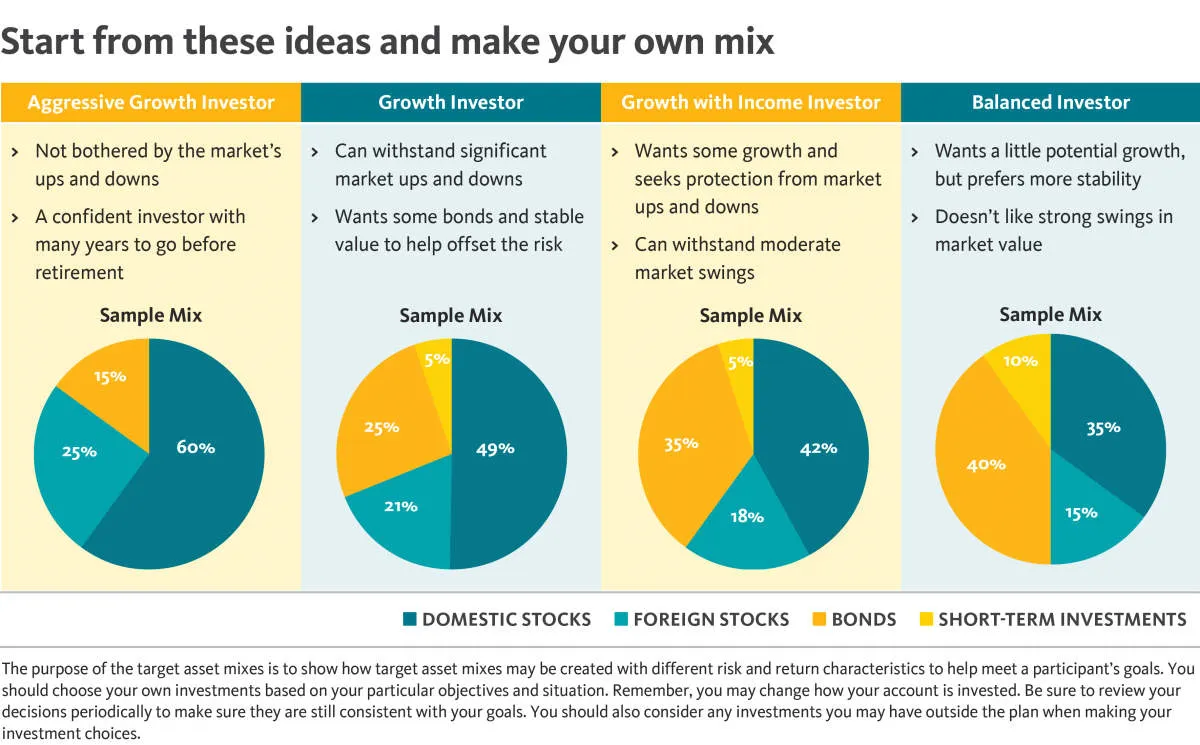

Choosing the Right Investment Mix

Building a successful investment portfolio isn’t about putting all your eggs in one basket. It’s about finding the right mix of assets that align with your financial goals, risk tolerance, and time horizon. This is where the concept of asset allocation comes in.

Asset allocation refers to the strategic distribution of your investment capital across different asset classes. The most common asset classes include:

- Stocks (Equities): Represent ownership in publicly traded companies. They offer potential for high growth but also come with higher volatility.

- Bonds (Fixed Income): Essentially loans you make to governments or corporations. They typically offer lower returns than stocks but are generally less volatile.

- Cash and Cash Equivalents: Highly liquid assets like savings accounts, money market funds, and short-term treasury bills. They offer stability but limited growth potential.

- Real Estate: Includes residential or commercial properties. It can provide both income and appreciation but can be illiquid.

- Alternative Investments: Include commodities, hedge funds, private equity, and more. They can provide diversification but often come with higher risks and fees.

The right investment mix for you will depend on several factors, including:

1. Risk Tolerance

How comfortable are you with the possibility of your investments fluctuating in value? Investors with a higher risk tolerance may allocate a larger portion to stocks, while those with a lower risk tolerance may prefer a more conservative approach with a higher allocation to bonds or cash.

2. Time Horizon

When do you need to access your invested money? If you have a long time horizon, you can ride out market fluctuations and potentially benefit from long-term growth in assets like stocks. A shorter time horizon may warrant a more conservative approach to preserve capital.

3. Financial Goals

Are you investing for retirement, a down payment on a home, or your child’s education? Your financial goals will significantly influence your investment mix. For example, a long-term goal like retirement may allow for a more aggressive portfolio, while a short-term goal may necessitate a more conservative approach.

Remember, diversification is key. By spreading your investments across different asset classes, you can potentially minimize losses and enhance returns. It’s also crucial to regularly review and adjust your investment mix as your circumstances and market conditions change.

Diversifying Your Portfolio

Don’t put all your eggs in one basket. You’ve probably heard this adage before, and it rings especially true when it comes to investing. Diversification is a risk management strategy that involves spreading your investments across a range of asset classes, industries, and geographical locations. This approach aims to reduce the impact of any single investment performing poorly on your overall portfolio.

Why is Diversification Important?

Diversification is crucial because different asset classes tend to perform differently under various market conditions. For example, when stocks are struggling, bonds might be performing well, and vice versa. By diversifying, you can potentially:

- Reduce Volatility: A well-diversified portfolio is likely to experience smoother returns over time, as losses in one area can be offset by gains in another.

- Mitigate Risk: Diversification helps protect your portfolio from the negative impact of unforeseen events that could affect a particular company, industry, or even an entire country.

- Enhance Potential Returns: By investing in a variety of assets, you increase your chances of capturing growth opportunities across different sectors and markets.

How to Diversify Your Portfolio

There are several ways to diversify your portfolio, and the best approach for you will depend on your individual financial goals, risk tolerance, and time horizon. Here are some common diversification strategies:

- Asset Allocation: Determine the percentage of your portfolio you want to allocate to major asset classes like stocks, bonds, and cash equivalents. This allocation should align with your risk profile and investment goals.

- Within Asset Class Diversification: Don’t just invest in large-cap stocks; consider including small-cap and mid-cap stocks as well. Within bonds, explore different maturities and credit qualities. For international exposure, research various emerging and developed markets.

- Regular Review and Rebalancing: Market fluctuations can cause your initial asset allocation to drift. Regularly review your portfolio and rebalance it to ensure it still aligns with your investment strategy.

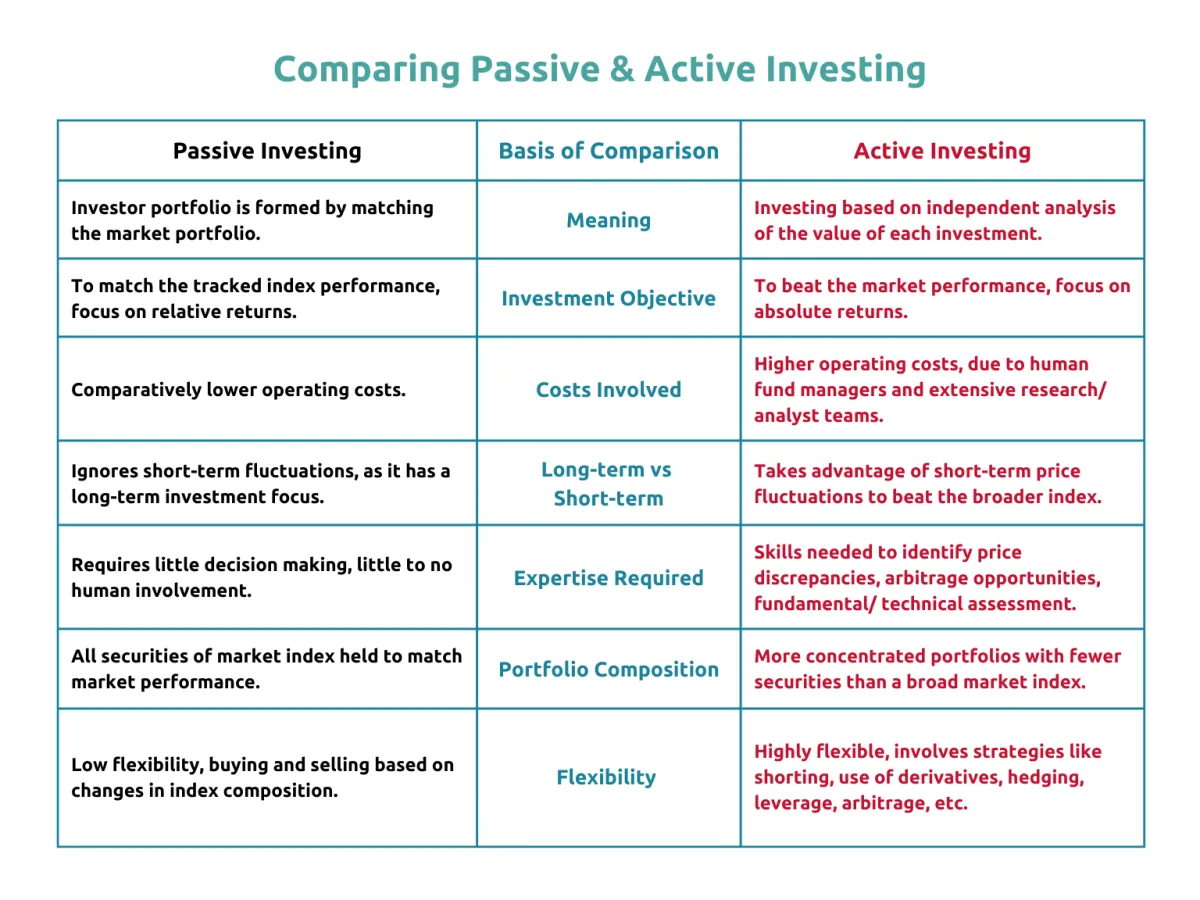

Active vs. Passive Investing

When it comes to growing your wealth in the financial markets, there are two primary approaches: active investing and passive investing. Understanding the core differences between these strategies is crucial in determining the most suitable option for your financial goals, risk tolerance, and time commitment.

Active Investing: Seeking Outperformance

Active investing involves a hands-on approach where investors, or their chosen fund managers, actively make investment decisions, buying and selling assets with the goal of outperforming a specific benchmark or market index.

Key Characteristics of Active Investing:

- Frequent Trading: Active managers adjust portfolios regularly, responding to market trends and economic data.

- In-Depth Research: Significant time and resources are dedicated to analyzing individual securities, market sectors, and economic indicators.

- Higher Fees: Active management typically involves higher fees due to the expertise and resources required for research and frequent trading.

Passive Investing: Tracking the Market

Passive investing centers around building a diversified portfolio that aims to replicate the performance of a particular market index, such as the S&P 500 or a bond index.

Key Characteristics of Passive Investing:

- Buy-and-Hold Approach: Passive investors generally hold investments for the long term, minimizing buying and selling activity.

- Lower Costs: Passive investment vehicles like index funds and ETFs tend to have significantly lower fees compared to actively managed funds.

- Broad Market Exposure: Investing in index-tracking funds provides instant diversification across a wide range of assets within the chosen index.

Monitoring and Adjusting Your Strategy

Once you’ve implemented your investment strategy, it’s not a “set it and forget it” situation. Market conditions change, your financial goals might evolve, and your risk tolerance can fluctuate. Regularly monitoring your portfolio and making necessary adjustments is crucial to staying on track.

How Often to Monitor

The frequency of monitoring depends on your investment style and time commitment. Active investors might check their portfolios daily or weekly, while passive investors may only review them quarterly or annually. Find a balance that provides peace of mind without leading to impulsive decisions.

Key Aspects to Monitor

- Portfolio Performance: Compare your returns to relevant benchmarks and assess whether your investments are meeting your expectations.

- Asset Allocation: Over time, your target asset allocation may drift due to market fluctuations. Rebalance your portfolio periodically to realign with your desired risk level.

- Investment Goals: Life throws curveballs. Have your financial goals changed? A job change, new family member, or nearing retirement all warrant a review of your investment strategy.

- Risk Tolerance: Your risk tolerance can shift based on market conditions and personal circumstances. If you’re feeling overly anxious about market volatility, it might be time to reassess your risk appetite.

Making Adjustments

Adjustments should be made strategically, not emotionally. Avoid making rash decisions based on short-term market swings. When changes are needed, consider:

- Rebalancing: Sell over-performing assets and buy under-performing ones to bring your portfolio back to your target allocation.

- Tax Efficiency: Be mindful of capital gains taxes when selling assets. Consider tax-loss harvesting strategies to offset potential gains.

- Seeking Professional Advice: If you’re unsure about how to adjust your strategy, consult with a qualified financial advisor. They can provide personalized guidance based on your unique circumstances.

Seeking Professional Advice

While this article provides a general overview of investment strategies, it’s crucial to remember that personal financial situations can vary greatly. What works for one person might not be the best approach for another. That’s where seeking guidance from a financial advisor can be invaluable.

A financial advisor can provide personalized advice tailored to your specific circumstances, including:

- Assessing your risk tolerance and investment goals

- Developing a customized investment plan

- Recommending specific investments and asset allocations

- Providing ongoing portfolio management and adjustments

- Answering your questions and offering financial education

When choosing a financial advisor, consider their:

- Credentials and experience

- Fee structure

- Communication style and how well you connect with them

Remember, investing involves inherent risks, and seeking professional advice can help you navigate those risks more effectively and make informed decisions aligned with your financial goals.

Conclusion

Choosing the right investment strategy requires assessing your financial goals, risk tolerance, and time horizon. It’s essential to diversify your portfolio and regularly review your investments to ensure they align with your objectives.