Planning ahead is crucial when preparing for a major purchase. Learn how to effectively manage your finances and make informed decisions in our comprehensive guide on ‘How to Plan Your Finances for a Major Purchase’.

Setting a Savings Goal

Before diving into the nitty-gritty of budgeting and saving, you need a clear picture of what you’re working towards. This is where setting a savings goal for your major purchase comes in.

Determine the Exact Cost: Research the current price of your desired item. Factor in potential price fluctuations, taxes, and any additional costs associated with the purchase, like delivery fees or installation charges.

Set a Realistic Timeline: When do you ideally want to make this purchase? Be honest with yourself about how long it might realistically take to save. A longer timeline will mean smaller monthly contributions, while a shorter timeline will require more aggressive savings.

Break Down Your Goal: A large savings goal can feel daunting. Break it down into smaller, more manageable milestones. This could be monthly savings targets or achieving a certain percentage of your overall goal.

Creating a Savings Plan

A solid savings plan is the cornerstone of affording your major purchase. Here’s how to build one:

1. Define Your Savings Goal

How much do you need to save? Be precise. Factor in not just the purchase price, but also potential additional costs like taxes, fees, or delivery charges.

2. Set a Realistic Timeframe

When do you want to make your purchase? A shorter timeframe means more aggressive saving. Be realistic about what you can comfortably achieve.

3. Break it Down

Divide your total savings goal by the number of months until your purchase. This gives you a clear monthly savings target. Seeing smaller, manageable amounts can make the process less daunting.

4. Automate Your Savings

Treat your savings like a non-negotiable bill. Set up automatic transfers from your checking account to your savings account each month. This ensures consistent progress and prevents impulse spending from derailing your plan.

5. Explore High-Yield Savings Options

Don’t settle for a basic savings account. Research high-yield savings accounts or money market accounts that offer better interest rates. Even a small percentage difference can add up over time.

6. Track Your Progress Regularly

Monitor your savings progress monthly. This helps you stay motivated and make adjustments if needed. If you experience a windfall (like a bonus or tax refund), consider putting a portion towards your goal to accelerate your progress.

Finding Extra Money to Save

Saving for a major purchase can seem daunting, but finding extra money to put towards your goal might be easier than you think. It often starts with a closer look at your spending habits and finding areas where you can cut back without drastically impacting your lifestyle.

Track Your Spending

The first step to finding extra money is understanding where your money is going. Use a budgeting app, a spreadsheet, or even just a notebook to track your income and expenses for a month or two. Categorize your spending (housing, groceries, entertainment, etc.) to identify areas where you might be able to save.

Cut Back on Non-Essentials

Once you have a clear picture of your spending, identify areas where you can cut back. These might include:

- Dining Out: Cooking at home more often can lead to significant savings.

- Entertainment: Explore free or low-cost entertainment options like parks, museums with free days, or local events.

- Subscriptions: Review your subscriptions for streaming services, magazines, or gym memberships you might not be using fully.

- Impulse Purchases: Before making a purchase, especially a non-essential one, give yourself a cooling-off period. You might find you don’t need it as much as you thought.

Boost Your Income

In addition to cutting expenses, consider ways to boost your income. This could include:

- Selling Unwanted Items: Declutter your home and sell unwanted clothing, electronics, or furniture online or through consignment stores.

- Side Hustle: Explore freelance work, gig economy opportunities, or part-time jobs that fit your skills and schedule.

Make Saving Automatic

Set up automatic transfers from your checking account to your savings account each month. Even small, consistent contributions add up over time.

Cutting Expenses to Save More

Saving for a major purchase requires a two-pronged approach: increasing your income and reducing your expenses. While finding ways to earn extra money is great, cutting back on your spending often offers the fastest route to boosting your savings rate. Here’s how to trim the fat from your budget:

1. Track Your Spending

You can’t manage what you don’t measure. Begin by diligently tracking your expenses for at least a month. Use a budgeting app, a spreadsheet, or even a simple notebook. Categorize your spending to identify areas where your money is going.

2. Identify Non-Essential Expenses

Once you have a clear picture of your spending habits, scrutinize each category. Look for non-essential expenses that you can comfortably reduce or eliminate altogether. This might include:

- Dining out too often

- Subscription boxes you rarely use

- Expensive gym memberships (explore cheaper alternatives)

- Impulse purchases

3. Set Spending Limits

Establish realistic spending limits for each category in your budget. This will help you stay mindful of your spending and prevent overspending in certain areas. Consider using cash envelopes for categories like groceries or entertainment to physically limit your spending.

4. Negotiate Lower Bills

Don’t be afraid to negotiate lower rates for recurring expenses like:

- Internet and cable: Call your provider and inquire about promotional offers or discounts.

- Insurance premiums: Shop around for better rates or ask your current provider for a lower premium.

- Credit card interest rates: If you carry a balance, call your credit card company and request a lower interest rate.

5. Find Free or Low-Cost Alternatives

Look for free or cheaper ways to enjoy your hobbies and entertainment. Instead of going to the movies, have a movie night at home. Explore free activities in your community, like concerts in the park or hiking trails.

Using High-Interest Accounts

When saving for a major purchase, making your money work for you is essential. That’s where high-interest accounts come in. These accounts offer a higher interest rate than traditional savings accounts, allowing your money to grow more quickly over time.

Here’s how high-interest accounts can help you reach your savings goals faster:

- Increased Earnings: The higher interest rate means your savings will accumulate more interest, accelerating your progress towards your target amount.

- Compound Interest: Many high-interest accounts offer compound interest, which means you earn interest on both your initial deposit and any interest earned previously. This compounding effect can significantly boost your savings over time.

Types of High-Interest Accounts to Consider:

- High-Yield Savings Accounts: Offered by online banks and credit unions, these accounts typically have higher interest rates than traditional savings accounts.

- Money Market Accounts (MMAs): MMAs offer variable interest rates that tend to be higher than regular savings accounts, but may have higher minimum balance requirements.

- Certificates of Deposit (CDs): CDs require you to lock in your money for a fixed period, but offer higher interest rates in exchange for the limited access to funds.

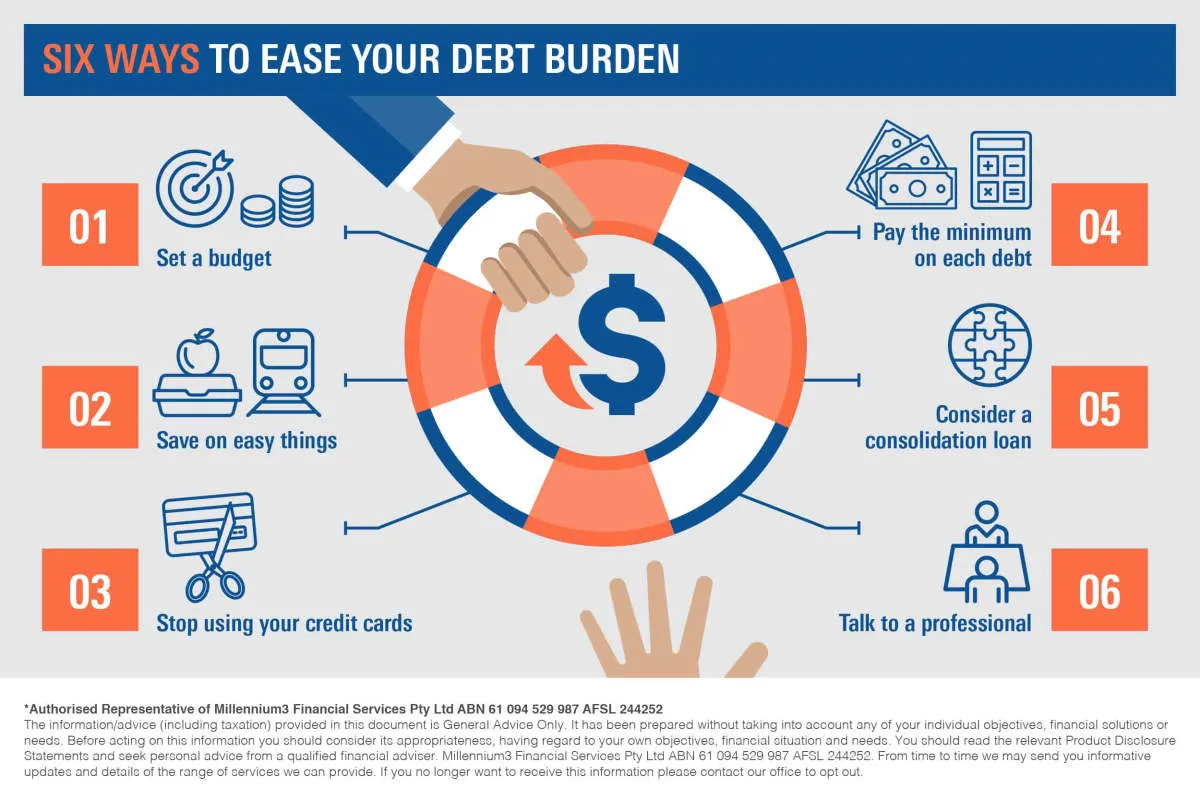

Avoiding Unnecessary Debt

Making a major purchase often requires financial planning and discipline. While loans and credit cards can bridge the gap between savings and the purchase price, it’s crucial to avoid taking on unnecessary debt that could strain your finances in the long run. Here’s how:

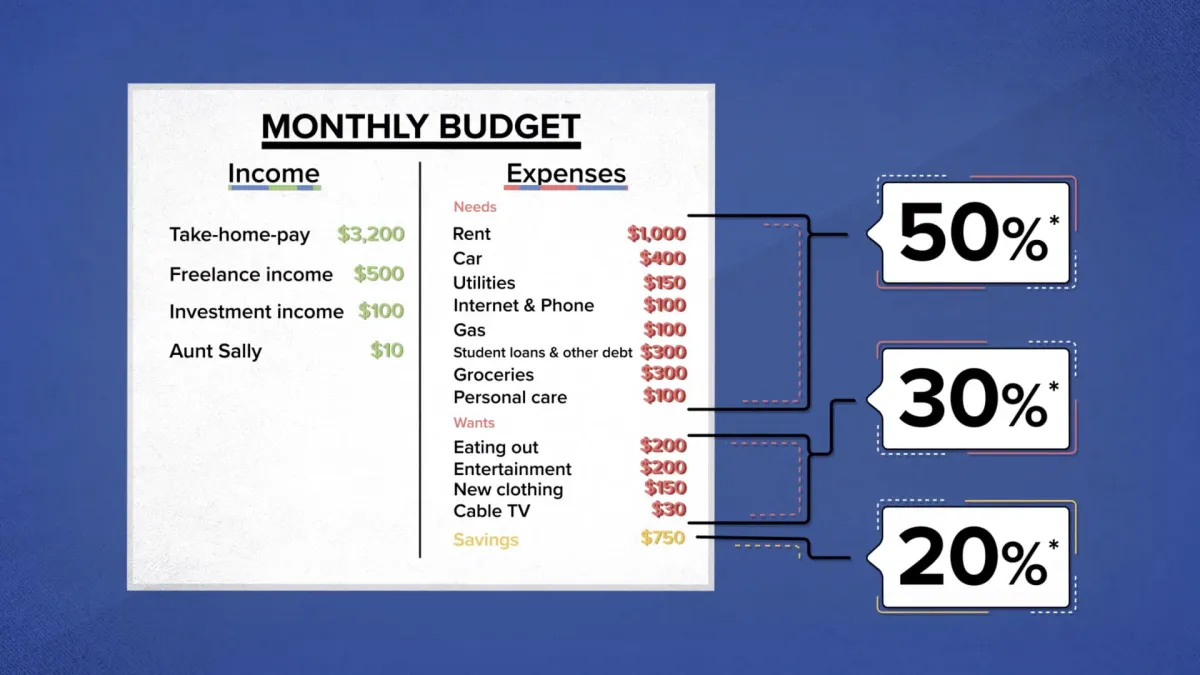

1. Build a Realistic Budget:

Before even considering a major purchase, thoroughly analyze your income, expenses, and savings. Identify areas where you can cut back on non-essential spending and allocate those funds towards your purchase goal. Having a clear picture of your financial standing will help you determine how much you can realistically afford to spend without relying heavily on debt.

2. Save Aggressively:

The more you can save upfront, the less you’ll need to borrow and the less interest you’ll pay. Consider setting a specific savings goal and timeframe for your purchase. Explore different savings options like high-yield savings accounts or certificates of deposit (CDs) to maximize your returns.

3. Explore Alternative Financing Options:

If you’re considering financing your purchase, don’t jump into the first loan offer you receive. Shop around for the best interest rates and loan terms from various lenders, including banks, credit unions, and online lenders. Compare annual percentage rates (APRs), fees, and repayment options to secure the most favorable terms.

4. Negotiate the Purchase Price:

Don’t be afraid to negotiate the price of the item you’re purchasing, especially if it’s a big-ticket item like a car or appliance. Research the fair market value beforehand and come prepared to make a reasonable offer. You might be surprised at how much you can save by simply asking for a better price.

5. Consider a Trade-In or Selling Existing Assets:

If you’re upgrading a device or appliance, explore trade-in options. Many retailers offer credit or discounts for old models, which can offset the cost of the new purchase. Additionally, consider selling other assets you no longer need or use to generate extra cash for your purchase.

6. Resist Impulse Purchases:

Major purchases should be well-thought-out decisions. Avoid making impulsive purchases driven by emotions or marketing tactics. Take your time, research your options thoroughly, and carefully evaluate your financial situation before committing to the purchase.

Tracking Your Savings Progress

Keeping tabs on your savings journey is just as important as planning for it. This allows you to stay motivated, make necessary adjustments, and celebrate milestones along the way. Here’s how to effectively track your savings progress:

1. Use a Dedicated Savings Account:

Open a separate savings account specifically for your major purchase. This keeps your funds organized and helps you visualize your progress without the distraction of your everyday transactions.

2. Employ Budgeting Apps or Spreadsheets:

Leverage technology or traditional methods to monitor your savings. Budgeting apps can automatically track your income and expenses, while spreadsheets offer a customizable platform to input and analyze your savings journey. Choose the method that best suits your preferences.

3. Set Milestones and Celebrate Achievements:

Break down your savings goal into smaller milestones. This makes the journey less daunting and provides a sense of accomplishment as you reach each milestone. Treat yourself to small rewards (within budget) to stay motivated.

4. Review and Adjust Regularly:

Life is dynamic, and your financial situation might change. Regularly review your savings plan and adjust it based on your current income, expenses, and any unforeseen circumstances. This ensures you stay on track despite potential challenges.

5. Visualize Your Goal:

Create a vision board or use visual aids to remind yourself of the end goal. This serves as a powerful motivator, especially when you encounter temptations or feel discouraged.

Reaching Your Purchase Goal

You’ve diligently planned, budgeted, and saved. Now, you’re in the home stretch of reaching your purchase goal. Here’s how to navigate this final stage:

1. Track Your Progress and Adjust:

Regularly monitor your savings progress. Are you on track to reach your goal by your intended purchase date? If not, don’t panic. Explore ways to adjust your budget or consider pushing back your timeline slightly.

2. Explore Financing Options (If Applicable):

For significant purchases like homes or cars, research financing options like loans. Compare interest rates, terms, and potential fees from different lenders to secure the most favorable deal. Factor any loan payments into your budget to ensure affordability.

3. Avoid Lifestyle Inflation:

As you get closer to your goal, resist the temptation to increase your spending. Maintain your current budget discipline to avoid derailing your progress at the final hour.

4. Set Up Automatic Transfers (If Needed):

If you haven’t already, consider setting up automatic transfers from your checking account to your dedicated savings account. This ensures consistent contributions and minimizes the risk of spending the money earmarked for your goal.

5. Review and Reassess:

Before making your purchase, take time to review your finances one last time. Ensure you’re comfortable with the overall impact on your financial situation and that your purchase aligns with your long-term goals.

Conclusion

Proper financial planning is crucial for a major purchase. Utilize budgeting, savings, and research to make informed decisions and achieve your financial goals.