Discover practical tips and strategies to enhance your financial well-being in our latest article. Learn how to manage your finances effectively and achieve a healthier financial future.

Understanding Financial Well-Being

Financial well-being is more than just having money in the bank. It’s a holistic sense of security and confidence in your financial situation. It’s about feeling in control of your finances, having the ability to meet your current and future financial obligations, and having the freedom to pursue your goals and dreams.

There are several key aspects to financial well-being, including:

- Financial Security: Having enough money to cover your basic needs, such as housing, food, and transportation, without experiencing constant stress or worry.

- Financial Freedom: Having the financial resources and flexibility to make choices that align with your values and aspirations. This might include pursuing higher education, starting a business, traveling, or retiring early.

- Financial Control: Feeling empowered and knowledgeable about your finances. It’s about actively managing your money, making informed financial decisions, and staying on track to meet your goals.

- Financial Resilience: Having the ability to withstand unexpected financial setbacks, such as job loss, medical emergencies, or economic downturns, without derailing your long-term financial stability.

Understanding your own definition of financial well-being is essential. It’s a personal journey that looks different for everyone. Identifying your values, priorities, and goals is the first step in creating a roadmap to achieve financial well-being.

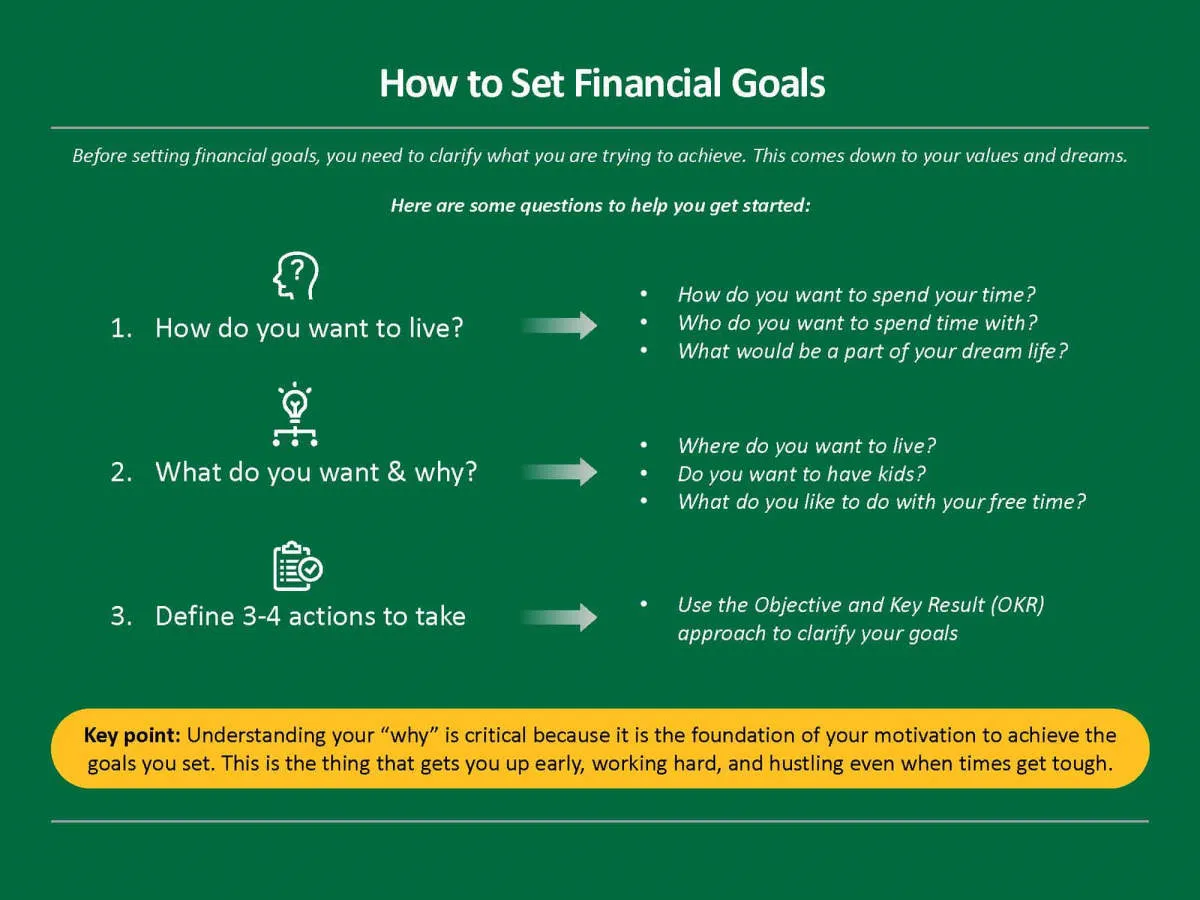

Setting Financial Goals

One of the most crucial steps towards improving your financial well-being is setting clear and achievable financial goals. Without goals, it’s easy to feel lost or unsure about where to direct your efforts. Financial goals act as a roadmap, guiding your financial decisions and helping you stay focused on what matters most.

Types of Financial Goals:

Financial goals can be categorized based on their time horizon:

- Short-term goals are achievable within a year, like building an emergency fund or paying off a credit card.

- Mid-term goals typically take a few years to reach, such as saving for a down payment on a house or buying a car.

- Long-term goals require five or more years of planning and saving, such as retirement planning or funding a child’s education.

SMART Goals:

A helpful framework for setting effective goals is the SMART method. Ensure your financial goals are:

- Specific: Clearly define your goal. Instead of saying “save more money,” specify an amount and purpose, like “save $5,000 for a down payment.”

- Measurable: Make your goals quantifiable to track progress. For example, “Reduce monthly spending by $200.”

- Attainable: Set realistic goals you can achieve with your current financial situation. Don’t aim for the impossible.

- Relevant: Choose goals aligned with your values and aspirations. Why is this goal important to you?

- Time-Bound: Establish a clear timeframe for achieving your goal to create a sense of urgency and accountability.

Prioritizing Your Goals:

It’s normal to have multiple financial goals. Prioritize them based on their importance to you and your current financial situation. This helps you focus your efforts and resources on what matters most at any given time.

Creating a Financial Plan

A well-structured financial plan is the cornerstone of achieving financial well-being. It acts as a roadmap guiding your financial decisions and helping you reach your financial goals. Here’s a step-by-step approach to creating your personalized plan:

1. Assess Your Current Financial Situation

Start by taking a detailed look at where you stand financially. This includes:

- Income and Expenses: Track your income sources and all your expenses to understand your cash flow.

- Assets and Liabilities: List down your assets (e.g., savings, investments, property) and liabilities (e.g., loans, credit card debts).

- Net Worth: Calculate your net worth by subtracting your liabilities from your assets. This gives you a snapshot of your current financial health.

2. Set SMART Financial Goals

Identify short-term and long-term financial goals that are:

- Specific

- Measurable

- Attainable

- Relevant

- Time-bound

Examples: Creating an emergency fund, saving for a down payment on a house, investing for retirement.

3. Create a Budget

Develop a realistic budget that aligns with your income, expenses, and financial goals. This involves:

- Tracking Expenses: Monitor your spending habits closely.

- Identifying Areas to Reduce Spending: Look for areas where you can cut back on unnecessary expenses.

- Allocating Funds to Savings and Investments: Prioritize saving and investing to achieve your goals.

4. Manage Debt Effectively

Develop a plan to manage and reduce your debts, such as:

- Prioritizing High-Interest Debts: Focus on paying off debts with the highest interest rates first.

- Exploring Debt Consolidation Options: Consider consolidating debts to simplify payments and potentially reduce interest costs.

5. Invest Wisely

Determine your risk tolerance and investment goals to create an investment strategy. Explore different investment options like:

- Stocks

- Bonds

- Mutual Funds

- Real Estate

6. Regularly Review and Adjust

Your financial situation and goals may change over time. Regularly review and adjust your financial plan to stay on track.

Budgeting for Success

Creating and sticking to a budget is the cornerstone of financial well-being. It’s about taking control of your money and making informed decisions about where it goes.

Here’s how to build a budget that works for you:

- Track Your Income and Expenses: Note down all sources of income and track every dollar you spend for a month. You can use a spreadsheet, budgeting apps, or even a simple notebook.

- Identify Needs vs. Wants: Differentiate between essential expenses (needs like rent, groceries) and discretionary spending (wants like entertainment, dining out).

- Set Realistic Financial Goals: Having clear goals, whether it’s saving for a down payment, paying off debt, or investing, gives your budget direction.

- Allocate Your Income: Decide how much of your income will go towards each spending category (needs, wants, savings, debt repayment) based on your priorities and goals.

- Find Areas to Cut Back: Analyze your spending habits to identify areas where you can potentially reduce expenses without drastically impacting your lifestyle.

- Automate Your Savings: Treat savings like a non-negotiable expense. Set up automatic transfers to your savings account each month.

- Review and Adjust Regularly: Your budget shouldn’t be static. Revisit it monthly, or as needed, to make adjustments based on changes in your income, expenses, or goals.

Saving and Investing Wisely

Saving and investing are essential aspects of improving your financial well-being. They go hand-in-hand in helping you build a secure future.

Saving: Building a Strong Foundation

Saving involves setting aside a portion of your income regularly. This financial cushion provides numerous benefits:

- Emergency Fund: Life is full of surprises, and having an emergency fund can help you navigate unexpected expenses like medical bills or car repairs without derailing your finances.

- Financial Security: Saving provides a safety net, offering peace of mind and reducing financial stress.

- Achieving Goals: Whether it’s a down payment on a house, a dream vacation, or your children’s education, saving helps you reach your financial goals faster.

Investing: Growing Your Wealth

Investing involves putting your money to work by purchasing assets that have the potential to increase in value over time. While investing carries risks, it offers significant potential rewards:

- Wealth Accumulation: Investing allows your money to grow at a rate that outpaces inflation, helping you build wealth over the long term.

- Reaching Financial Goals: By investing wisely, you can accelerate your progress towards your financial goals, whether it’s retiring early or achieving financial independence.

Tips for Saving and Investing Wisely

- Create a Budget: Understanding your income and expenses is crucial for identifying areas where you can save more effectively.

- Set Realistic Goals: Start with achievable saving and investing targets and gradually increase them as your financial situation improves.

- Automate Savings: Set up automatic transfers from your checking account to your savings or investment accounts to make saving a consistent habit.

- Diversify Your Investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to manage risk.

- Seek Professional Advice: Consult with a financial advisor to create a personalized saving and investment plan that aligns with your goals and risk tolerance.

Managing Debt Effectively

Debt is a common financial obligation that, if not managed properly, can significantly impact your overall financial well-being. However, with a proactive and strategic approach, you can gain control of your debt and work towards becoming debt-free.

1. Create a Budget and Track Your Spending

The first step to effectively managing debt is to understand your cash flow. Create a detailed budget that outlines your income and expenses. Track your spending meticulously to identify areas where you can cut back and free up more money to put towards debt repayment.

2. Prioritize High-Interest Debts

Not all debts are created equal. Make a list of all your debts, including interest rates and minimum payments. Prioritize paying down high-interest debts first, such as credit cards, as they accrue interest more quickly and can trap you in a cycle of debt.

3. Explore Debt Consolidation or Refinancing Options

If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. Debt consolidation can simplify your finances and potentially reduce your monthly payments. Similarly, explore refinancing options for existing loans to secure a lower interest rate and save money over the life of the loan.

4. Negotiate with Creditors

Don’t be afraid to reach out to your creditors and try to negotiate more favorable terms. Explain your financial situation and see if they are willing to lower your interest rates, waive fees, or create a more manageable payment plan. Open communication and a proactive approach can sometimes lead to positive outcomes.

5. Seek Professional Guidance if Needed

If you’re struggling to manage your debt on your own, don’t hesitate to seek professional help. A financial advisor can provide personalized guidance, develop a debt management plan, and offer support throughout the process.

Building an Emergency Fund

One of the cornerstones of strong financial well-being is having a safety net to fall back on. An emergency fund is that safety net. This is money set aside specifically for unexpected expenses or financial hardships, like:

- Job loss

- Medical bills

- Car repairs

- Home repairs

Without an emergency fund, these situations can quickly spiral into debt and damage your overall financial health.

How much should you save?

A good rule of thumb is to aim for 3-6 months’ worth of living expenses. This may seem daunting, but it doesn’t have to happen overnight.

Tips for Building Your Emergency Fund:

- Start small: Even $10 or $20 a week adds up over time.

- Make it automatic: Set up automatic transfers from your checking to your savings account.

- Cut expenses: Find areas in your budget where you can cut back and redirect that money to your emergency fund.

- Windfalls: Put any unexpected income – tax refunds, bonuses, or gifts – into your emergency fund.

- Separate accounts: Keep your emergency fund in a separate account from your everyday spending money to avoid accidental use.

Seeking Professional Advice

While there’s plenty of free financial advice available, sometimes it’s best to consult with a professional. Financial advisors can provide personalized guidance tailored to your specific situation, goals, and risk tolerance.

Here are some instances when seeking professional advice can be particularly beneficial:

- Complex financial situations: If you’re dealing with significant assets, investments, or estate planning needs, a financial advisor can help navigate the complexities.

- Major life changes: Events like marriage, divorce, birth of a child, or receiving an inheritance often necessitate financial adjustments where professional guidance proves valuable.

- Feeling overwhelmed: Managing finances can be stressful. If you’re feeling overwhelmed or unsure about making decisions, a financial advisor can provide clarity and support.

When choosing a financial advisor, consider their credentials, experience, and fee structure. Look for a fiduciary, meaning they’re legally obligated to act in your best interest.

Conclusion

In conclusion, taking proactive steps such as budgeting, saving, and investing can significantly improve your financial well-being in the long run. It’s important to set goals and prioritize financial stability for a secure future.