In times of economic downturn like a recession, managing your finances is crucial. This article will provide practical tips and strategies to help you navigate through financial challenges and secure your financial stability during tough times.

Understanding the Impact of a Recession

A recession can feel like a period of widespread financial instability. It’s far more than just a stock market dip; it represents a broader economic downturn affecting various aspects of our lives. To navigate it effectively, we need to understand its potential impacts:

Job Security and Income:

Recessions often lead to reduced consumer spending, impacting business revenues and profitability. This can trigger a chain reaction:

- Hiring freezes: Companies may become hesitant to hire new employees.

- Layoffs: Existing employees might face job losses as companies downsize to cut costs.

- Wage stagnation: Salary increases and bonuses could become less frequent or smaller.

Investments and Savings:

The value of investments like stocks and bonds can fluctuate significantly during recessions. This volatility can impact:

- Retirement savings: 401(k)s and IRAs can lose value, making retirement planning more challenging.

- Investment portfolios: The overall worth of investment portfolios might decline, affecting financial goals.

Cost of Living:

While some prices might drop during a recession, others might rise due to factors like inflation and supply chain disruptions.

Borrowing and Credit:

During recessions, lenders often tighten their criteria, making it harder to secure loans or access credit. Interest rates might also fluctuate, potentially impacting existing loans with variable rates.

Assessing Your Financial Situation

Before you can make any moves to manage your finances during a recession, it’s crucial to understand where you stand financially. This means taking a clear and honest look at your income, expenses, assets, and debts.

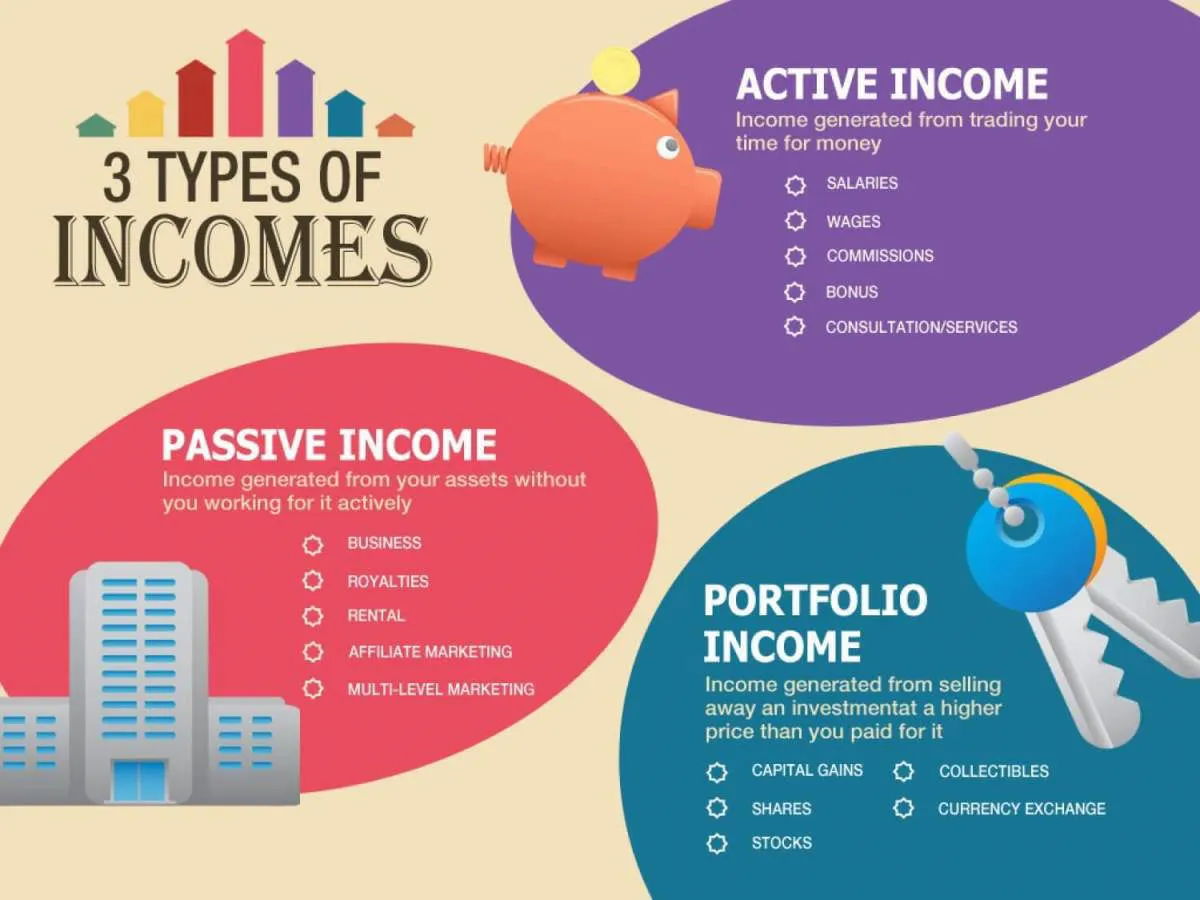

Income and Expenses:

Start by listing all sources of your income. Include your salary, wages, any side hustles, investment income, or government benefits. Next, track your expenses diligently. Categorize them into essential (housing, food, utilities) and non-essential (entertainment, dining out, subscriptions). This exercise will reveal your disposable income and areas where you might potentially cut back.

Assets and Debts:

Compile a list of your assets, including your savings, checking account balances, retirement accounts, and the value of any property you own. Subsequently, list out all your debts – credit card balances, student loans, mortgages, auto loans, etc. Calculate your net worth by subtracting your total debts from your total assets. Understanding your net worth provides a snapshot of your overall financial health.

Analyzing Your Financial Position:

With a clear picture of your income, expenses, assets, and debts, you can now analyze your financial position. Are you living within your means? Do you have an emergency fund? What is your debt-to-income ratio? Answering these questions honestly will highlight your financial strengths and weaknesses, enabling you to plan effectively for the recession.

Creating a Recession Budget

When a recession hits, one of the most crucial steps you can take to weather the storm is to create a recession budget. This differs from your regular budget as it requires a laser focus on essentials and identifying areas for significant cuts.

1. Analyze Your Current Spending:

Start by scrutinizing your bank statements, credit card bills, and any expense tracking tools you use. Categorize your spending into needs and wants. Be ruthless in your assessment—what might have been a need in good times could be a want during a recession.

2. Identify Essential Expenses:

Your recession budget should prioritize essential expenses. These typically include:

- Housing (rent or mortgage payments)

- Utilities (electricity, gas, water)

- Food (groceries)

- Transportation (car payments, public transportation)

- Healthcare (insurance premiums, necessary medical expenses)

- Debt payments (minimum payments on loans and credit cards)

3. Cut Back on Non-Essential Spending:

This is where you’ll need to make tough decisions. Look for areas where you can significantly reduce or eliminate non-essential expenses. Consider these areas:

- Dining out (cook at home more often)

- Entertainment (explore free or low-cost options)

- Subscriptions (streaming services, gym memberships)

- Shopping (reduce impulse purchases)

- Travel (postpone non-essential trips)

4. Set Realistic Spending Limits:

Once you’ve identified essential expenses and areas to cut back, establish realistic spending limits for each category. This might involve finding cheaper alternatives, negotiating better rates with service providers, or simply committing to spending less.

5. Track Your Progress and Adjust:

Creating a recession budget is an ongoing process. Regularly track your spending to ensure you’re staying within your limits. Be prepared to adjust your budget as needed based on changes in your income or expenses.

Cutting Non-Essential Expenses

During a recession, tightening your budget becomes crucial, and identifying non-essential expenses to cut is a good place to start. While what constitutes “non-essential” varies based on individual circumstances, it generally refers to expenses that aren’t necessary for your basic needs and well-being.

Identifying Your Non-Essential Expenses

Start by meticulously reviewing your recent bank and credit card statements. Categorize your expenses to clearly see where your money is going. Look for areas where you can cut back without drastically impacting your lifestyle.

Some common non-essential expenses include:

- Dining out: Cooking at home is significantly cheaper than restaurant meals.

- Entertainment subscriptions: Evaluate the necessity of multiple streaming services, magazine subscriptions, or gym memberships. Consider downsizing or pausing some temporarily.

- Shopping: Differentiate between “wants” and “needs.” Reduce spending on clothes, shoes, electronics, and other discretionary items.

- Travel: Consider postponing expensive trips and explore affordable, local vacation options.

- Personal care: Space out salon appointments or explore more affordable options for haircuts, manicures, etc.

Tips for Cutting Back

- Set a budget: Allocate specific amounts for different expense categories, including a strict limit for non-essentials.

- Track your spending: Use budgeting apps or spreadsheets to monitor where your money is going.

- Find free or cheaper alternatives: Explore free entertainment options like parks, libraries, and community events.

- Negotiate bills: Contact service providers to negotiate lower rates for internet, phone, or insurance.

- Delay gratification: Resist impulse purchases and give yourself time to evaluate if you truly need an item.

Building an Emergency Fund

During a recession, having a financial safety net is more critical than ever. Job security can become uncertain, and unexpected expenses can arise. This is where an emergency fund becomes your best ally.

What is an emergency fund? An emergency fund is a separate savings account specifically designed to cover unexpected costs or income loss. This is not your vacation fund or your “new phone” fund; it’s there to protect you from financial hardship in challenging times.

How much should you save? Ideally, aim to have 3-6 months’ worth of living expenses in your emergency fund. This might seem daunting, but start small. Even saving a small amount each month will add up over time.

Where should you keep your emergency fund? Keep your emergency fund separate from your regular checking account. Consider a high-yield savings account or a money market account to earn some interest while keeping your money easily accessible.

How to build your emergency fund during a recession:

- Reduce unnecessary expenses: Analyze your spending habits and identify areas where you can cut back.

- Increase your income: Explore opportunities for a side hustle or freelance work to supplement your income.

- Sell unwanted items: Declutter your home and sell items you no longer need or use.

- Make saving automatic: Set up automatic transfers to your emergency fund each payday, even if it’s a small amount.

Finding Temporary Income Sources

Recessions often lead to job losses and financial uncertainty. If you’re facing a period of unemployment or reduced income, exploring temporary income sources can be crucial to bridge the gap and manage your finances effectively.

Here are some avenues to consider:

1. Gig Economy and Freelancing:

The gig economy offers a flexible way to earn income on your own terms. Platforms like Upwork, Fiverr, and TaskRabbit connect freelancers with clients seeking various services, such as writing, graphic design, virtual assistance, and more. Assess your skills and explore opportunities that match your expertise.

2. Part-Time Employment:

While finding a full-time job may be challenging during a recession, seeking part-time employment can provide a steady stream of income. Consider industries experiencing increased demand, such as grocery stores, delivery services, and online retailers.

3. Selling Unused Assets:

Decluttering your home can also generate income. Sell unwanted items through online marketplaces like eBay, Craigslist, or Facebook Marketplace. Clothes, electronics, furniture, and collectibles can be sold to boost your cash flow.

4. Renting Out Assets:

If you own assets like a spare room, parking space, or even tools, consider renting them out for additional income. Platforms like Airbnb (for short-term rentals) and Neighbor (for storage space) can facilitate the process.

5. Online Surveys and Microtasks:

Although not a significant income source, online surveys and microtasks can provide small earnings in your spare time. Websites like Swagbucks, Amazon Mechanical Turk, and Prolific offer opportunities to earn rewards or cash for completing surveys, watching videos, or performing simple tasks.

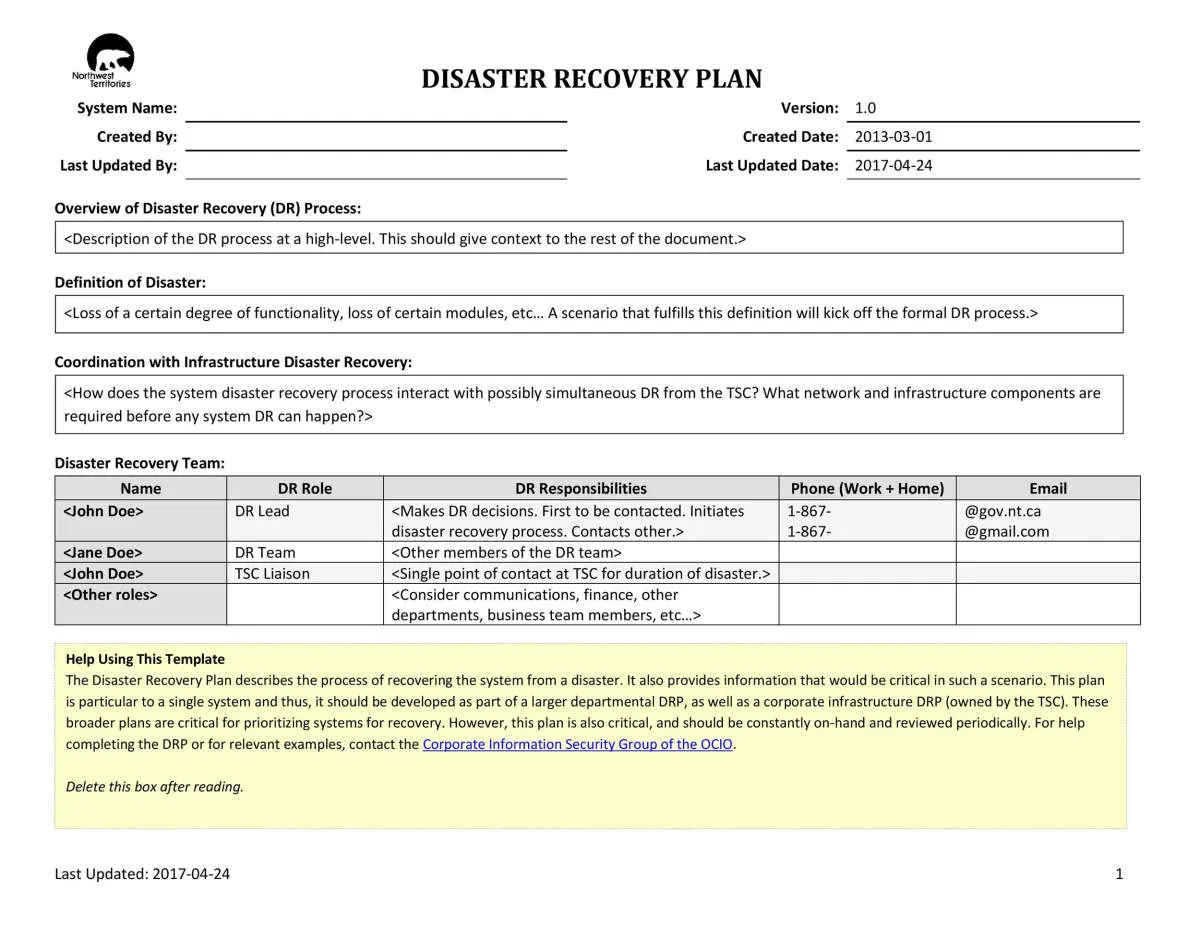

Managing Debt During a Recession

Recessions can put a strain on finances, especially when it comes to managing debt. Reduced income or job loss can make it challenging to keep up with loan payments. Here’s how to navigate debt during a recession:

1. Take Stock of Your Debt

Begin by listing all your debts, including credit cards, personal loans, student loans, and mortgages. Note down the interest rates, minimum monthly payments, and total outstanding balances. Understanding your complete debt picture is crucial for effective management.

2. Prioritize Your Debts

Not all debts are created equal. Prioritize high-interest debts like credit cards, as they accrue interest quickly and can trap you in a cycle of debt. Focus on paying more than the minimum payment on these high-interest debts while making minimum payments on others.

3. Negotiate with Lenders

Don’t hesitate to contact your lenders and explain your financial situation. During tough economic times, many lenders are willing to work with borrowers. You might be able to negotiate lower interest rates, waived fees, or modified payment plans to make your debt more manageable.

4. Explore Debt Consolidation

If you have multiple debts, consider debt consolidation. This involves taking out a new loan to pay off existing ones, ideally at a lower interest rate. This can simplify your debt management and potentially reduce your monthly payments.

5. Seek Professional Guidance

If you’re struggling to manage debt on your own, don’t be afraid to seek professional help. A financial advisor can provide personalized advice, assess your options, and guide you towards the best course of action for your specific circumstances.

Planning for Financial Recovery

While navigating a recession requires immediate financial adjustments, it’s equally crucial to plan for the recovery phase. Even as the economy begins to rebound, a proactive approach to rebuilding your financial stability is essential.

Reassess Your Budget and Financial Goals

After weathering the storm of a recession, it’s time to re-evaluate your budget. Factor in any income changes and identify areas where spending habits might have shifted during the downturn. This updated budget serves as the foundation for your financial recovery plan. With a clear picture of your income and expenses, revisit your short-term and long-term financial goals. You might need to adjust timelines or prioritize certain objectives based on your financial situation post-recession.

Rebuild Emergency Savings

If the recession forced you to tap into your emergency fund, prioritize replenishing it. Aim to have 3-6 months’ worth of living expenses saved up. This cushion provides security and peace of mind as you continue to navigate the post-recession landscape.

Manage Debt Strategically

If you accumulated debt during the recession, create a strategic plan for repayment. Prioritize high-interest debts while making consistent, on-time payments for all obligations. Explore options like debt consolidation or balance transfers to potentially reduce interest burdens and streamline repayment.

Seek Opportunities for Growth

While economic recovery can be gradual, it also presents opportunities. Consider exploring potential avenues for career advancement or upskilling to enhance your earning potential. Additionally, stay informed about new job opportunities that arise as businesses begin to expand again.

Conclusion

During a recession, managing finances strategically is crucial. By creating a budget, cutting unnecessary expenses, and saving for emergencies, individuals can navigate economic challenges effectively.