Learn effective strategies to manage financial stress with these helpful tips. Discover practical ways to improve your financial well-being and reduce anxiety surrounding money matters.

Understanding Financial Stress

Financial stress is a common experience, affecting people of all ages, backgrounds, and income levels. It’s that feeling of worry, anxiety, or fear that arises from challenges related to money.

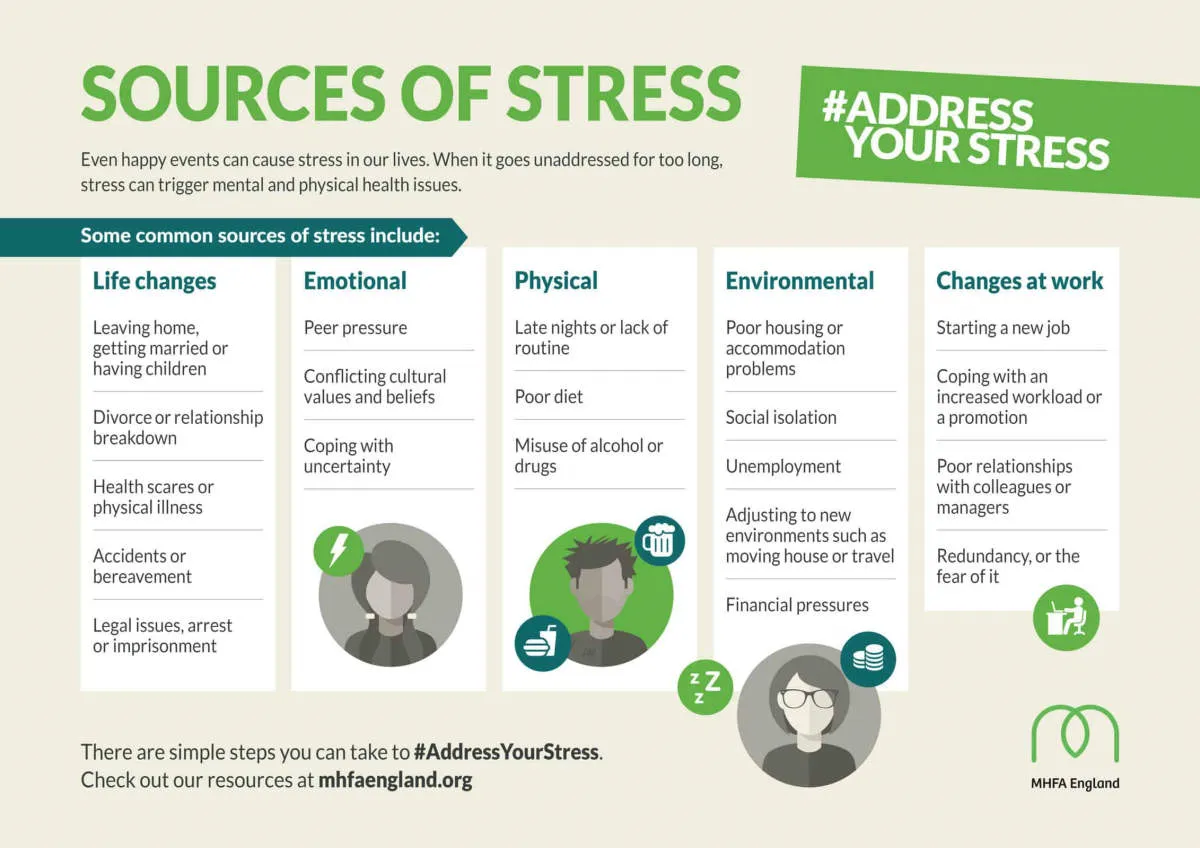

Common sources of financial stress include:

- Job loss or instability

- High levels of debt

- Unexpected expenses (medical bills, car repairs, etc.)

- Low income or difficulty making ends meet

- Lack of financial literacy or poor financial planning

- Major life events (marriage, divorce, having a child, etc.)

Financial stress doesn’t just impact your wallet; it can significantly affect your overall well-being.

The effects of financial stress can manifest in various ways:

- Mental health: Increased anxiety, depression, difficulty sleeping, irritability, feelings of hopelessness.

- Physical health: Headaches, fatigue, digestive problems, weakened immune system, high blood pressure.

- Relationships: Strained relationships with partners, family, and friends due to arguments and tension related to finances.

- Work performance: Decreased focus, productivity, and increased absenteeism due to worry and distractions.

- Lifestyle choices: Engaging in unhealthy coping mechanisms such as overeating, substance abuse, or social withdrawal.

Identifying Sources of Financial Stress

Before you can effectively manage your financial stress, it’s crucial to pinpoint the root causes. This involves taking a hard look at your financial situation and identifying the specific factors that are causing you anxiety.

Here are some common sources of financial stress:

- Debt: High levels of credit card debt, student loans, or personal loans can lead to overwhelming financial pressure.

- Low Income: Living paycheck to paycheck or struggling to make ends meet on a limited income is a major stressor.

- Unexpected Expenses: Medical bills, car repairs, or home maintenance costs can throw your budget off track and cause significant worry.

- Job Insecurity: The fear of losing your job or experiencing a reduction in income can be incredibly stressful.

- Poor Financial Habits: Overspending, lack of budgeting, and impulsive purchases can create and perpetuate financial difficulties.

- Relationship Conflicts: Disagreements with a spouse or partner about finances are a common source of stress.

- Comparison to Others: Constantly comparing your financial situation to others’ can lead to feelings of inadequacy and anxiety.

Identifying your personal triggers for financial stress is the first step towards effective management.

Creating a Financial Plan

One of the most effective ways to combat financial stress is to create a solid financial plan. This provides a roadmap for your money, allowing you to feel more in control and less anxious about your finances. Here’s how to get started:

1. Assess Your Current Financial Situation

Begin by taking stock of where you stand financially. Calculate your net worth (assets minus liabilities), track your income and expenses, and review your credit report. This honest assessment will reveal your financial strengths and weaknesses.

2. Set SMART Financial Goals

Identify both short-term and long-term financial goals. Make sure your goals are SMART – Specific, Measurable, Achievable, Relevant, and Time-bound. Whether it’s saving for a down payment, paying off debt, or investing for retirement, having clear goals will keep you motivated.

3. Create a Budget

A budget is essential for financial planning. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards your goals. There are various budgeting methods, so find one that suits your lifestyle.

4. Build an Emergency Fund

Unexpected expenses can derail even the best financial plans. Having an emergency fund provides a safety net and peace of mind. Aim to save 3-6 months’ worth of living expenses in a readily accessible account.

5. Manage Debt Effectively

High-interest debt can be a major source of stress. Create a debt reduction strategy, such as the debt snowball or avalanche method. Prioritize paying down high-interest debt while making minimum payments on others.

6. Review and Adjust Regularly

Your financial plan is not static. It’s crucial to review and adjust it periodically based on changes in your income, expenses, goals, or life circumstances. Aim to review your plan at least annually, or more frequently if needed.

Building an Emergency Fund

Financial stress often stems from unexpected expenses and a lack of financial preparedness. One of the most effective ways to combat this stress is by building a solid emergency fund.

An emergency fund is a separate savings account dedicated solely to covering unforeseen costs, such as:

- Job loss

- Medical emergencies

- Car repairs

- Home repairs

Having this financial safety net can provide peace of mind and prevent you from going into debt when unexpected events occur.

How to Build an Emergency Fund

- Set a Savings Goal: Aim for 3-6 months’ worth of living expenses. Start small and gradually increase your savings over time.

- Create a Budget: Track your income and expenses to identify areas where you can cut back and save more.

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund each month.

- Find Additional Income: Explore side hustles or freelance opportunities to boost your savings rate.

Remember, building an emergency fund takes time and discipline. By consistently contributing to your fund, you’ll be better prepared to weather financial storms and reduce overall stress.

Seeking Professional Help

Sometimes, managing financial stress requires more than just budgeting tips and lifestyle changes. If your financial worries are overwhelming, causing significant distress, or impacting your daily life, it’s crucial to seek help from a professional.

Here’s who you can turn to:

- Financial Advisors: These professionals can help you create a personalized financial plan, tackle debt, and make informed investment decisions.

- Credit Counselors: If debt is a major source of your stress, credit counselors can provide guidance on debt management, budgeting, and negotiating with creditors.

- Therapists or Counselors: Financial stress can take a toll on your mental health. Therapists can provide coping mechanisms for anxiety and stress related to your finances. They can also help you address any underlying emotional or behavioral patterns contributing to financial difficulties.

Remember, seeking professional help is a sign of strength and a proactive step towards regaining control of your financial well-being.

Practicing Financial Self-Care

Financial self-care involves adopting habits and practices that promote a healthy relationship with money and reduce financial stress. Here are some tips for practicing financial self-care:

1. Create a Realistic Budget and Track Your Spending

Creating a budget is crucial for understanding where your money is going. Track your income and expenses to identify areas where you can save and make informed financial decisions.

2. Set Realistic Financial Goals

Having clear financial goals provides direction and motivation. Set achievable goals that align with your values and aspirations, whether saving for a down payment, paying off debt, or investing for the future.

3. Educate Yourself About Personal Finance

Take the time to learn about basic financial concepts such as budgeting, saving, investing, and managing debt. Numerous online resources, books, and workshops are available to enhance your financial literacy.

4. Seek Professional Financial Advice

Consider consulting with a financial advisor who can provide personalized guidance based on your circumstances. They can help you create a financial plan, make investment decisions, or develop a debt management strategy.

5. Practice Mindfulness and Gratitude

Incorporate mindfulness practices into your daily routine to cultivate awareness of your financial thoughts and feelings. Practice gratitude for what you have, which can help shift your mindset from scarcity to abundance.

6. Celebrate Small Victories

Acknowledge and celebrate your financial achievements, no matter how small they may seem. Rewarding yourself along the way can help you stay motivated and maintain a positive outlook on your financial journey.

Using Stress Management Techniques

Financial stress can significantly impact your mental and physical health. Incorporating stress management techniques into your daily routine can help you navigate challenging financial times more effectively.

Here are some techniques to consider:

- Mindfulness Meditation: Practicing mindfulness meditation, even for a few minutes each day, can help calm your mind, reduce anxiety, and improve your focus. Focus on your breath, acknowledge your thoughts and feelings without judgment, and gently guide your attention back to the present moment.

- Deep Breathing Exercises: When stress arises, engage in deep, slow breaths. Inhale deeply through your nose, hold for a few seconds, and exhale slowly through your mouth. Deep breathing can help regulate your heart rate and promote relaxation.

- Physical Activity: Exercise releases endorphins, which have mood-boosting effects. Engage in regular physical activity that you enjoy, such as brisk walking, jogging, dancing, or swimming.

- Yoga and Tai Chi: These ancient practices combine gentle movements, deep breathing, and meditation, promoting relaxation, flexibility, and stress reduction.

- Spending Time in Nature: Connecting with nature has calming effects on the mind and body. Take walks in the park, sit by the ocean, or simply spend time observing the beauty of your surroundings.

- Engaging in Hobbies: Dedicate time to activities that bring you joy and help you unwind. Engaging in hobbies can provide a sense of accomplishment and distract you from financial worries.

- Connecting with Loved Ones: Talk to trusted friends, family members, or a therapist about your feelings. Sharing your concerns and seeking support can provide emotional relief and perspective.

Staying Positive and Motivated

Financial stress can take a toll on your mental and emotional well-being. When you’re bogged down by money worries, it’s easy to slip into negativity and feel overwhelmed. However, maintaining a positive outlook is crucial for navigating challenging financial times and staying motivated to improve your situation.

Here are some tips for staying positive and motivated when facing financial stress:

- Focus on what you can control: Dwelling on things beyond your control will only amplify stress. Instead, concentrate your energy on aspects you can influence, such as creating a budget, exploring additional income streams, or contacting creditors to discuss options.

- Celebrate small victories: Breaking down your financial goals into smaller, manageable steps allows you to acknowledge and celebrate achievements along the way. Each step forward, no matter how small, contributes to your overall progress.

- Practice gratitude: Take time to appreciate the positive aspects of your life, even amidst financial difficulties. Gratitude can shift your perspective and remind you of the good things you have.

- Seek support from loved ones: Talking to trusted friends or family members about your feelings can provide emotional support and help alleviate stress. Sharing your concerns with someone who understands can provide comfort and perspective.

- Visualize your goals: Create a vision board or regularly visualize yourself achieving your financial goals. Visualizing success can reinforce your commitment and boost motivation.

Conclusion

In conclusion, implementing these financial stress management tips can greatly improve your financial well-being and reduce anxiety related to money matters.