Learn practical tips and strategies on how to save money on medical expenses in our comprehensive guide. From choosing the right insurance plan to utilizing healthcare discounts, we’ve got you covered.

Understanding Medical Expenses

Before you can effectively save money on medical expenses, it’s crucial to understand what constitutes these costs. Medical expenses are not just limited to doctor’s visits. They encompass a wide range of products and services related to your health and well-being. Here’s a breakdown:

Direct Medical Costs:

- Doctor’s visits: This includes consultations with general practitioners, specialists, and surgeons.

- Hospital stays: Costs associated with inpatient care, including room charges, nursing care, and meals.

- Emergency room visits: Typically more expensive than regular doctor’s visits, these are for immediate and urgent medical needs.

- Prescription drugs: Costs vary greatly depending on the medication, dosage, and whether you have insurance coverage.

- Medical tests and procedures: This category includes blood tests, X-rays, MRIs, surgeries, and more.

- Medical equipment: Costs for items like crutches, wheelchairs, oxygen tanks, and other assistive devices.

Indirect Medical Costs:

- Transportation: Costs associated with traveling to and from medical appointments, including gas, parking, or public transit.

- Childcare: If you need someone to watch your children during medical appointments or hospital stays.

- Lost wages: Taking time off work for medical reasons can lead to a loss of income.

Understanding the different types of medical expenses can help you anticipate costs, budget accordingly, and explore potential areas where you can save money.

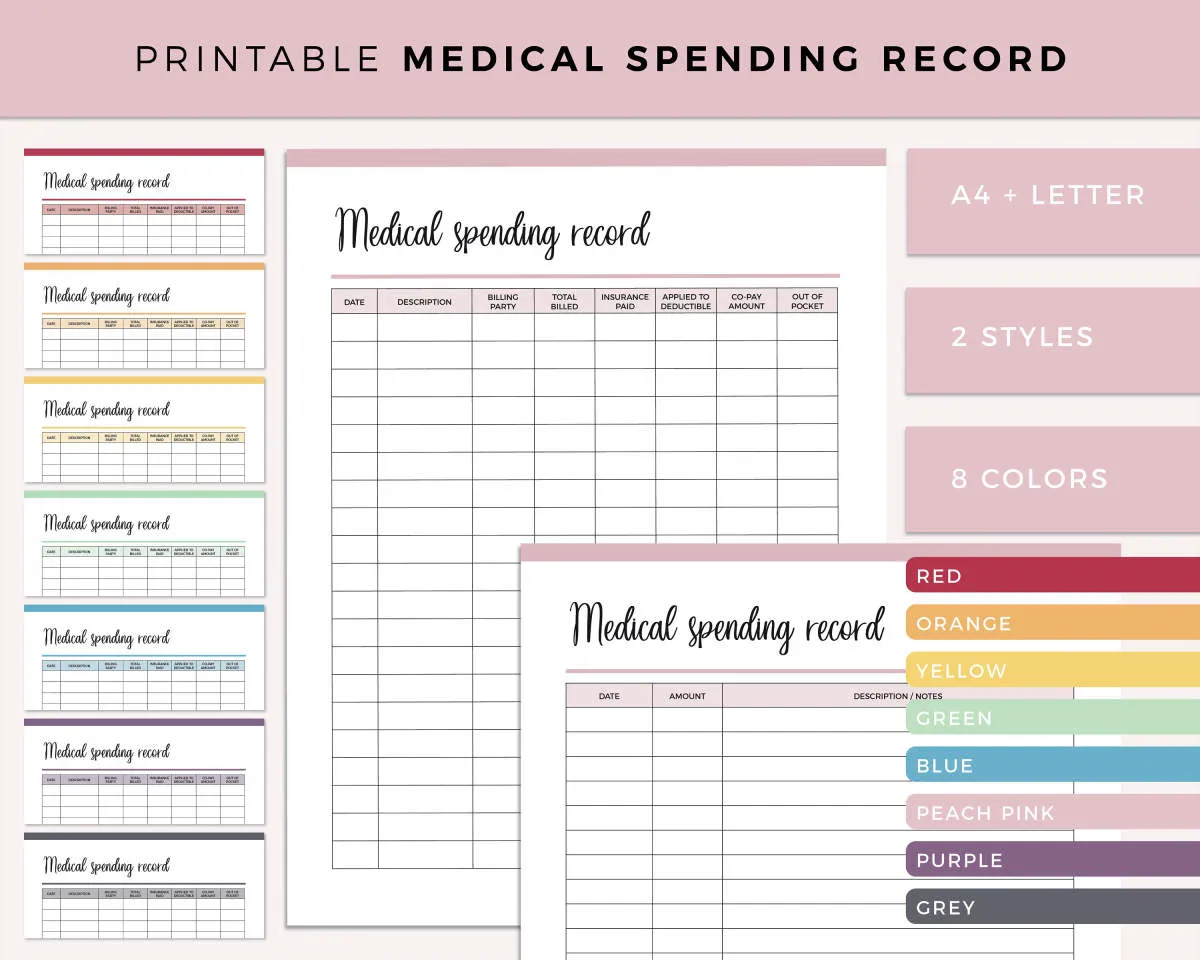

Creating a Medical Budget

Just like managing your everyday finances, creating a medical budget can give you a clearer picture of your healthcare expenses and help you identify potential savings. Here’s how to get started:

1. Track Your Medical Spending

Begin by tracking all your medical expenses for a few months. This includes:

- Doctor’s visits (including co-pays and deductibles)

- Hospital stays

- Prescription medications

- Medical equipment

- Therapy sessions

- Dental and vision care

- Insurance premiums

Use a spreadsheet, budgeting app, or even a simple notebook to record these expenses.

2. Categorize Your Expenses

Once you have a record of your spending, categorize your medical expenses. This will help you identify areas where you spend the most and where you might be able to cut back.

3. Set Realistic Goals

Look for potential areas where you can reduce spending. Can you explore generic medications? Are there alternative therapies to consider? Remember to be realistic and prioritize your health needs.

4. Allocate Funds Regularly

Treat your medical budget like any other essential expense category. Consider setting aside a specific amount each month towards your medical fund. This can help you be prepared for both expected and unexpected medical costs.

5. Review and Adjust

Regularly review your medical budget, especially if you experience changes in your health, insurance plan, or medical needs. Life changes, and your budget should adapt alongside those changes.

Finding Affordable Health Insurance

One of the most significant medical expenses you face is health insurance. Thankfully, there are ways to find affordable coverage without sacrificing quality.

1. Explore the Marketplace

The Health Insurance Marketplace (healthcare.gov) offers a range of plans from different providers. During open enrollment, you can compare plans side-by-side and see if you qualify for subsidies based on your income.

2. Consider a High-Deductible Health Plan (HDHP)

If you’re relatively healthy, an HDHP often has lower monthly premiums. While you’ll have a higher deductible to meet before insurance kicks in, you can pair an HDHP with a Health Savings Account (HSA) to save on medical expenses tax-free.

3. Check for Employer-Sponsored Plans

If your employer offers health insurance, it’s usually the most affordable option. Carefully compare the plans offered and factor in your employer’s contribution towards premiums.

4. Look into Group Plans

Joining a group plan through a professional organization, union, or alumni association can give you access to lower rates due to collective bargaining power.

5. Negotiate with Providers

Don’t be afraid to negotiate with insurance companies. Ask about discounts, payment plans, or if they offer any wellness programs that could lower your premiums.

Saving on Prescription Costs

Prescription drugs can put a serious dent in your budget, but there are ways to save without compromising your health. Here are some strategies to consider:

1. Ask for Generics

Generic medications contain the same active ingredients as brand-name drugs but are significantly cheaper. Always ask your doctor if a generic version is available for your prescription.

2. Explore Discount Programs

Several discount programs can help you save money on prescription medications. These programs work independently from insurance and often offer significant savings, especially for those without prescription drug coverage. Popular options include GoodRx, SingleCare, and RxSaver.

3. Utilize Mail-Order Pharmacies

For long-term prescriptions, consider using a mail-order pharmacy. They often provide discounts for ordering larger quantities and may offer lower prices than traditional pharmacies.

4. Negotiate with Your Pharmacist

You might be surprised to learn that you can negotiate prescription drug prices with your pharmacist. They may be willing to match a lower price you found elsewhere or offer a discount for cash payments.

5. Discuss Treatment Options with Your Doctor

Don’t hesitate to talk to your doctor about more affordable treatment options. They may be aware of alternative medications or therapies that are more budget-friendly.

6. Check for Manufacturer Coupons and Assistance Programs

Many pharmaceutical companies offer coupons and patient assistance programs to help offset the cost of their medications. You can often find these programs on the manufacturer’s website or by contacting them directly.

7. Review Your Insurance Coverage

Familiarize yourself with your health insurance plan’s formulary and prescription drug coverage. Understanding your plan’s tiers and co-pay structure can help you make informed decisions about your prescriptions.

Using Health Savings Accounts

A Health Savings Account (HSA) is a tax-advantaged account that can be used to save and pay for qualified medical expenses. To be eligible for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP).

Benefits of Using an HSA:

- Triple Tax Advantages: Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- Funds Roll Over: Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year after year, allowing for long-term savings.

- Portable: HSAs are owned by the individual, not the employer, so you can take them with you if you change jobs or retire.

How to Use an HSA:

- Open an HSA account with a qualified custodian.

- Contribute to your HSA up to the annual contribution limit.

- Use your HSA funds to pay for eligible medical expenses, such as deductibles, copayments, and prescription drugs.

Maximizing Your HSA:

- Consider making the maximum contribution each year to take advantage of the tax benefits.

- If possible, pay for medical expenses out-of-pocket and let your HSA funds grow tax-free.

- Explore investment options within your HSA to potentially accelerate savings growth.

Negotiating Medical Bills

Medical bills can put a serious strain on your finances, but don’t despair. Many people don’t realize that medical bills are often negotiable. You can take steps to potentially lower your costs and make your healthcare more affordable.

Tips for Negotiating Medical Bills:

- Review Your Bill Carefully: Before you even consider negotiating, scrutinize your medical bill for any errors. Look for duplicate charges, incorrect dates, or services you didn’t receive. You’d be surprised how often mistakes happen.

- Contact Your Provider: Reach out to your doctor’s office or the hospital billing department. Explain your financial situation and ask if they offer payment plans, discounts for prompt payment, or if they’d be willing to reduce the overall bill.

- Negotiate a Lower Rate: Don’t be afraid to negotiate. Medical providers are sometimes willing to accept less than the full amount, especially if it means getting paid something rather than nothing.

- Consider a Payment Plan: If you can’t afford to pay the bill all at once, ask about setting up a payment plan. This can make the cost more manageable over time.

- Seek Professional Help: If you’re struggling to navigate the negotiation process on your own, consider enlisting the help of a medical billing advocate. These professionals can help you understand your bills, spot errors, and negotiate on your behalf for a fee.

Planning for Medical Emergencies

Medical emergencies are never expected and often come with a hefty price tag. While you can’t always prevent accidents or illnesses, you can take steps to mitigate the financial burden should an emergency arise. Here are some things to consider:

1. Build an Emergency Fund

Having a dedicated emergency fund is crucial for handling unexpected medical costs. Aim to save at least three to six months’ worth of living expenses. This fund can help cover deductibles, copayments, and out-of-pocket expenses associated with emergency care.

2. Understand Your Health Insurance Policy

Take the time to thoroughly review your health insurance policy. Understand your coverage limits, deductibles, copayments, and out-of-network benefits. Knowing the ins and outs of your policy will help you make informed decisions during a medical emergency.

3. Research In-Network Providers

Familiarize yourself with hospitals and healthcare providers within your insurance network. Seeking care within your network can significantly reduce your out-of-pocket expenses. Keep a list of in-network providers easily accessible in case of an emergency.

4. Consider a High-Deductible Health Plan (HDHP) with a Health Savings Account (HSA)

If you’re generally healthy, an HDHP with an HSA can be a financially savvy option. These plans come with lower premiums and allow you to contribute pre-tax dollars to an HSA, which can be used for qualified medical expenses, including emergency care.

5. Prepare a Medical Emergency Kit

Assemble a medical emergency kit containing essential supplies like bandages, antiseptics, pain relievers, and a first-aid manual. Having these items readily available can help address minor injuries at home, potentially preventing unnecessary trips to the emergency room.

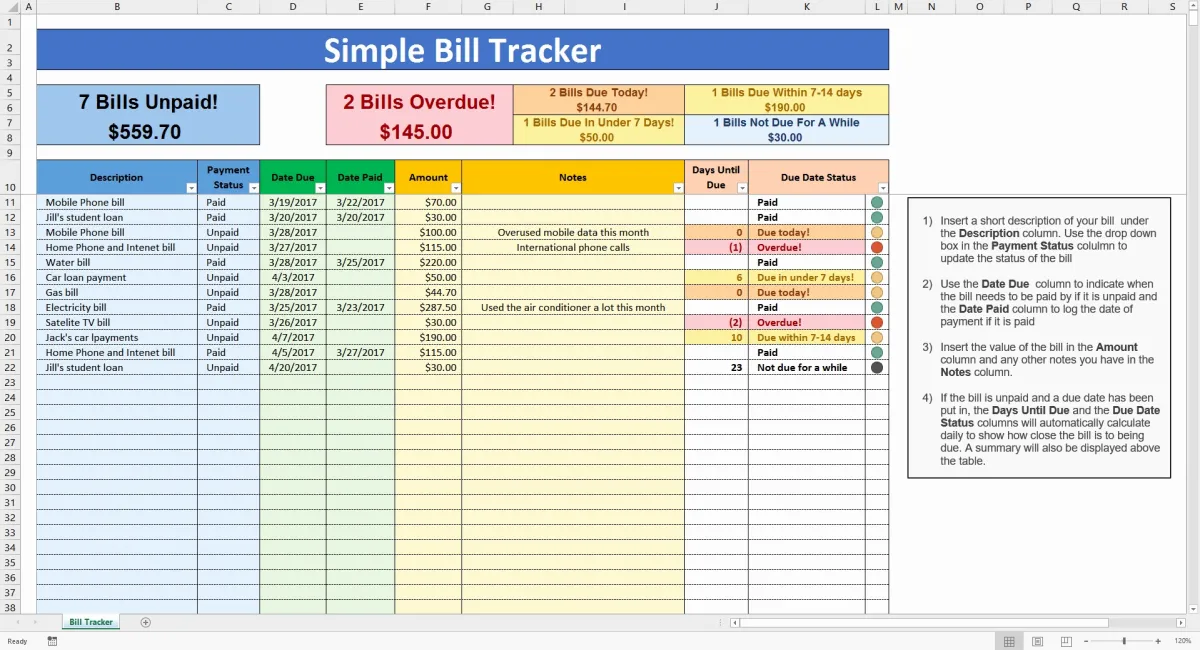

Tracking Your Medical Spending

The first step towards saving money on medical expenses is understanding where your money is going. Tracking your medical spending allows you to:

- Identify areas of high spending. Are you spending a disproportionate amount on a particular medication or type of care?

- Spot billing errors. Medical bills are notoriously complex, and errors can easily slip through the cracks.

- Negotiate better rates. If you have a clear picture of your spending, you’re in a better position to negotiate payment plans or lower prices with providers.

- Make informed healthcare decisions. Knowing the cost of different treatment options can help you make more informed choices about your care.

How to Track Your Spending

There are several ways to track your medical spending:

- Spreadsheet: Create a simple spreadsheet to log your medical expenses, including the date, provider, service, and cost.

- Apps: Several apps are designed specifically for tracking medical expenses. These apps can often connect to your bank account or credit card to automatically import expenses.

- Checkbook Register: If you prefer a low-tech approach, you can use your checkbook register to track medical expenses.

Conclusion

In conclusion, managing healthcare costs requires planning, seeking discounts, utilizing insurance benefits, and exploring generic or alternative treatments to save money on medical expenses.