Why Financial Planning Matters

Financial planning is more than just budgeting (though that’s certainly a crucial part!). It’s a holistic approach to managing your money that empowers you to achieve your short-term and long-term financial goals. Whether you dream of buying a home, retiring early, or simply navigating life’s unexpected expenses with confidence, financial planning provides the roadmap to get you there.

Here’s why it matters:

- Reduces Financial Stress: Knowing where your money is going and having a plan for the future can significantly reduce anxiety. You’ll be better equipped to handle financial emergencies and unexpected costs.

- Helps Achieve Goals: Financial planning allows you to define your goals (like buying a house, funding education, or early retirement) and create a realistic plan to achieve them.

- Enables Smart Spending and Saving: By tracking your income and expenses, you gain a clear picture of your spending habits. This awareness helps you identify areas to cut back and free up funds for savings and investments.

- Secures Your Future: A solid financial plan includes strategies for retirement planning, ensuring you can maintain your lifestyle even after you stop working.

- Protects Your Loved Ones: Financial planning considers factors like insurance and estate planning, providing a safety net for your family in case of unexpected events.

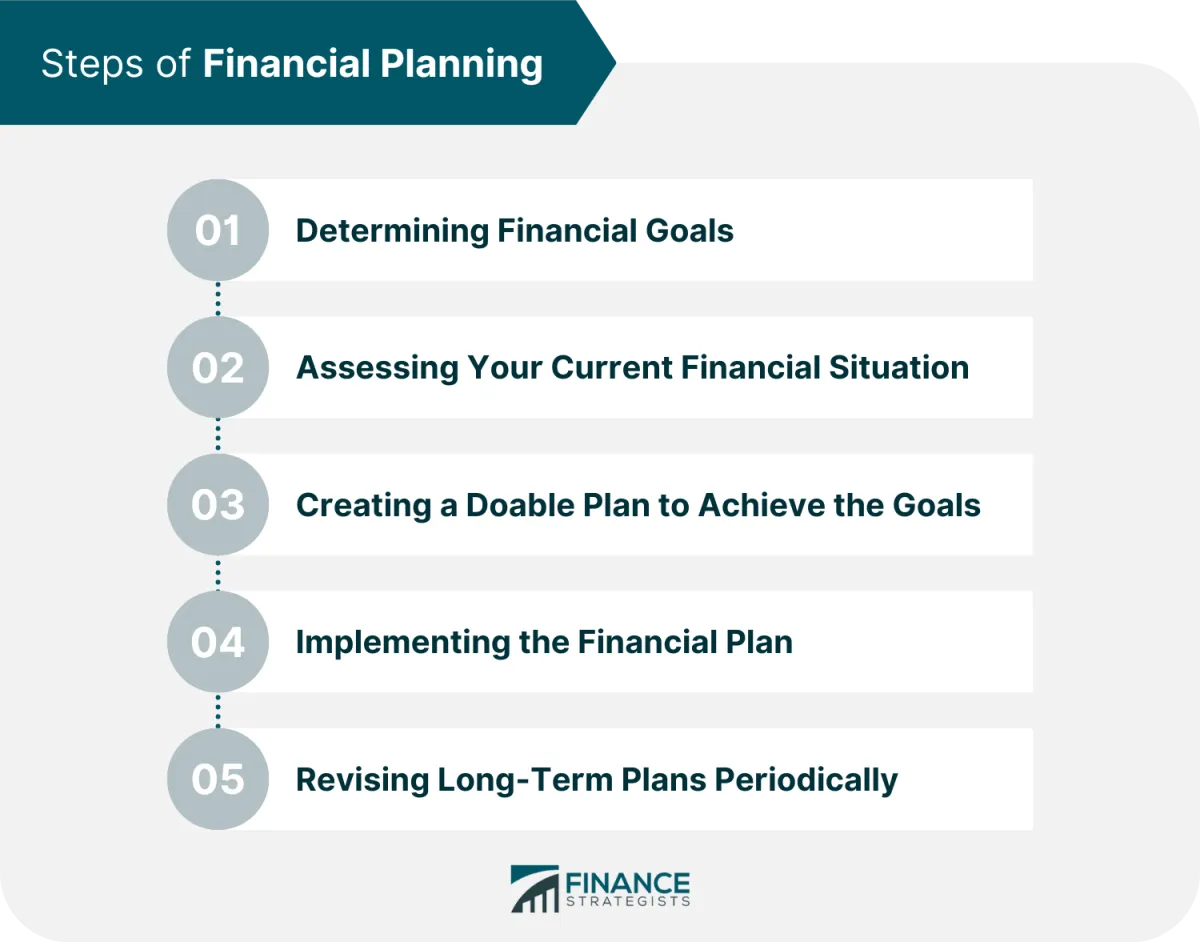

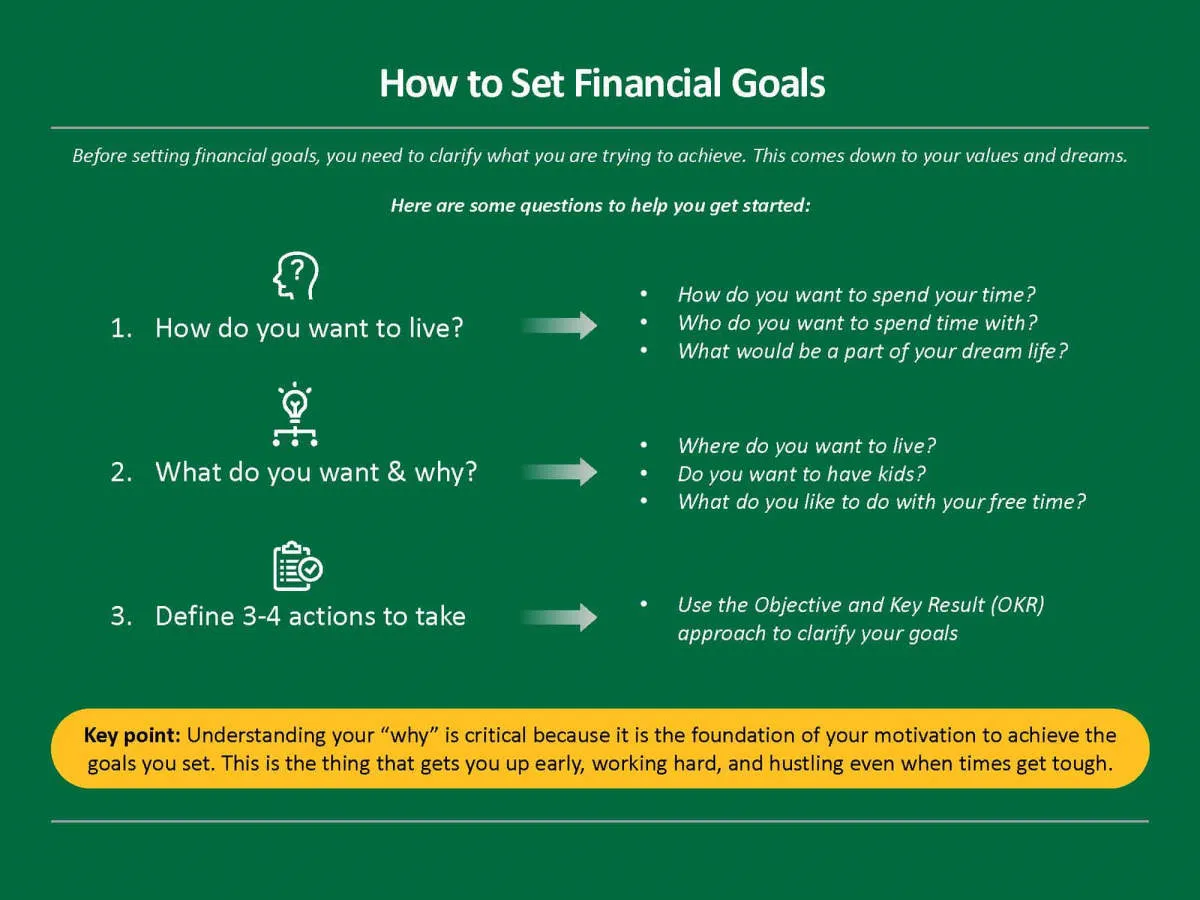

Setting Financial Goals

Financial planning without goals is like sailing without a destination. You might enjoy the journey, but you’ll likely end up lost. Setting clear, specific financial goals is crucial for providing direction and motivation to your financial plan.

Start by defining your short-term, mid-term, and long-term goals.

- Short-term goals could include building an emergency fund, paying off credit card debt, or saving for a down payment on a car. These are goals you aim to achieve within the next year or two.

- Mid-term goals might involve saving for a down payment on a house, funding a child’s education, or taking a dream vacation. These goals typically take a few years to achieve.

- Long-term goals often include planning for retirement, investing for future generations, or achieving financial independence. These goals require a longer time horizon, often decades.

Make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-Bound. For example, instead of saying “I want to save more money,” a SMART goal would be “I want to save $5,000 for a down payment on a new car within the next two years by automatically transferring $200 to my savings account each month.”

Regularly review and adjust your goals as your life circumstances change. Marriage, children, career changes, and other life events can all impact your financial priorities.

Budgeting Tips for Success

Creating and sticking to a budget is the cornerstone of successful financial planning. It allows you to track your income and expenses, identify areas where you can save, and allocate funds towards your financial goals. Here are some effective budgeting tips:

1. Track Your Income and Expenses

Start by monitoring where your money is coming from and going. Utilize budgeting apps, spreadsheets, or a notebook to record all your income sources and every expense for a month.

2. Differentiate Needs vs. Wants

Analyze your spending habits to distinguish between necessities (needs) and luxuries (wants). Prioritize needs like housing, utilities, and groceries, while finding ways to reduce spending on non-essential wants.

3. Set Realistic Goals

Establish clear financial goals, whether it’s saving for a down payment, paying off debt, or investing for retirement. Having specific objectives will motivate you to budget effectively.

4. Employ the 50/30/20 Rule

Consider allocating your after-tax income as follows:

- 50% for Needs: Essential expenses like rent/mortgage, utilities, groceries, transportation.

- 30% for Wants: Discretionary spending on dining out, entertainment, hobbies.

- 20% for Savings and Debt Repayment: Building an emergency fund, investing, or paying down debt (credit cards, loans).

5. Automate Your Savings

Set up automatic transfers from your checking account to your savings or investment accounts. This “pay yourself first” approach ensures consistent saving.

6. Review and Adjust Regularly

Don’t treat your budget as static. Review it monthly or quarterly, especially after major life changes (job change, marriage, having children) and make necessary adjustments to align with your current financial situation.

Investing for the Future

Investing is a crucial aspect of financial planning that involves putting your money to work for you, aiming to grow it over time. It’s not just about getting rich quick; it’s about securing your financial future and achieving your long-term goals, whether it’s retiring comfortably, buying a home, or funding your children’s education.

Here’s why investing is crucial for your financial well-being:

- Outpaces Inflation: Investing helps your money grow at a rate that ideally outpaces inflation, ensuring your purchasing power increases over time.

- Achieve Financial Goals: Whether it’s saving for a down payment or retirement, investing provides the means to reach significant financial milestones.

- Generate Passive Income: Certain investments generate passive income streams, providing financial stability and potentially supplementing your regular earnings.

Key Considerations for Investing:

- Risk Tolerance: Understanding your comfort level with potential investment losses is essential for choosing appropriate investment vehicles.

- Investment Horizon: Your time horizon, or how long you plan to invest, significantly influences the types of investments suitable for your goals.

- Diversification: Spreading your investments across different asset classes is crucial for mitigating risk and maximizing potential returns.

Protecting Your Assets

Protecting your assets is a crucial part of financial planning. It’s about safeguarding what you’ve worked hard for against potential risks and ensuring your financial security in the face of unexpected events.

Here are some key steps to consider:

1. Insurance Coverage: Your Safety Net

Adequate insurance is paramount. Review your policies for:

- Health Insurance: Protects you from potentially devastating medical expenses.

- Life Insurance: Provides financial support to your dependents in case of your passing.

- Disability Insurance: Replaces a portion of your income if you become unable to work.

- Property Insurance: Covers your home and belongings against damage or loss.

2. Emergency Fund: A Financial Cushion

Life is full of surprises, and not all of them are good. An emergency fund acts as a buffer against unexpected expenses like job loss, medical bills, or car repairs. Aim for 3-6 months’ worth of living expenses.

3. Estate Planning: Securing Your Legacy

Estate planning isn’t just for the wealthy. It involves:

- Will: Specifies how you want your assets distributed after your death.

- Trusts: Can help manage assets and potentially reduce estate taxes.

- Power of Attorney: Designates someone to make financial and healthcare decisions on your behalf if you become incapacitated.

4. Risk Management: Identifying and Mitigating Threats

Identify potential risks to your assets, such as market volatility, liability lawsuits, or natural disasters. Develop strategies to mitigate these risks through diversification, legal protection, or preventative measures.

Planning for Retirement

Retirement might seem far off, but planning for it early is crucial for financial comfort later in life. The earlier you start, the more time your investments have to grow. Here’s what to consider:

1. Determine Your Retirement Goals:

What does your ideal retirement look like? Do you want to travel the world, pursue hobbies, or simply live comfortably? Defining your goals will help you estimate how much money you’ll need.

2. Estimate Your Retirement Expenses:

Consider your estimated living expenses, healthcare costs, and potential travel or leisure activities. Keep in mind that inflation can erode purchasing power over time.

3. Explore Retirement Savings Plans:

Utilize tax-advantaged retirement accounts like 401(k)s or IRAs. Contribute regularly and maximize employer matching contributions if available.

4. Consider Diversifying Your Investments:

Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes like stocks, bonds, and real estate to manage risk.

5. Review and Adjust Regularly:

As you approach retirement, review your plan annually or whenever significant life changes occur. Adjust your savings rate, investment strategy, and withdrawal plan as needed.

Managing Debt Effectively

Debt is a common aspect of modern life, but if not managed effectively, it can quickly spiral out of control and become a significant source of financial stress. To ensure your debts don’t hold you back from achieving your financial goals, consider implementing these strategies:

1. Create a Debt Management Plan

Start by listing all your debts, including the creditor, outstanding balance, interest rate, and minimum monthly payment. This overview will provide a clear picture of your current debt landscape. Prioritize your debts based on interest rates, focusing on high-interest debts first, as they accrue more interest over time.

2. Explore Debt Consolidation Options

If you have multiple debts with varying interest rates, consider consolidating them into a single loan with a lower interest rate. This approach can simplify your debt management and potentially reduce your overall interest payments.

3. Negotiate with Creditors

Don’t hesitate to contact your creditors and negotiate more favorable terms, such as lower interest rates, waived fees, or extended repayment periods. Creditors may be willing to work with you, especially if you’re facing financial difficulties.

4. Consider the Avalanche or Snowball Method

Two popular debt repayment strategies are the avalanche and snowball methods. The avalanche method focuses on paying down the debt with the highest interest rate first, while making minimum payments on other debts. The snowball method targets the smallest debt first, regardless of interest rate, to gain momentum and motivation from quick wins.

5. Automate Your Payments

Set up automatic payments to ensure you never miss a due date and incur late fees. This automated approach can simplify your financial management and help you stay on track with your repayment goals.

6. Seek Professional Advice

If you’re struggling to manage your debt or need personalized guidance, consider seeking professional advice from a financial advisor. They can provide tailored strategies based on your specific financial situation.

Regularly Reviewing Your Plan

Creating a financial plan is a great first step, but it shouldn’t be treated as something you do once and forget about. Life is constantly changing, and your financial plan needs to adapt alongside those changes. Regularly reviewing your plan ensures it remains relevant and effective in helping you reach your financial goals.

How Often Should You Review?

The frequency of your reviews depends on your individual circumstances and preferences. However, a good rule of thumb is to review your plan at least once a year. Additionally, consider reviewing your plan whenever a major life event occurs, such as:

- Significant change in income

- Marriage or divorce

- Birth or adoption of a child

- Job loss or change

- Large inheritance or unexpected expense

What to Look for During a Review

During your review, assess the following:

- Progress towards goals: Are you on track to meet your short-term and long-term goals? Have any timelines changed?

- Net worth: Has your net worth increased or decreased? What factors have contributed to this change?

- Budget: Is your budget still realistic and aligned with your current income and expenses?

- Investments: Is your investment strategy still suitable for your risk tolerance and goals? Are there any adjustments needed?

- Insurance coverage: Do you have adequate insurance coverage for your current situation?

- Emergency fund: Is your emergency fund sufficient to cover unexpected expenses?