Looking to start investing but have limited funds? Learn how to begin investing with little money and grow your wealth effectively.

Understanding Investing Basics

Before diving into the world of investing, even with a smaller budget, it’s crucial to grasp some fundamental concepts. This foundational knowledge will help you make informed decisions and potentially minimize risks.

What is Investing?

Investing essentially means putting your money to work for you. Instead of letting it sit idle in a savings account, you’re aiming to grow your wealth over time. This growth can come from:

- Dividends: Regular payments made by some companies to their shareholders.

- Interest: Earnings from lending out your money, like with bonds.

- Appreciation: An increase in the value of your investment, such as stocks or real estate.

Risk and Return

A core principle in investing is the relationship between risk and return. Higher potential returns usually come with higher risk, and vice-versa. For instance:

- Stocks offer the potential for high returns, but their value can also fluctuate significantly.

- Bonds are generally considered less risky than stocks, but they typically offer lower returns.

Understanding your risk tolerance—how comfortable you are with the possibility of losing money—is essential for choosing suitable investments.

Diversification: Don’t Put All Your Eggs in One Basket

Diversification is a risk management strategy that involves spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and within those classes. By diversifying, you reduce the impact of a single investment performing poorly on your overall portfolio.

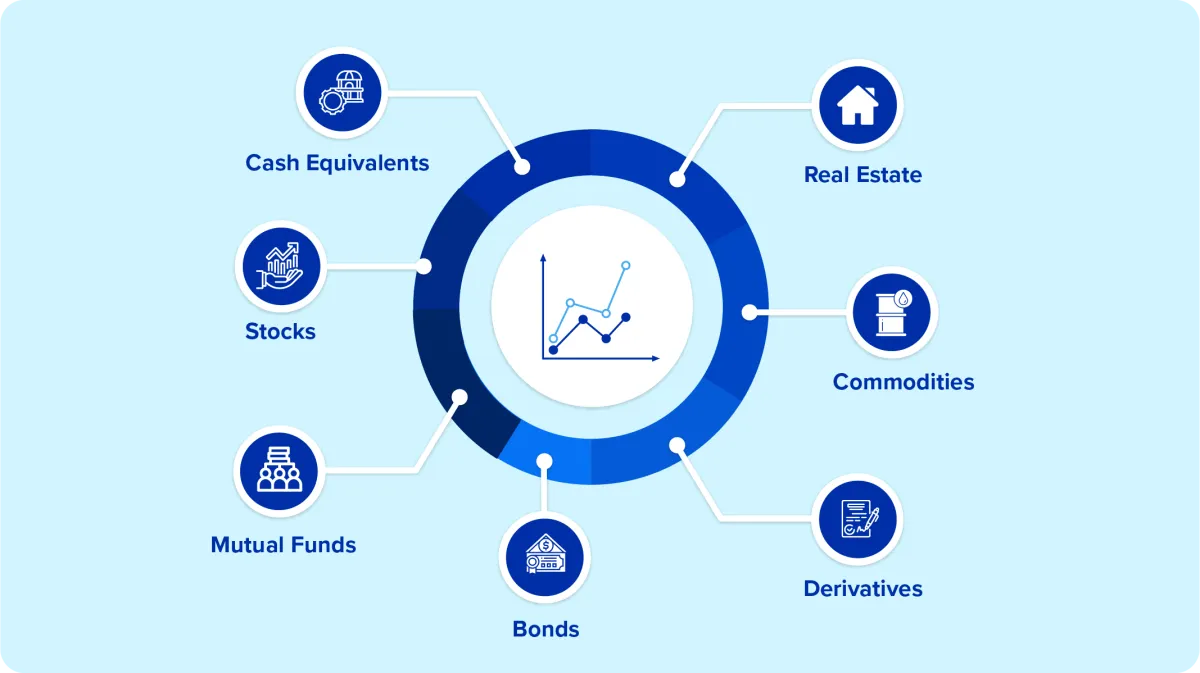

Different Types of Investments

Even with a small amount to invest, a wide array of investment options are available to you. Here are some of the most common:

1. High-Yield Savings Accounts and Money Market Accounts

These accounts offer higher interest rates than traditional savings accounts, making them a relatively low-risk way to grow your money. While they won’t make you rich quickly, they provide a safer return than investing in the stock market.

2. Certificates of Deposit (CDs)

CDs offer a fixed interest rate for a set period of time. You agree to keep your money invested for the term of the CD, and in return, you earn a higher interest rate than a savings account. However, you’ll face penalties for withdrawing your money early.

3. Index Funds and Mutual Funds

Index funds and mutual funds allow you to invest in a basket of stocks or bonds, providing instant diversification. Index funds track a specific market index, like the S&P 500, while mutual funds are actively managed by professionals. Both offer a way to invest in the stock market with less risk than buying individual stocks.

4. Exchange-Traded Funds (ETFs)

Similar to index funds, ETFs track a specific market index, sector, or commodity. However, ETFs trade on stock exchanges like individual stocks, providing more flexibility in terms of buying and selling.

5. Fractional Shares

Many brokerage accounts now offer the ability to purchase fractional shares, allowing you to buy a portion of a share of expensive stocks. This can be a good option if you want to invest in companies with high share prices but have limited capital.

6. Micro-Investing Apps

Micro-investing apps make it easy to invest small amounts of money regularly. These apps round up your purchases to the nearest dollar and invest the spare change into a diversified portfolio of stocks or bonds.

How to Save Money for Investing

Investing might seem intimidating, especially when you’re not starting with a lot of money. However, the most crucial step is simply getting started, and that often begins with saving. Here are some practical tips to help you accumulate funds for investing, even on a tight budget:

1. Track Your Spending and Identify Areas to Cut Back

Understanding where your money goes is the foundation of saving. Utilize budgeting apps, spreadsheets, or even a simple notebook to track your income and expenses for a month or two. Once you have a clear picture, identify non-essential spending areas where you can cut back. This might involve eating out less, finding cheaper entertainment options, or canceling subscriptions you don’t use regularly.

2. Set Realistic Savings Goals

Instead of aiming for an arbitrary amount, set specific, measurable, achievable, relevant, and time-bound (SMART) savings goals. For example, instead of saying, “I want to save for investing,” aim for something like, “I will save $50 every week for the next six months to start investing.” Having clear goals can increase your motivation and track your progress.

3. Automate Your Savings

Make saving effortless by automating transfers to your savings or investment account. Set up a recurring transfer from your checking account after each paycheck. Even small amounts, when saved consistently, can add up significantly over time.

4. Explore Additional Income Sources

Boost your savings rate by exploring additional income opportunities. This could involve selling unused items online, taking on a side hustle, or freelancing in your spare time. The extra income can be channeled directly into your investment fund.

5. Be Patient and Consistent

Building a solid foundation for investing takes time. Don’t get discouraged if your savings grow slowly at first. Stay committed to your savings plan, remain patient, and celebrate your progress along the way. The power of consistent saving, even with small amounts, can lead to significant long-term results.

Choosing the Right Investments

When you’re starting with limited capital, it’s crucial to choose investments that align with your risk tolerance, investment timeline, and financial goals. Here’s a breakdown of some popular investment options for beginners:

1. Micro-Investing Apps

Micro-investing apps like Acorns or Stash allow you to invest small amounts of money, often by rounding up your everyday purchases. These apps typically invest your spare change into diversified portfolios of low-cost ETFs, making them a great option for beginners.

2. Fractional Shares

Many brokerage accounts now offer the option to buy fractional shares, which are portions of individual stocks. This allows you to invest in companies with high share prices, even with a small budget.

3. Low-Cost Index Funds and ETFs

Index funds and ETFs track a specific market index, such as the S&P 500. They offer instant diversification by spreading your investment across hundreds of stocks or bonds. Look for index funds and ETFs with low expense ratios, which can eat into your returns.

4. High-Yield Savings Accounts and CDs

While not technically “investments,” high-yield savings accounts and Certificates of Deposit (CDs) offer higher interest rates than traditional savings accounts. They provide a relatively safe way to grow your money, especially if you have a shorter time horizon or lower risk tolerance.

5. Educational Resources

Before diving into any investment, take the time to educate yourself. There are countless free resources available online, including articles, videos, and courses, that can teach you about different investment strategies and concepts.

Remember: Investing always involves some level of risk. It’s important to thoroughly research any investment before putting your money into it. Consider consulting with a financial advisor if you need personalized guidance.

The Power of Compound Interest

One of the most significant advantages of starting to invest early, even with a small amount, is the power of compound interest. In simple terms, compound interest is “interest earned on interest.” When you reinvest your earnings, you’re essentially growing your money at an exponential rate.

Imagine this: you invest $100, and it earns a 5% return in the first year. You now have $105. Instead of withdrawing the $5 profit, you reinvest it. In the second year, you earn a 5% return on $105, not just the initial $100. This cycle continues, with your earnings generating even more earnings over time. The longer you let your money compound, the more significant the impact.

Here’s why this is crucial when investing with little money: Compound interest helps to accelerate your wealth-building journey, even with small starting amounts. It allows you to make significant progress over the long term without needing to invest large sums upfront.

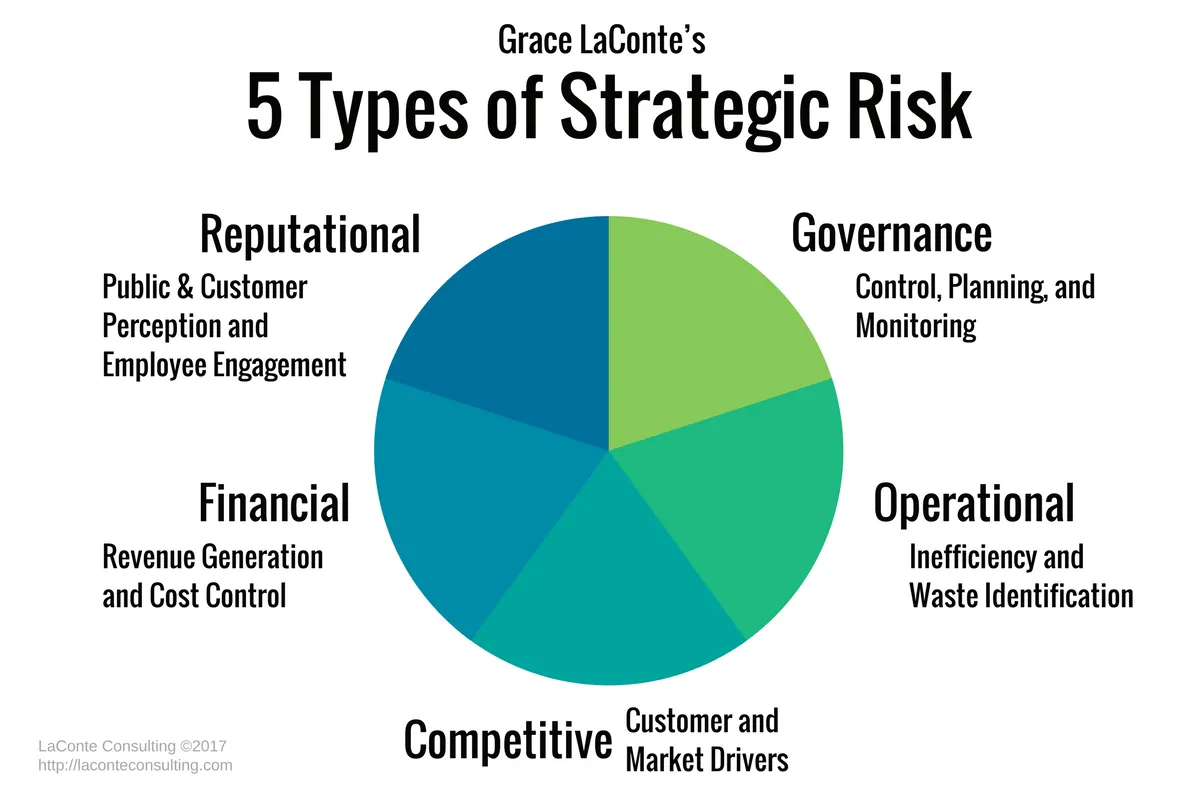

Risk Management Strategies

Investing always comes with inherent risks, especially when you’re starting with limited capital. Here are some risk management strategies to consider:

1. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversifying your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate losses. When one investment isn’t performing well, others may be able to cushion the impact.

2. Start Small and Gradually Increase Investments

Instead of investing a large sum upfront, consider starting with smaller amounts and gradually increasing your contributions over time. This “dollar-cost averaging” approach can help average out the cost of investments and reduce the impact of market volatility.

3. Invest for the Long Term

Short-term market fluctuations are inevitable. However, investing with a long-term perspective can help ride out these temporary dips. Patience is key in the investing world.

4. Do Your Research and Understand Your Risk Tolerance

Before investing in anything, thoroughly research the investment and understand the associated risks. Determine your own risk tolerance – how much potential loss you’re comfortable with. This will guide you toward investments that align with your comfort level.

5. Consider Professional Advice

If you’re unsure about managing investment risks, seeking advice from a qualified financial advisor can be beneficial. They can provide personalized guidance based on your financial situation and risk tolerance.

Investing in Low-Cost Index Funds

One of the most accessible and effective ways to start investing with little money is through low-cost index funds. These funds pool money from multiple investors to purchase a diverse basket of assets, such as stocks or bonds, that track a particular market index, like the S&P 500.

Benefits of Index Funds:

- Low Fees: Index funds are passively managed, meaning they aim to replicate the performance of an index rather than actively picking stocks. This results in significantly lower expense ratios compared to actively managed funds, saving you money in the long run.

- Diversification: By investing in an index fund, you instantly gain exposure to a wide range of companies or assets, reducing the impact of any single investment on your overall portfolio.

- Simplicity: Index funds offer a straightforward way to invest in the market without requiring extensive research or stock-picking expertise. You can choose an index fund that aligns with your investment goals and risk tolerance.

Getting Started with Index Funds:

- Choose a brokerage account: Numerous online brokerage platforms cater to investors of all levels, offering access to index funds with low or no trading fees.

- Select an index fund: Research and compare different index funds based on the underlying index they track, expense ratios, and historical performance.

- Start investing: Begin by investing a small amount and gradually increase your contributions over time as your budget allows.

Monitoring Your Investments

Keeping a watchful eye on your investments is crucial, even if you’re starting with a small amount. Monitoring helps you understand how your investments are performing, identify potential issues early on, and make informed decisions about rebalancing or adjusting your strategy.

Here’s how to effectively monitor your investments:

1. Regularly Review Your Portfolio:

Set a schedule to review your investment portfolio. The frequency depends on your comfort level, but monthly or quarterly checks are good starting points. Look at the performance of individual investments and your overall portfolio.

2. Track Performance Against Benchmarks:

Compare your investment returns against relevant benchmarks to gauge their effectiveness. For example, if you invest in index funds, compare their performance to the underlying index they track.

3. Utilize Online Platforms and Tools:

Most brokerage accounts and investment platforms offer online tools and resources to track your investments. Take advantage of these features to monitor performance, set up alerts, and access research reports.

4. Stay Informed About Market Trends:

Keep abreast of market news and economic indicators that could impact your investments. While you don’t need to become an expert, understanding the broader market context can help you make more informed decisions.

5. Rebalance Your Portfolio Periodically:

As your investments grow or market conditions change, your portfolio’s asset allocation may drift from your original plan. Regularly rebalancing involves selling assets that have performed well and buying more of those that have lagged, to realign with your desired risk tolerance.

Conclusion

Starting to invest with limited funds is possible through affordable options like micro-investing apps and low-cost index funds. Consistency and patience are key to grow your investment portfolio over time.