Discover practical tips and strategies to reduce housing expenses in our comprehensive guide on How to Save Money on Housing Expenses.

Assessing Your Housing Costs

The first step to saving money on housing is understanding where your money is going. Take a hard look at your housing expenses. This goes beyond just your rent or mortgage payment. Consider these factors:

- Rent/Mortgage: This is likely your biggest housing expense. Note the exact amount, due date, and any potential increases coming up.

- Utilities: This includes electricity, gas, water, sewage, and trash. Track your average monthly costs for each.

- Internet/Cable/Streaming: These can add up quickly. List out each service and its cost.

- Maintenance/Repairs: Whether renting or owning, factor in costs for routine upkeep and unexpected repairs.

- Property Taxes (Homeowners): If you own, include your annual property tax payment.

- Homeowners Insurance (Homeowners): Factor in your annual insurance premium.

Once you’ve listed all your housing costs, calculate your total monthly spending. This will give you a clear picture of your housing expenses and serve as a baseline for finding potential savings.

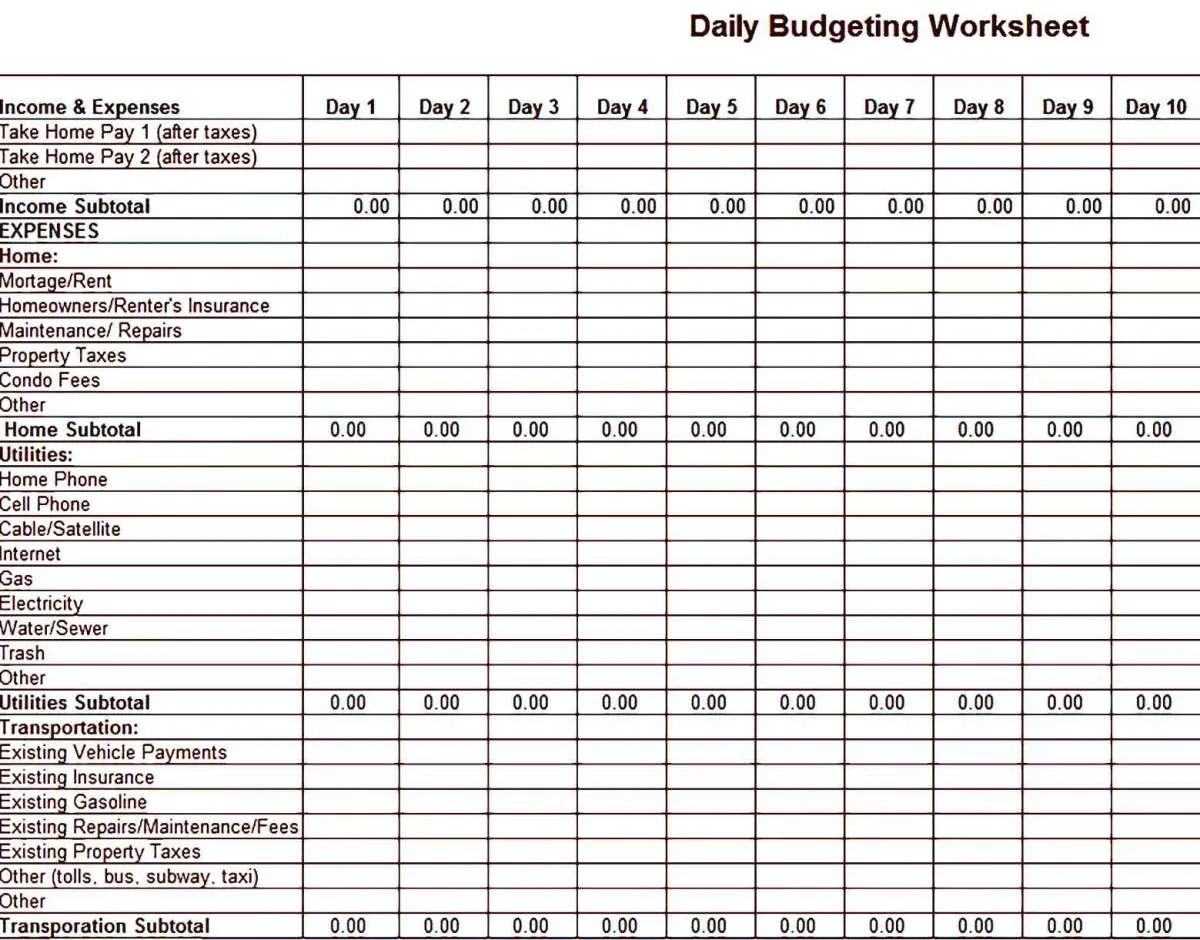

Creating a Housing Budget

One of the most effective ways to save money on housing expenses is to create a comprehensive budget. This will help you track your income and expenses, identify areas where you can cut back, and make informed decisions about your housing situation.

Here are the steps to create a housing budget:

- Calculate Your Income: Determine your total monthly income from all sources, including your salary, wages, bonuses, investments, and any other sources of revenue.

- Track Your Housing Expenses: List down all your housing-related expenses. This includes your rent or mortgage payments, property taxes, insurance premiums, utilities, maintenance costs, and any other fees associated with your housing.

- Determine Your Housing Expense Ratio: Divide your total monthly housing expenses by your total monthly income. Ideally, your housing expenses should not exceed 30% of your gross income. This ratio will help you assess if your housing costs are within a reasonable range.

- Identify Areas for Reduction: Analyze your housing expenses and look for areas where you can potentially cut back. For instance, you could consider downsizing to a smaller home or apartment, renting out a spare room, or negotiating with your landlord or mortgage lender for better rates or payment plans.

- Set Realistic Savings Goals: Establish clear and attainable savings goals for your housing expenses. Determine how much you can realistically afford to save each month and explore different savings options, such as opening a dedicated savings account or setting up automatic transfers.

- Review and Adjust Regularly: Periodically review and adjust your housing budget as needed. Your income and expenses may fluctuate, so it’s essential to keep your budget updated to reflect your current financial situation. Make adjustments as necessary to ensure you stay on track with your savings goals and maintain a healthy financial balance.

Finding Affordable Housing

One of the most significant expenses you’ll face is housing. Finding affordable housing can free up a considerable portion of your budget for other essential needs or savings goals. Here are some strategies to consider:

1. Consider Location, Location, Location

Housing costs can vary drastically depending on where you live. Explore areas with a lower cost of living, even if it means living in a smaller town or commuting a bit further.

2. Explore Different Housing Options

Don’t limit yourself to just apartments or houses. Consider options like:

- Shared Housing: Renting a room in a house or apartment with roommates can significantly reduce your rent and utility bills.

- Micro-Apartments or Tiny Homes: These smaller living spaces often come at a lower cost and can be an excellent option for minimalist living.

- Mobile Homes or Manufactured Homes: These can be a more affordable alternative to traditional homes, especially in certain areas.

3. Negotiate Rent and Look for Incentives

Don’t be afraid to negotiate with landlords, especially in a competitive rental market. You might secure a lower rent or other perks like a free month’s rent or waived amenity fees.

4. Look for Housing Assistance Programs

Various government and non-profit organizations offer housing assistance programs for low-income individuals and families. Research programs available in your area.

5. Consider House Hacking

If you’re open to it, house hacking involves buying a multi-unit property and renting out the other units to offset your mortgage payments.

Tips for Reducing Rent

Rent is often the largest monthly expense, but there are several strategies you can use to potentially lower yours:

Negotiate with Your Landlord

Don’t be afraid to negotiate with your landlord, especially if you’re a good tenant with a history of on-time payments. Research average rent prices in your area and come prepared to discuss a fair rate.

Downsize to a Smaller Unit or Get a Roommate

Consider downsizing to a smaller apartment or finding a roommate to share the costs. While this might mean adjusting your living situation, it can significantly reduce your monthly rent payments.

Relocate to a More Affordable Area

If you’re open to it, explore relocating to a more affordable neighborhood or city. Do your research and compare the cost of living in different areas to find a place that suits your budget.

Look for Rent-Controlled or Subsidized Housing Options

Some cities offer rent-controlled apartments or subsidized housing programs for eligible individuals and families. Research the options available in your area to see if you qualify.

Offer Services in Exchange for Reduced Rent

If you have valuable skills, like handyman work, pet sitting, or cleaning, consider approaching your landlord about exchanging services for reduced rent. This can be a mutually beneficial arrangement.

Saving on Home Maintenance

Keeping up with home maintenance is crucial for preventing costly repairs down the road. However, staying on top of upkeep doesn’t have to break the bank. Here are some effective strategies for saving money on home maintenance:

DIY When Possible

Many home maintenance tasks can be tackled by homeowners, even those with limited experience. Simple tasks like replacing air filters, cleaning gutters, and patching drywall can save you significant amounts compared to hiring professionals. Numerous online resources and tutorials can guide you through these projects.

Prioritize Preventative Maintenance

Addressing minor issues promptly can prevent them from escalating into major, expensive problems. For instance, regularly inspecting and cleaning your HVAC system can extend its lifespan and prevent costly breakdowns. Similarly, checking for and repairing roof leaks immediately can avert significant water damage.

Shop Around for Contractors

When professional help is necessary, don’t hesitate to get quotes from multiple contractors. Compare their prices, experience, and warranties to ensure you’re getting the best value. Ask for recommendations from friends, family, or neighbors who have had positive experiences with local contractors.

Take Advantage of Seasonal Savings

Many home improvement stores offer discounts on maintenance-related items during specific seasons. For instance, you might find deals on insulation in the fall or air conditioning units in the spring. Plan ahead and stock up on supplies when they’re on sale.

Negotiate with Contractors

Don’t be afraid to negotiate prices with contractors, especially for larger projects. Ask if they offer discounts for seniors, military personnel, or repeat customers. Additionally, inquire about payment plans or potential cost savings by combining multiple services.

Look for Energy-Efficient Upgrades

While some energy-efficient upgrades require an upfront investment, they can lead to substantial long-term savings on utility bills. Consider investing in energy-efficient appliances, LED lighting, or improved insulation to reduce your monthly expenses.

Using Energy-Efficient Appliances

A significant portion of your household energy consumption goes towards running appliances. By investing in energy-efficient models, you can significantly reduce your utility bills over time. Here’s how:

Look for the Energy Star Label

When shopping for new appliances, always look for the Energy Star label. This certification indicates that the product meets strict energy-efficiency guidelines set by the U.S. Environmental Protection Agency. Energy Star appliances use less energy than standard models, saving you money on your utility bills.

Consider the Long-Term Savings

While energy-efficient appliances may have a higher upfront cost, remember to factor in the long-term savings. The reduced energy consumption over the appliance’s lifespan can result in substantial savings, potentially offsetting the initial investment.

Upgrade Strategically

If your budget doesn’t allow for replacing all your appliances at once, prioritize the ones that consume the most energy. Typically, refrigerators, washing machines, and dryers have the highest energy consumption. Upgrading these appliances first can lead to more significant savings.

Proper Maintenance Matters

Even the most energy-efficient appliances need regular maintenance to perform optimally. Clean your refrigerator coils, check for leaks in your washing machine hoses, and clean your dryer’s lint trap after every use. These simple steps can improve energy efficiency and extend the life of your appliances.

Tracking Your Housing Spending

The first step to saving money on housing is understanding where your money is going. It’s easy to know how much you spend on rent or your mortgage each month, but are you aware of the less obvious costs associated with your living situation?

Start by tracking all housing-related expenses for at least a month, ideally three months to get a clear picture of your spending habits. Here are some key categories to monitor:

- Rent or mortgage payments

- Utilities: Electricity, gas, water, garbage, sewer

- Internet and cable

- Renter’s or homeowner’s insurance

- Property taxes (if applicable)

- Maintenance and repairs: Include everything from appliance repairs to landscaping costs

- Home improvement projects: Even small upgrades add up!

You can use a spreadsheet, budgeting app, or even a notebook to track your spending. The important thing is to be consistent and thorough in recording all housing-related expenses.

Staying on Budget

Once you’ve found a place to live that fits your budget, staying on budget requires ongoing diligence. Here are some tips to help you keep housing costs in check:

Track Your Spending

Keep a close eye on your income and expenses, including both fixed and variable costs associated with housing. This will help you identify areas where you can potentially save.

Set Realistic Spending Limits

Create a realistic budget that allocates a specific amount for housing expenses, including rent or mortgage payments, utilities, maintenance, and other associated costs. Stick to this budget as much as possible.

Negotiate with Your Landlord or Lender

Don’t be afraid to negotiate with your landlord or lender, especially if you’re a long-term tenant with a good payment history. You might be able to secure a lower rent or mortgage rate.

Explore Cost-Saving Measures

Consider ways to reduce your utility bills, such as using energy-efficient appliances, lowering your thermostat in the winter, and using less water. Small changes can add up to significant savings over time.

Build an Emergency Fund

Unexpected housing expenses, such as repairs, can arise. Having an emergency fund specifically for these costs can help you avoid going into debt or falling behind on other bills.

Review Your Budget Regularly

Regularly review your budget to ensure that your housing expenses remain aligned with your overall financial goals. As your income or expenses change, adjust your budget accordingly.

Conclusion

In conclusion, implementing cost-saving strategies such as budgeting, negotiating rent, and considering alternative housing options can significantly reduce housing expenses.