Identity theft can devastate your finances. Learn essential tips to safeguard your financial information and prevent identity theft attacks from wreaking havoc on your financial stability.

Understanding Identity Theft

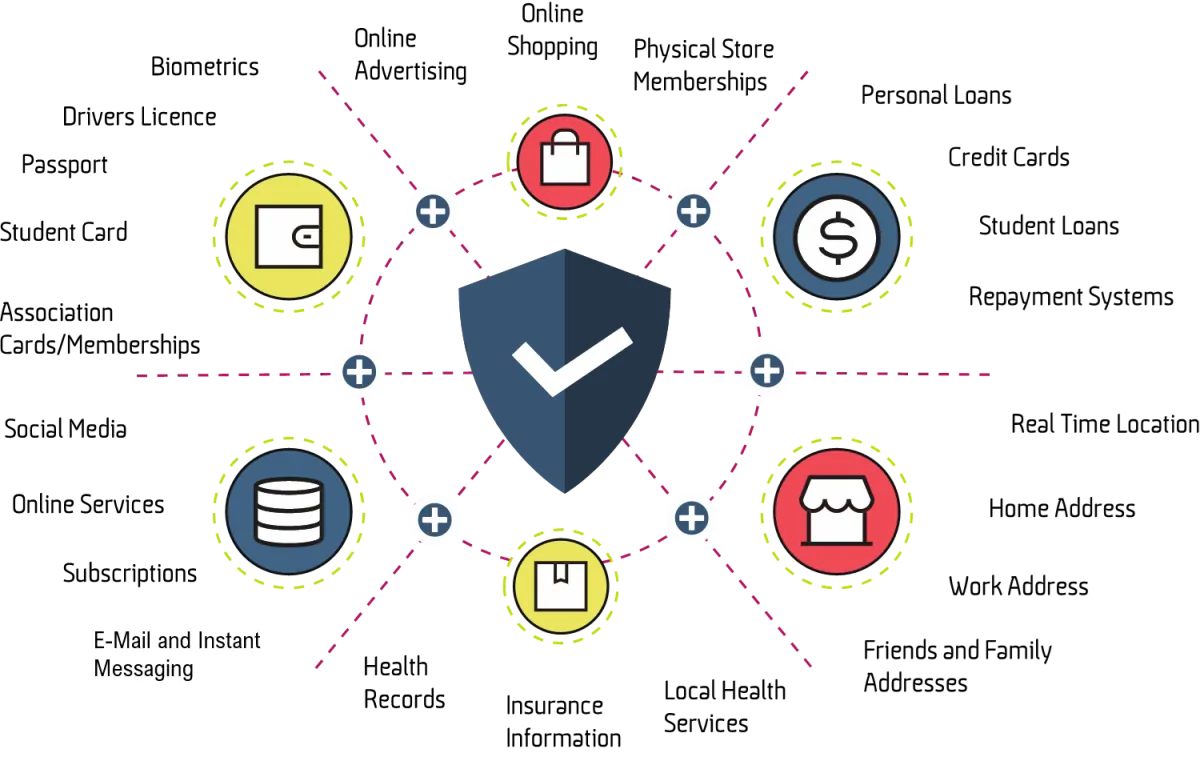

Identity theft occurs when someone steals your personal information and uses it without your permission. This information can include your name, address, Social Security number, credit card numbers, and bank account information.

Thieves can use your stolen identity to:

- Open new credit card accounts

- Take out loans in your name

- Access your existing bank accounts

- File for bankruptcy

- Receive medical care using your insurance

Identity theft can have a devastating impact on your finances and your credit score. It can take months or even years to resolve the problems caused by identity theft.

Tips for Protecting Personal Information

Protecting your personal information is the first line of defense against identity theft and financial fraud. Here are some essential tips to keep your data safe:

1. Secure Your Physical Documents

Shred sensitive documents: This includes bank statements, credit card offers, medical bills, and anything with your Social Security number or account numbers.

Store important documents securely: Keep passports, birth certificates, and Social Security cards in a secure location like a home safe or a locked filing cabinet.

2. Practice Safe Online Habits

Use strong passwords and don’t reuse them: Create complex passwords with a mix of upper and lowercase letters, numbers, and symbols. Consider a password manager to keep track of them.

Beware of phishing scams: Don’t click on links or open attachments from suspicious emails. Verify requests for personal information from companies directly.

Secure your home Wi-Fi: Use a strong password and enable network encryption (WPA2 or WPA3).

Be cautious on public Wi-Fi: Avoid accessing sensitive accounts like banking or shopping while using public Wi-Fi. If you must, consider using a VPN.

3. Monitor Your Accounts and Reports

Regularly review your bank and credit card statements: Look for any unauthorized transactions and report them immediately.

Check your credit reports: Request free credit reports annually from each of the three major credit bureaus (Equifax, Experian, TransUnion) and review them for any inaccuracies or suspicious activity.

Consider a credit monitoring service: These services can alert you to potential identity theft by monitoring your credit reports for changes.

4. Be Careful Who You Share Information With

Limit the personal information you share online: Be mindful of what you post on social media and avoid publicly sharing sensitive data.

Be wary of phone scams: Don’t give out personal information over the phone unless you initiated the call and trust the source.

5. Protect Your Devices

Use strong passwords or biometrics to lock your devices: This helps prevent unauthorized access to your personal information.

Keep software up to date: Install security updates for operating systems, apps, and antivirus software to protect against vulnerabilities.

Monitoring Your Credit Report

Regularly monitoring your credit report is one of the most effective ways to protect yourself from identity theft. It allows you to:

- Detect suspicious activity early: By checking your report frequently, you can identify any unauthorized accounts or inquiries, indicating that someone might be attempting to use your identity.

- Dispute inaccuracies: Errors on your credit report can negatively impact your financial health. Monitoring allows you to spot and dispute these inaccuracies promptly.

- Track your financial progress: Regularly reviewing your credit report helps you understand your credit standing and track your progress towards your financial goals.

You can obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. It’s recommended to stagger these reports throughout the year to have more frequent access to your credit information. Additionally, various credit monitoring services are available, often for a fee, that provide alerts and updates on your credit report in real time.

Using Strong Passwords

One of the most effective ways to protect your financial information is to use strong, unique passwords for all of your financial accounts. A strong password is:

- At least 12 characters long

- Includes a mix of upper and lowercase letters, numbers, and symbols

- Is not a word found in the dictionary or a common phrase

- Is different from the passwords you use for other accounts

It may seem daunting to remember a bunch of complex passwords, but a password manager can be incredibly helpful in generating and storing your passwords securely.

Tips for Creating Strong Passwords:

- Think of a phrase instead of a word: Instead of “password,” use the first letters of each word in a phrase like “My dog Sparky loves chasing squirrels” to create “MdSlcs!”.

- Substitute numbers and symbols: Replace letters in a word with similar-looking numbers and symbols, like “pa$$w0rd” for “password.”

- Don’t reuse passwords: Having the same password across multiple platforms makes it easier for hackers to access your information.

- Enable two-factor authentication (2FA) whenever possible: This adds an extra layer of security by requiring a unique code from your phone or email in addition to your password.

Avoiding Phishing Scams

Phishing scams are one of the most common ways that identity thieves attempt to steal your personal information. These scams typically involve fraudulent emails, text messages, or websites that are designed to trick you into giving up your sensitive data, such as your Social Security number, bank account information, or credit card details.

Here are some tips to help you avoid phishing scams:

- Be wary of unsolicited emails or messages. Legitimate companies rarely ask for personal information via email or text. If you receive an unsolicited message that seems suspicious, don’t click on any links or attachments. Instead, contact the company directly using a verified phone number or email address.

- Look for red flags. Phishing emails and websites often contain misspellings, grammatical errors, or awkward phrasing. They may also use generic greetings, such as “Dear customer,” instead of your name. Pay close attention to the sender’s email address and the website’s URL. Look for any inconsistencies or suspicious characters.

- Hover over links before you click. This will allow you to see the actual URL where the link will take you. If the URL looks suspicious or doesn’t match the link text, don’t click on it.

- Don’t give out personal information unless you’re sure of the recipient. If you’re unsure whether a website or email is legitimate, don’t enter any personal information. It’s better to be safe than sorry.

- Keep your software updated. Software updates often include security patches that can help protect your devices from phishing attacks. Make sure your operating system, web browser, and other software are up to date.

- Use a spam filter. A good spam filter can help block phishing emails from reaching your inbox. Most email providers offer built-in spam filters.

- Report phishing attempts. If you receive a phishing email, you can report it to the Anti-Phishing Working Group (APWG) at https://www.apwg.org. You can also report it to the company or organization that the phishing email is impersonating.

What to Do if Your Identity is Stolen

Discovering your identity has been stolen can be incredibly stressful. It’s crucial to act quickly and decisively to minimize the damage. Here’s a step-by-step guide on what to do:

1. Report the Identity Theft

- Contact the Companies Where You Know Fraud Occurred: Immediately contact credit card companies, banks, or any other institutions where you suspect fraudulent activity.

- File a Police Report: Report the identity theft to your local police department. This report can be helpful for your records and for dealing with credit reporting agencies and creditors.

- Report to the Federal Trade Commission (FTC): File a complaint with the FTC at IdentityTheft.gov. This website provides valuable resources and helps you create a personalized recovery plan.

2. Place a Fraud Alert and Credit Freeze

- Fraud Alert: Contact one of the three major credit bureaus (Experian, Equifax, TransUnion) and request a fraud alert. This alert requires lenders to verify your identity before issuing new credit in your name.

- Credit Freeze: Consider placing a credit freeze (also known as a security freeze) with all three credit bureaus. This action restricts access to your credit report, making it much harder for identity thieves to open new accounts.

3. Review Your Credit Reports

Obtain free copies of your credit reports from all three credit bureaus at AnnualCreditReport.com. Scrutinize them for any unauthorized accounts, inquiries, or suspicious activity. Dispute any inaccuracies immediately.

4. Close Compromised Accounts

Contact your bank and credit card companies to close any accounts that were opened fraudulently or that you believe have been compromised. Request new account numbers and passwords.

5. Change Your Passwords

Change passwords for all your online accounts, especially those related to banking, finance, and email. Use strong, unique passwords for each account.

6. Monitor Your Accounts

Keep a close eye on your bank accounts, credit card statements, and other financial statements for any signs of suspicious activity. Report anything unusual immediately.

Reporting Identity Theft

Discovering you’re a victim of identity theft can be incredibly stressful. However, taking swift and decisive action is crucial in mitigating the damage. Here’s a step-by-step guide on reporting identity theft:

1. Contact the Companies Where Fraud Occurred

Immediately reach out to the financial institutions, credit card companies, or any other businesses where you suspect fraudulent activity has taken place. Report the identity theft to their fraud departments and follow their specific instructions.

2. Report to the Federal Trade Commission (FTC)

File a report with the FTC at IdentityTheft.gov. This website provides valuable resources for victims and helps authorities track identity theft trends. Filing a report will provide you with an Identity Theft Affidavit, a crucial document for disputing fraudulent charges.

3. Contact Credit Reporting Agencies

Notify the three major credit reporting agencies – Equifax, Experian, and TransUnion. Place a fraud alert on your credit reports. This alert will make it more difficult for thieves to open new accounts in your name. Consider a credit freeze for stronger protection, restricting access to your credit report entirely.

4. Report to Law Enforcement

While not always required, filing a police report can be beneficial. It creates an official record of the crime, which may be necessary for insurance claims or other legal proceedings. Contact your local police department to file a report.

5. Keep Detailed Records

Maintain thorough documentation of all correspondence, including dates, names, and outcomes. Keep copies of all reports filed, letters sent and received, and any other relevant information. This documentation will be vital as you work to resolve the situation.

Recovering from Identity Theft

Discovering that you’re a victim of identity theft can be incredibly stressful. It’s crucial to act quickly and decisively to minimize the damage and begin the recovery process. Here’s a step-by-step guide to help you navigate this challenging situation:

1. Report the Theft

Immediately report the identity theft to the relevant authorities. File a police report with your local law enforcement agency and obtain a copy of the report. Additionally, contact the Federal Trade Commission (FTC) to report the identity theft and receive guidance tailored to your situation.

2. Contact Credit Reporting Agencies

Reach out to the major credit reporting agencies (Equifax, Experian, and TransUnion) to report the identity theft. Request a fraud alert to be placed on your credit reports. This alert notifies creditors to take extra precautions before granting credit in your name. Consider placing a credit freeze, which restricts access to your credit reports, making it harder for thieves to open new accounts.

3. Close Compromised Accounts

Identify and close any accounts that have been compromised or opened fraudulently. Contact your bank, credit card companies, and other financial institutions to report the identity theft. They will guide you through their specific procedures for closing accounts and disputing unauthorized transactions.

4. Review Your Credit Reports

Obtain copies of your credit reports from all three credit bureaus. Carefully review each report for any suspicious activity, such as unfamiliar accounts, inquiries, or addresses. Dispute any errors or fraudulent entries with the credit reporting agencies and the respective creditors.

5. Create a Recovery Plan

Work with your financial institutions, credit reporting agencies, and law enforcement to create a recovery plan. This plan should outline the steps you need to take to restore your identity and credit, as well as prevent future fraud. Document all communications, actions taken, and expenses incurred as a result of the identity theft.

Conclusion

Stay vigilant by monitoring your accounts regularly and implementing strong passwords to safeguard your finances from identity theft.