Discover how high-interest accounts can help you maximize your savings and reach your financial goals faster than ever before.

Understanding High-Interest Accounts

A high-interest account is a type of savings account that typically offers a higher interest rate compared to traditional savings accounts. These accounts are designed to help you grow your money faster by providing a greater return on your deposits.

How High-Interest Accounts Work:

When you deposit money into a high-interest account, the financial institution pays you interest on your balance. The interest rate is usually variable, meaning it can fluctuate based on market conditions. However, high-interest accounts generally offer more competitive rates than standard savings accounts, leading to greater earnings over time.

Types of High-Interest Accounts:

- Online Savings Accounts: Offered by online banks, these accounts often come with higher interest rates due to lower overhead costs.

- Money Market Accounts (MMAs): MMAs typically offer higher rates than traditional savings accounts but may have higher minimum balance requirements.

- Certificates of Deposit (CDs): CDs require you to lock in your money for a fixed term, in exchange for a higher interest rate than savings accounts or MMAs.

Types of High-Interest Accounts

When aiming to maximize your savings with high-interest accounts, it’s essential to understand the different types available, as each comes with its own set of features and benefits:

1. High-Yield Savings Accounts

Offered by online banks and credit unions, these accounts typically offer higher interest rates compared to traditional savings accounts. They provide easy access to your funds and are FDIC or NCUA insured, ensuring the safety of your deposits.

2. Money Market Accounts (MMAs)

MMAs combine features of both savings and checking accounts. They usually offer higher interest rates than traditional savings accounts while providing check-writing privileges and debit card access. However, they may have higher minimum balance requirements.

3. Certificates of Deposit (CDs)

CDs require you to lock in your savings for a predetermined period, ranging from a few months to several years. In return, you earn a fixed interest rate that’s typically higher than savings accounts and MMAs. However, early withdrawals are subject to penalties.

4. Online Savings Accounts

Offered exclusively by online banks, these accounts often come with higher interest rates and lower fees compared to traditional brick-and-mortar banks. They provide the convenience of online banking and mobile check deposits.

5. Credit Union Share Savings Accounts

Credit unions, being member-owned financial institutions, often offer competitive interest rates on their share savings accounts. These accounts function similarly to traditional savings accounts but may come with additional perks and benefits for members.

Benefits of High-Interest Savings

High-interest savings accounts offer a range of advantages over traditional savings accounts, making them a compelling option for maximizing your savings growth. Let’s delve into the key benefits:

Increased Interest Earnings

The most significant advantage is the potential to earn a higher interest rate compared to standard savings accounts. This means your money grows at a faster pace, allowing you to accumulate wealth more effectively over time. Even a slightly higher interest rate can make a substantial difference in your long-term savings outcome.

Compound Interest Power

High-interest accounts often come with the benefit of compounding interest. This means that the interest you earn is added back to your principal balance, and subsequently, interest is earned on the new, higher amount. This cycle repeats itself, leading to exponential growth of your savings over the long run.

Lower Risk, Guaranteed Returns

Unlike investments in stocks or bonds, high-interest savings accounts are considered low-risk. Your deposits are typically insured by the FDIC (in the US) or equivalent institutions in other countries, providing peace of mind and security for your funds. While returns are not guaranteed in the stock market, interest rates on these accounts are typically fixed or variable within a specific range, offering a level of predictability for your savings growth.

How to Open a High-Interest Account

Opening a high-interest account is generally a straightforward process, quite similar to opening a traditional savings account. Here’s a step-by-step guide to help you get started:

1. Choose a Financial Institution

Decide whether you prefer a traditional bank or an online bank or credit union. Online institutions often offer more competitive interest rates due to lower overhead costs.

2. Compare Account Options

Once you’ve chosen a few potential institutions, compare their high-yield savings accounts. Pay close attention to:

- Interest rates: Look for the highest APY available.

- Fees: Check for monthly maintenance fees, minimum balance requirements, or other charges.

- Features: Consider features like mobile banking, ATM access, or bill pay options.

3. Gather Required Information

Typically, you’ll need the following to open an account:

- Social Security number

- Government-issued photo ID

- Minimum opening deposit amount

4. Complete the Application

You can usually apply online, over the phone, or in person at a branch. You’ll need to provide the information gathered in the previous step and agree to the account terms and conditions.

5. Fund Your Account

Make your initial deposit to activate your account. This can often be done through a bank transfer, mobile check deposit, or by mailing a check.

6. Set Up Account Access

Once your account is funded, you’ll be able to set up online and mobile banking access, order checks if applicable, and begin enjoying the benefits of your new high-interest account.

Tips for Maximizing Your Savings

When it comes to high-interest accounts, simply parking your money isn’t enough to maximize your savings. Here are some strategies to consider:

1. Automate Your Savings

Make saving effortless by setting up automatic transfers from your checking account to your high-interest account. Schedule these transfers to coincide with your paydays to ensure you’re regularly putting money aside.

2. Explore Compounding Frequency

Interest compounding allows you to earn interest on your interest. The more frequently interest is compounded (e.g., daily or monthly), the faster your savings can grow. Look for accounts with favorable compounding frequencies.

3. Take Advantage of Bonus Offers

Many financial institutions offer sign-up bonuses or promotional interest rates to attract new customers. Research and compare these offers to maximize your initial deposit. Be sure to read the terms and conditions to understand any requirements or limitations.

4. Regularly Review and Adjust

Interest rates can fluctuate, and new offers may become available. Regularly review your account’s interest rate and compare it with competitors. Don’t hesitate to switch to a different institution or account if you find a better deal.

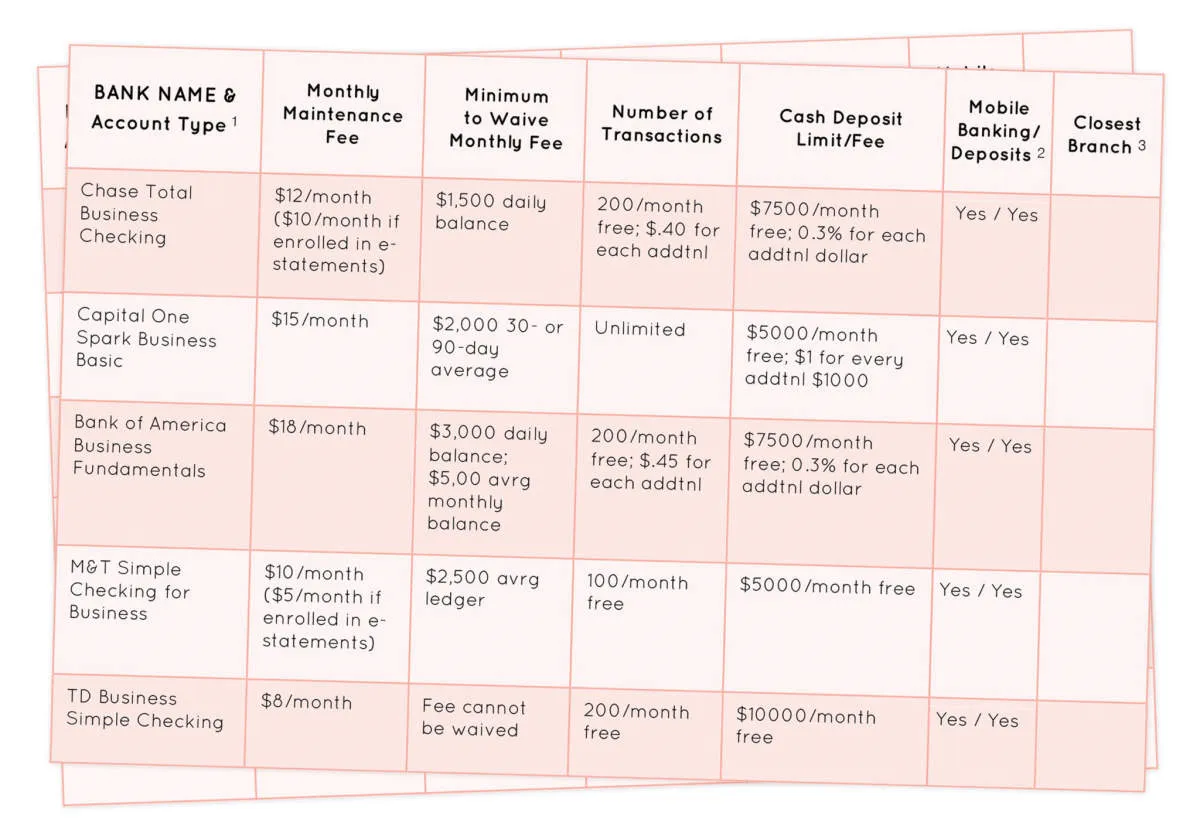

Comparing Different Banks and Accounts

Once you’ve decided to prioritize a high-interest account, the next crucial step is to compare what different banks and account types offer. Don’t settle for the first seemingly good rate you see. A little research can go a long way in maximizing your earnings.

Factors to Consider:

- Annual Percentage Yield (APY): This is the most crucial factor. A higher APY means more interest earned on your balance.

- Fees: Pay close attention to monthly maintenance fees, minimum balance requirements, or early withdrawal penalties. These can eat into your interest earnings.

- Compounding Frequency: Interest can be compounded daily, monthly, or annually. More frequent compounding leads to faster growth.

- Online Access and Features: A user-friendly online platform and mobile app can make managing your money easier.

- Insurance Coverage: Ensure the account is FDIC-insured (for US banks) or CDIC-insured (for Canadian banks) for up to the maximum allowed, protecting your savings.

Types of High-Interest Accounts to Compare:

- High-Yield Savings Accounts: These usually offer higher APY than traditional savings accounts and allow for easy access to your funds.

- Money Market Accounts: These accounts often come with check-writing privileges and debit cards but may have higher minimum balance requirements.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a set period, generally providing higher APYs than savings accounts. However, you’ll need to lock your money in for the CD term.

Utilizing online comparison tools and reading financial institution reviews can be very helpful during this process. Remember, your goal is to find the account that aligns best with your financial needs and helps you reach your savings goals faster.

Avoiding Fees and Charges

While high-interest accounts are designed to help you grow your savings, it’s essential to be aware of potential fees that could eat into your returns. Here’s what to look out for:

Common Fees to Watch For:

- Monthly maintenance fees: Some banks charge a fee simply for having an account open, especially if your balance falls below a specific minimum.

- Transaction fees: Be mindful of limits on withdrawals or transfers, as exceeding them might incur fees.

- Inactivity fees: Some accounts penalize you for not making regular transactions.

- Paper statement fees: Opting for electronic statements can often help you avoid paper statement fees.

Tips to Avoid Fees:

- Read the fine print: Before opening an account, thoroughly review the fee schedule to understand any potential costs.

- Compare accounts: Don’t hesitate to shop around and compare offerings from different banks or credit unions.

- Meet minimum balance requirements: If the account has a minimum balance requirement, make sure you can comfortably maintain it to avoid fees.

- Take advantage of waivers: Some banks waive monthly fees if you meet specific criteria, such as setting up direct deposit or maintaining a certain number of transactions.

- Contact customer service: If you’re hit with an unexpected fee, don’t be afraid to contact customer service. They may be willing to waive it, especially if you’re a long-time customer.

By being diligent about avoiding fees, you can ensure that your high-interest account lives up to its potential and helps you maximize your savings.

Monitoring Your Savings Growth

Keeping a watchful eye on your savings growth is an essential part of maximizing your high-interest account. Regularly monitoring your progress helps you stay motivated, spot potential issues, and make informed decisions about your financial future. Here’s how you can effectively monitor your savings growth:

Track Your Interest Earnings

One of the most satisfying aspects of high-interest accounts is witnessing the power of compounding in action. Each interest payment adds to your principal, generating even more interest over time. Keep track of your monthly or quarterly interest earnings to see how your money is multiplying.

Utilize Online Banking Tools

Most financial institutions offer online banking platforms or mobile apps that provide real-time updates on your account balances and transaction history. Take advantage of these tools to conveniently monitor your savings progress on a regular basis. Some platforms even offer features that allow you to set savings goals and track your progress visually.

Review Your Statements Regularly

Even if you primarily rely on online banking, make it a habit to review your monthly or quarterly account statements. These statements provide a comprehensive overview of your account activity, including interest earned, fees charged (if any), and account balance. Carefully examine these statements for any discrepancies or unexpected charges.

Set Reminders for Periodic Reviews

Life can get busy, and it’s easy to forget about monitoring your savings regularly. To stay on top of your finances, set reminders on your phone or calendar to review your savings progress at least once a month. This will help you stay engaged and make adjustments as needed.

Conclusion

In conclusion, utilizing high-interest accounts is a smart way to maximize savings and increase wealth through growing returns on your investments.