Learn top strategies to build a robust investment portfolio, from diversification to risk management. Discover key insights to maximize your investment success.

Understanding Portfolio Building

Building an investment portfolio is a fundamental aspect of securing your financial future and achieving your long-term financial goals. It’s about strategically allocating your capital across a diversified mix of assets to mitigate risk and maximize returns. This process is not about chasing quick profits but rather a disciplined approach to growing your wealth over time.

What is an Investment Portfolio?

An investment portfolio is essentially a basket containing various investment assets that you hold. These assets can include:

- Stocks: Representing ownership shares in publicly traded companies.

- Bonds: Essentially loans you provide to governments or corporations in exchange for interest payments.

- Mutual Funds and Exchange-Traded Funds (ETFs): Offering instant diversification by pooling money from multiple investors to invest in a basket of assets.

- Real Estate: Physical properties like residential or commercial buildings.

- Commodities: Raw materials such as gold, oil, or agricultural products.

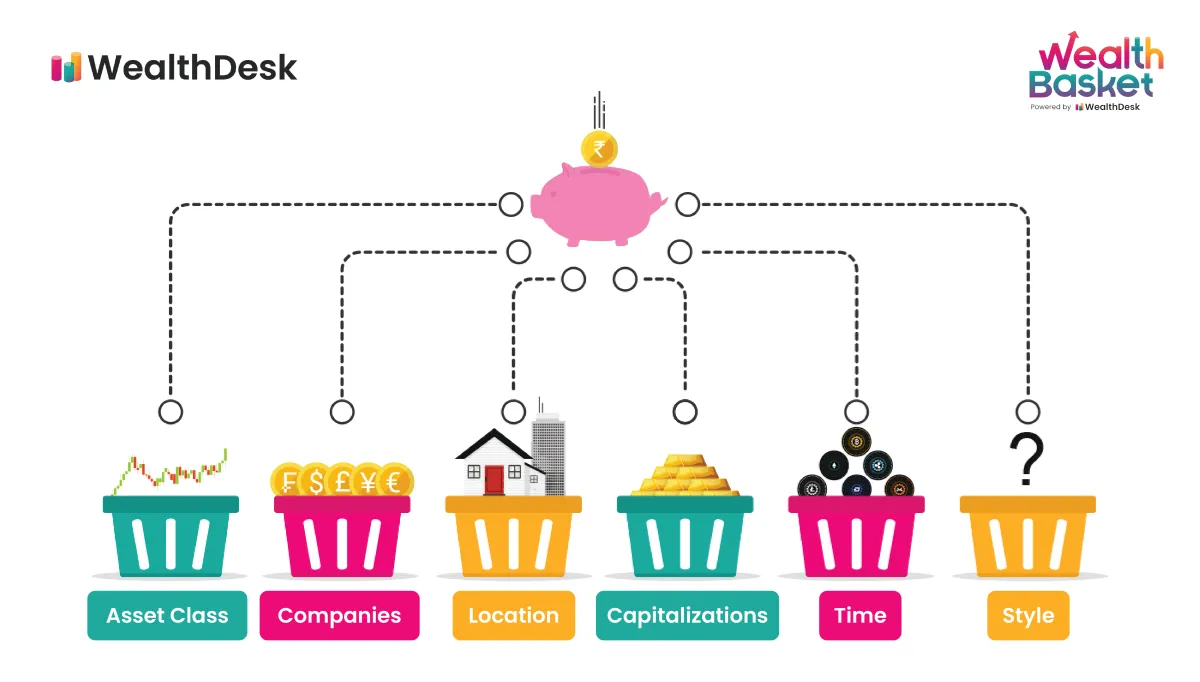

The Importance of Diversification

A core principle of portfolio building is diversification, often dubbed “not putting all your eggs in one basket.” Diversification involves spreading your investments across different asset classes, industries, and geographical regions. The goal is to reduce the impact of any single investment performing poorly on your overall portfolio.

Setting Investment Goals

Before diving headfirst into the world of investing, it’s crucial to establish clear and concise investment goals. These goals act as your financial compass, guiding your investment decisions and helping you stay focused on your desired outcomes.

Consider these key factors when setting your investment goals:

- Time Horizon: When do you need to access the invested funds? Short-term goals (within 5 years) require different investment strategies than long-term goals (10+ years).

- Risk Tolerance: How comfortable are you with the possibility of market fluctuations? A higher risk tolerance may lead to greater potential returns but also comes with a higher chance of losses.

- Financial Situation: Assess your current income, expenses, debts, and assets. Understanding your overall financial picture helps determine how much capital you can realistically invest.

- Specific Objectives: Are you saving for retirement? A down payment on a house? Clearly define your objectives to align your investment choices accordingly.

Remember to make your goals measurable, attainable, relevant, and time-bound (SMART goals). This approach will keep you motivated and on track throughout your investment journey.

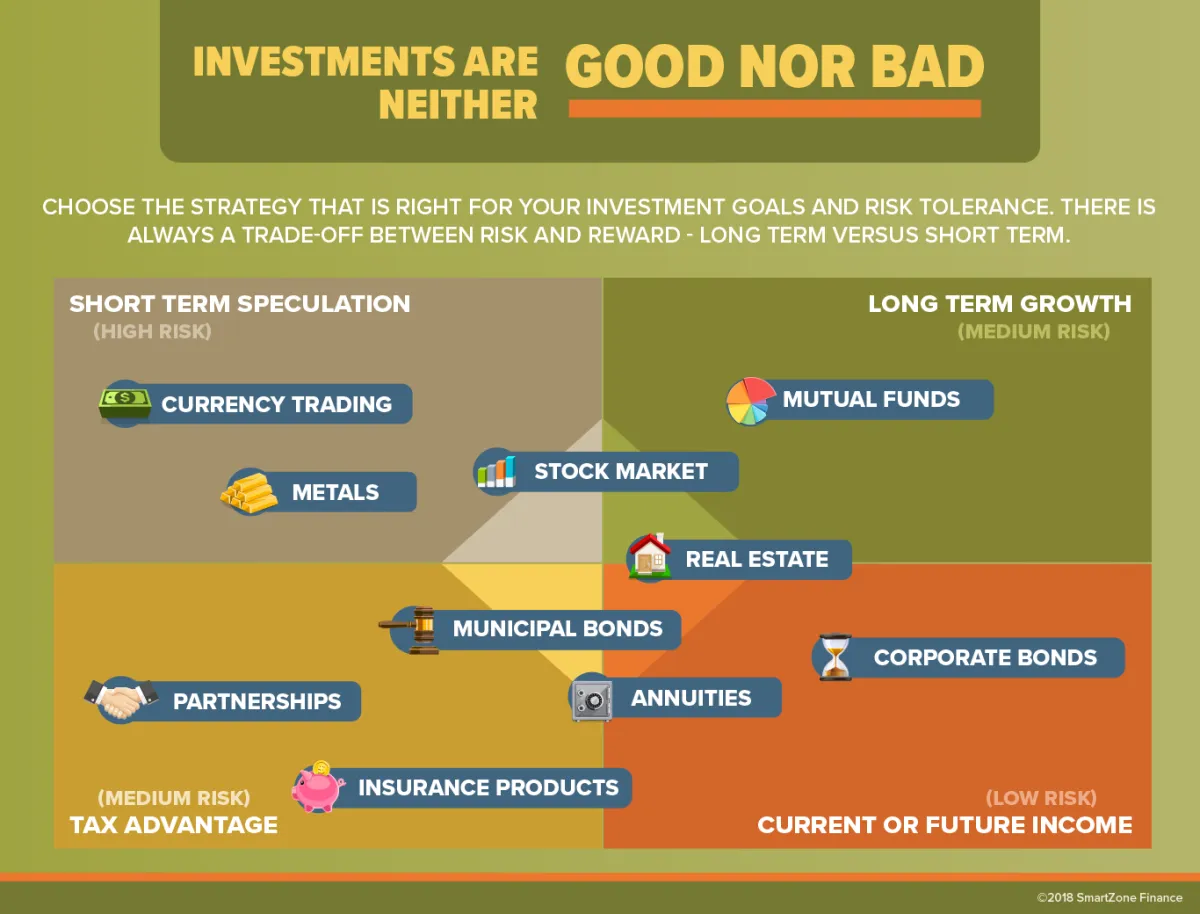

Choosing the Right Mix of Investments

Building a strong investment portfolio isn’t about picking a single “winner,” but rather about diversification – spreading your money across different asset classes to manage risk and maximize potential returns. The ideal mix for you depends on several factors:

1. Risk Tolerance

How much volatility are you comfortable with?

- High-risk tolerance: You might allocate more to growth stocks or emerging markets, which offer higher potential returns but also come with greater fluctuations.

- Low-risk tolerance: A larger portion of your portfolio might be in bonds or cash equivalents, which offer stability but may have lower growth potential.

2. Investment Time Horizon

When do you need to access your invested funds?

- Long-term goals (retirement, for example): Allow you to ride out market dips and potentially benefit from long-term growth in stocks or real estate.

- Short-term goals (down payment on a house): Might require more conservative investments that are less affected by market swings.

3. Financial Goals

What are you saving and investing for?

- Retirement: May call for a mix that balances growth and income generation.

- Preserving capital: Might involve a greater emphasis on low-risk investments.

4. Asset Allocation Strategies

Consider these common approaches (but consult a financial advisor for personalized guidance):

- Rule of 100: Subtract your age from 100 – the resulting number is the percentage you might allocate to stocks, with the remainder in bonds.

- Target-date funds: Automatically adjust their asset allocation to become more conservative as you approach your retirement date.

Diversifying Your Portfolio

Diversification is a risk management strategy that involves spreading your investments across a range of asset classes, sectors, and geographical regions. The goal is to reduce the impact of any single investment on your overall portfolio performance.

Here’s why diversification is crucial:

- Reduces Risk: If one investment performs poorly, others can potentially offset the losses. It cushions your portfolio against market volatility.

- Enhances Potential Returns: By investing in different areas, you increase your chances of capturing gains in various market conditions.

- Provides Long-Term Stability: Diversification smooths out the ups and downs inherent in investing, making it easier to stick with your long-term financial plan.

Key Asset Classes to Consider:

- Stocks (Equities): Represent ownership in publicly traded companies. Offer potential for high growth but come with higher volatility.

- Bonds (Fixed Income): Loans you make to governments or corporations. Generally less risky than stocks and provide steady income.

- Real Estate: Tangible assets like land or property. Can offer rental income and potential for appreciation.

- Commodities: Raw materials like gold, oil, or agricultural products. Can act as an inflation hedge.

- Alternative Investments: Include hedge funds, private equity, and venture capital. Can provide further diversification but often come with higher risks and fees.

Risk Management Strategies

Building a strong investment portfolio isn’t just about picking winning stocks. It’s also about managing risk effectively to protect your hard-earned money. Here’s how:

1. Diversification: Don’t Put All Your Eggs in One Basket

Diversification is the cornerstone of risk management. By spreading your investments across different asset classes (stocks, bonds, real estate, etc.), sectors, and geographies, you reduce the impact of a single investment performing poorly. If one area of your portfolio takes a hit, the others can cushion the blow.

2. Asset Allocation: Finding the Right Balance

Determine your risk tolerance and investment timeline to establish an appropriate asset allocation strategy. A younger investor with a longer time horizon might allocate a larger portion to stocks (higher risk, higher potential return), while someone closer to retirement might favor a more conservative approach with a higher allocation to bonds.

3. Understand Your Investments

Thoroughly research any investment before putting your money into it. Understand the potential risks and rewards. Don’t invest in something you don’t comprehend. Knowledge is power when it comes to managing risk.

4. Set Stop-Loss Orders

Consider using stop-loss orders to automatically sell a security when it reaches a certain price. This can help limit potential losses if a stock starts to decline significantly.

5. Regularly Review and Rebalance

Market fluctuations can shift your portfolio’s asset allocation over time. Regularly review and rebalance your portfolio to ensure it still aligns with your risk tolerance and investment goals.

6. Seek Professional Advice

Consider consulting with a qualified financial advisor who can provide personalized guidance on risk management and investment strategies tailored to your specific financial situation.

Regularly Rebalancing Your Portfolio

Rebalancing is the process of realigning the asset allocation of your portfolio to your original target weights. As market conditions change, some assets may outperform others, causing your portfolio to drift from its intended allocation. This can expose you to more or less risk than you’re comfortable with.

For example, let’s say your target portfolio allocation is 60% stocks and 40% bonds. After a strong bull market, your stock holdings may grow to represent 75% of your portfolio. This means you’re now overexposed to stock market volatility. Rebalancing involves selling some of your stock holdings and purchasing bonds to bring your portfolio back to the desired 60/40 split.

Benefits of Rebalancing

- Maintains Risk Profile: Rebalancing keeps your investments aligned with your risk tolerance, preventing you from becoming overly exposed to any single asset class.

- Enforces Discipline: Regular rebalancing encourages a disciplined approach to investing, helping you avoid emotional decision-making based on market swings.

- Potential to Enhance Returns: While not guaranteed, rebalancing can sometimes enhance returns by prompting you to “buy low and sell high.” You’re essentially selling assets that have become relatively expensive and buying assets that have become relatively cheap.

How Often Should You Rebalance?

There’s no one-size-fits-all answer to how often you should rebalance. Some common approaches include:

- Calendar-based rebalancing: Rebalance your portfolio on a set schedule, such as quarterly or annually.

- Threshold-based rebalancing: Rebalance whenever an asset class drifts more than a certain percentage from its target allocation (e.g., 5% or 10%).

The best approach for you will depend on your individual circumstances, risk tolerance, and how actively you want to manage your portfolio.

Monitoring Investment Performance

Building a strong investment portfolio isn’t a “set it and forget it” endeavor. Regular monitoring is crucial to ensure your investments continue aligning with your financial goals and risk tolerance. Here’s how to effectively track your portfolio’s performance:

1. Establish a Benchmark

Don’t just look at raw numbers. Compare your portfolio’s returns against relevant benchmarks like the S&P 500 (for stocks) or a bond index. This gives you context and helps assess if your investment strategy is outperforming or lagging behind the market.

2. Review Frequency

Resist the urge to check your portfolio daily, as short-term fluctuations are normal. Aim for a quarterly review, unless you’re nearing a major financial goal or experiencing significant market shifts.

3. Analyze Asset Allocation

Over time, your initial asset allocation—the percentage of stocks, bonds, etc.—may drift. Rebalance your portfolio periodically to realign with your desired risk level and long-term goals.

4. Evaluate Individual Holdings

Are certain investments consistently underperforming compared to their benchmarks? Identify weak links and determine if they warrant further research or potential replacement with stronger performers.

5. Consider External Factors

Factor in broader economic conditions, interest rate changes, and geopolitical events that might influence your portfolio’s performance. This big-picture perspective aids in making informed investment decisions.

6. Leverage Technology

Utilize online platforms, financial software, or mobile apps to streamline monitoring. Many tools offer real-time data, performance charts, and personalized alerts, making it easier to stay on top of your investments.

Seeking Professional Advice

Building a strong investment portfolio often requires more than just personal knowledge and research. Seeking advice from a qualified financial advisor can provide invaluable insights and guidance tailored to your specific financial situation, goals, and risk tolerance.

Benefits of Professional Financial Advice:

- Personalized Investment Strategy: A financial advisor can help you create a customized investment plan aligned with your financial goals, time horizon, and risk appetite.

- Objective Perspective: Financial advisors offer an unbiased viewpoint, helping you make rational investment decisions and avoid emotional biases.

- Diversification Expertise: They can guide you in diversifying your portfolio across different asset classes, sectors, and geographical regions to manage risk effectively.

- Market Knowledge and Analysis: Financial advisors stay updated on market trends, economic indicators, and investment opportunities, providing valuable insights to inform your decisions.

- Regular Portfolio Monitoring and Rebalancing: They can help you monitor your portfolio’s performance and make necessary adjustments to ensure it stays aligned with your goals.

Choosing the Right Financial Advisor:

When selecting a financial advisor, consider their credentials, experience, fee structure, and whether their investment philosophy aligns with yours. Look for advisors who are Certified Financial Planners (CFPs) or Chartered Financial Analysts (CFAs), as these designations indicate a high level of competency and ethical standards.

Conclusion

Implementing diversification, thorough research, and long-term perspective are key elements in constructing a resilient investment portfolio.