Learn how to cut down on your monthly expenses with these practical tips and strategies to save money on your bills effectively.

Assessing Your Monthly Bills

The first step to saving money on your monthly bills is understanding where your money is going. It’s easy to go on autopilot, paying bills without much thought. However, taking the time to assess your bills can reveal areas where you can cut back and save significantly.

1. Gather Your Bills

Collect all of your monthly bills, including:

- Rent/Mortgage

- Utilities (electricity, gas, water, sewer)

- Internet and Cable/Streaming Services

- Phone

- Groceries

- Transportation

- Insurance (health, car, renter’s/homeowner’s)

- Debt payments (credit cards, student loans)

- Subscriptions (streaming, music, gym, etc.)

2. Track Your Spending

Review your bank statements and credit card bills for the past few months. This will give you a clear picture of how much you spend in each category. There are also helpful budgeting apps and software available that can automatically track your spending and categorize it for you.

3. Identify Areas for Savings

Once you have a clear understanding of your spending habits, look for areas where you can potentially save. This might involve:

- Negotiating with service providers: Call your internet, phone, and cable providers to see if you can get a better rate or switch to a more affordable plan.

- Reducing usage: Be more mindful of your energy and water consumption. Turn off lights when you leave a room, take shorter showers, and unplug electronics when not in use.

- Finding cheaper alternatives: Compare prices for insurance, groceries, and other recurring expenses. Consider switching brands or shopping at discount stores.

- Cutting back on non-essential expenses: Identify subscriptions or memberships you don’t use regularly and consider canceling them. You can also limit dining out and find more affordable entertainment options.

Tips for Reducing Utility Costs

Utility bills, encompassing electricity, water, and gas, can take a substantial bite out of your monthly budget. Fortunately, there are numerous strategies you can implement to curb these expenses and keep more money in your pocket.

Electricity Saving Tips

- Switch to LED Lighting: LED bulbs are significantly more energy-efficient than traditional incandescent bulbs, lasting longer and using less energy to produce the same amount of light.

- Unplug Electronics When Not in Use: Many electronic devices continue to draw power even when turned off, contributing to “phantom energy” consumption. Unplug chargers, appliances, and electronics when not in use to save electricity.

- Use Power Strips: Connecting multiple devices to a power strip allows you to easily turn off multiple items with one switch, further reducing phantom energy use.

- Lower Your Water Heater Temperature: Water heating is a major energy expense. Lowering your water heater temperature by a few degrees can lead to significant savings.

- Optimize Your Thermostat: Programmable thermostats allow you to automatically adjust the temperature based on your schedule, ensuring you’re not heating or cooling an empty house.

Water Conservation Measures

- Fix Leaks Promptly: A dripping faucet or running toilet can waste a surprising amount of water. Address leaks as soon as they arise to prevent unnecessary water usage.

- Install Low-Flow Fixtures: Low-flow showerheads and faucets reduce water consumption without sacrificing water pressure.

- Be Mindful of Water Usage: Take shorter showers, turn off the faucet while brushing your teeth, and only run the dishwasher and washing machine when full to conserve water.

Gas Efficiency Strategies

- Improve Insulation: Proper insulation helps regulate your home’s temperature, reducing the workload on your heating and cooling systems. Consider adding insulation to your attic, walls, and crawl spaces.

- Service Your HVAC System: Regular maintenance ensures your heating and cooling system operates efficiently, reducing energy waste and lowering your gas bill.

- Utilize Natural Light and Ventilation: Open curtains and blinds during the day to take advantage of natural light and warmth. Open windows at night for ventilation to reduce reliance on air conditioning.

Saving on Internet and Cable Bills

Internet and cable bills are often a significant monthly expense. Fortunately, there are several strategies you can use to reduce these costs without sacrificing your entertainment or connectivity:

Negotiate with Your Provider

Don’t be afraid to negotiate with your current internet and cable provider. Call their customer service line and inquire about:

- Special promotions or discounts: Providers frequently offer promotional rates for new customers. See if you qualify for any current offers or discounts for being a loyal customer.

- Bundling options: Bundling your internet and cable services can often lead to significant savings compared to purchasing them separately.

- Loyalty discounts: If you’ve been a customer for a long time, ask about loyalty discounts or other perks.

Explore Alternative Providers

Research alternative internet and cable providers in your area. Consider these options:

- Fiber optic internet: Fiber optic internet providers often offer faster speeds at competitive prices.

- DSL internet: DSL internet, which uses your existing phone line, can be a more affordable option, especially if you don’t need the fastest speeds.

- Satellite internet: While generally more expensive and with higher latency, satellite internet can be an option in rural areas where other choices are limited.

Cut the Cable Cord

One of the most effective ways to save money is to cut the cable cord altogether. Consider these alternatives:

- Streaming services: Services like Netflix, Hulu, Amazon Prime Video, and Disney+ offer a wide variety of on-demand content at a fraction of the cost of traditional cable.

- Over-the-air (OTA) antenna: An OTA antenna allows you to watch local channels for free in high definition.

Reduce Your Internet Usage

Lowering your internet data usage can potentially reduce your bill if your provider has data caps or overage fees. Consider these tips:

- Monitor your data usage: Keep track of your internet data usage to avoid exceeding any data limits.

- Optimize streaming quality: Adjust the video streaming quality to a lower resolution to reduce data consumption.

- Use Wi-Fi whenever possible: Connect to Wi-Fi networks instead of using your cellular data to avoid data overage charges.

Cutting Phone Expenses

Your phone bill is likely a significant monthly expense, but there are numerous ways to trim it down without sacrificing connectivity. Here are some effective strategies to consider:

1. Analyze Your Usage

Before making any changes, understand your calling, texting, and data habits. Review your past few bills to identify areas of overspending.

2. Consider a Smaller Data Plan

Many people overestimate their data needs. If you’re consistently below your limit, downgrading to a smaller plan can lead to substantial savings.

3. Utilize Wi-Fi Whenever Possible

Connecting to Wi-Fi networks at home, work, or public places minimizes data usage. Make it a habit to automatically connect to available Wi-Fi.

4. Explore Alternative Phone Providers

Don’t be afraid to shop around. Many smaller carriers offer competitive plans with lower costs compared to major providers.

5. Negotiate with Your Current Provider

Contact your current provider and inquire about discounts, promotions, or more affordable plans. Loyalty can sometimes be rewarded.

6. Limit Premium Services

Avoid unnecessary add-ons like voicemail transcriptions, ringtones, or caller ID services. These charges can quickly add up.

7. Bundle Your Services

Consider bundling your phone service with your internet or cable TV provider. Bundles often come with significant discounts.

8. Explore Family Plans

If you live with family members or roommates, a shared family plan can significantly reduce individual costs.

9. Track Your Data Usage

Use your phone’s built-in data monitoring tools or download a data tracking app to monitor your consumption and avoid overage fees.

10. Take Advantage of Free Communication Apps

Utilize free communication apps like WhatsApp, Messenger, or Telegram for texting and calling when connected to Wi-Fi. This can dramatically reduce your reliance on cellular minutes and texts.

Reducing Insurance Premiums

Insurance is a crucial aspect of financial planning, but it can also take a significant chunk out of your monthly budget. Fortunately, there are several strategies you can employ to potentially lower your insurance premiums without sacrificing coverage:

1. Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Different insurance providers have different underwriting criteria and risk assessments, which can lead to significant price variations. Take the time to obtain quotes from multiple insurers to compare rates and coverage options.

2. Bundle Insurance Policies

Many insurance companies offer discounts if you bundle multiple policies, such as auto and home insurance, with the same provider. Consolidating your policies can lead to substantial savings.

3. Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can often lower your monthly premiums. However, ensure you have enough savings to cover the higher deductible in case of a claim.

4. Maintain a Good Credit Score

In many states, insurance companies use credit-based insurance scores to assess risk. Maintaining a good credit score can help you qualify for lower insurance rates. Pay your bills on time and manage your debt responsibly.

5. Ask About Discounts

Insurance companies offer various discounts based on factors such as your age, driving record, safety features in your car or home, and even your occupation or affiliations. Inquire about potential discounts that you may be eligible for.

Managing Subscription Services

Subscription services can quietly drain your bank account if you’re not careful. That monthly charge for a streaming service you barely use or a meal kit you’ve fallen out of love with can add up. Taking control of your subscriptions is a powerful way to save money each month.

Take Inventory

Start by making a list of all your subscriptions. This includes streaming services, music platforms, software subscriptions, meal kits, clothing boxes – everything! Note down the monthly cost for each.

Evaluate Your Usage

Now, be honest with yourself. How often do you really use each subscription? If you’re only watching one show a month on a streaming service, it might be time to consider canceling. The same goes for services you’ve forgotten you even had.

Trim the Fat

Make the tough decisions and cancel the subscriptions you don’t use enough to justify the cost. Remember, you can always resubscribe later if you really miss it.

Explore Sharing Options

Many streaming services offer plans where you can share an account with family or friends. This can significantly reduce the cost per person. Just make sure the service allows it and everyone is comfortable sharing their login information.

Negotiate or Downgrade

Don’t be afraid to contact your service providers. Sometimes, you can negotiate a lower price, especially if you’ve been a loyal customer for a while. If not, consider downgrading to a less expensive plan. Even small savings per month can add up over time.

Set Spending Limits

To avoid future subscription overload, set a monthly spending limit for this category. This will help you be more mindful of the services you sign up for and encourage you to prioritize the ones you truly value.

Negotiating with Service Providers

One of the most effective ways to save money on your monthly bills is to negotiate better rates with your service providers. Many people are hesitant to negotiate, but it’s often simpler than you’d think. Here’s how to approach it:

1. Be Prepared

Before you pick up the phone, do your homework. Research competitor pricing in your area, understand your current plan details (data usage, contract length, etc.), and note down any instances of poor service you’ve experienced. This information will be your leverage.

2. Be Polite and Persistent

When you call, be polite and respectful. Explain that you’re looking to reduce your monthly expenses and inquire about potential discounts or promotions. Don’t be afraid to politely decline their initial offer and reiterate your desired rate. Persistence can pay off.

3. Leverage Competition

Let your current provider know that you’re aware of competitor offers. This can make them more willing to match or beat those prices to keep your business. Having the competitor’s information readily available will strengthen your position.

4. Bundle Services

Many companies offer discounts if you bundle services like internet, phone, and cable. If you’re currently using multiple providers, consider consolidating under one to potentially lower your overall costs.

5. Be Willing to Walk Away

Sometimes, the best negotiation tactic is being willing to walk away. If your current provider is unwilling to budge on price, be prepared to switch to a competitor. This shows you’re serious about saving money and might prompt them to reconsider their stance.

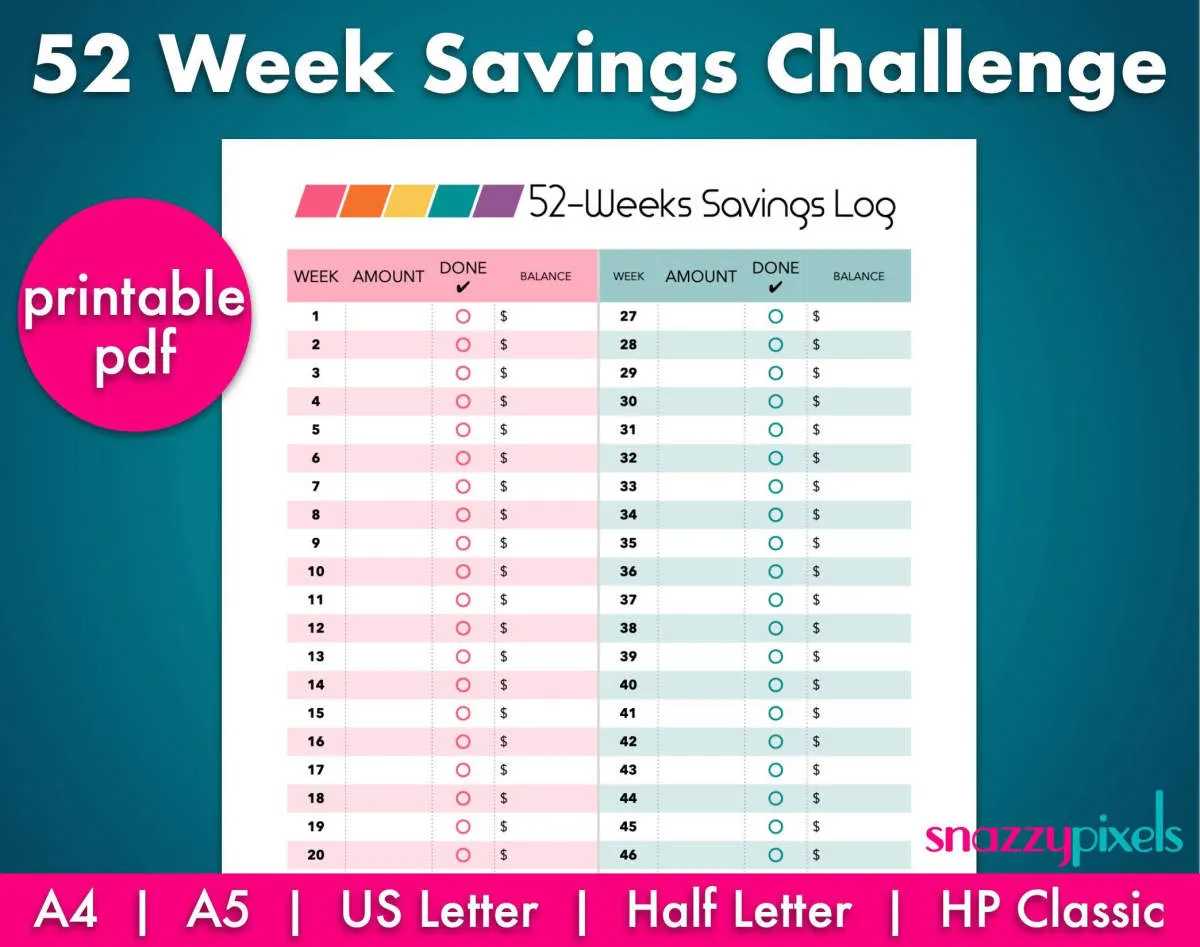

Tracking Your Savings

Keeping track of your savings is just as important as finding ways to reduce your monthly expenses. It allows you to see how much progress you’re making, identify areas where you can improve, and stay motivated to reach your financial goals. Here are some effective methods to track your savings:

1. Use a Budgeting App or Spreadsheet

Numerous budgeting apps and spreadsheet templates are readily available to help you monitor your income and expenses. These tools often come with features that automatically categorize your transactions and generate visual representations of your spending habits, making it easier to track your savings progress.

2. Maintain a Dedicated Savings Account

Consider opening a separate savings account specifically for your savings goals. This will help you visualize your progress and avoid accidentally spending money that you’ve set aside.

3. Set Realistic Savings Goals

Establish achievable savings targets to stay motivated and track your progress effectively. Break down larger goals into smaller, more manageable milestones to make the saving process less daunting.

4. Review Your Progress Regularly

Regularly review your savings progress, whether it’s weekly, bi-weekly, or monthly. This practice helps you stay accountable, identify any potential issues, and make necessary adjustments to your budget or savings strategies.

5. Celebrate Milestones

Acknowledge and celebrate your savings milestones, no matter how small they may seem. Recognizing your achievements can help you stay motivated and reinforce positive financial habits.

Conclusion

In conclusion, by implementing these effective ways to save money on your monthly bills, you can significantly reduce your expenses and achieve financial stability in the long run.