In this guide, discover essential steps to develop a sustainable financial plan that secures your future financial stability and goals.

Importance of a Sustainable Financial Plan

A sustainable financial plan is not just about managing money; it’s about securing your future and achieving your long-term financial goals. Here’s why it’s crucial:

1. Financial Security and Peace of Mind

Knowing you have a plan in place to navigate life’s uncertainties brings peace of mind. A sustainable plan acts as a buffer against unexpected expenses, economic downturns, and job loss, providing a safety net for you and your loved ones.

2. Achieving Your Financial Goals

Whether it’s buying a home, starting a business, funding your children’s education, or retiring comfortably, a sustainable plan outlines the steps to reach those goals. It provides a roadmap for saving, investing, and managing debt effectively to turn your aspirations into reality.

3. Long-Term Financial Independence

A sustainable financial plan empowers you to make informed financial decisions that prioritize long-term stability over short-term gratification. It focuses on building wealth gradually and strategically, ultimately leading to financial independence and the freedom to pursue your passions without being limited by finances.

4. Adaptability to Life Changes

Life is unpredictable. A sustainable plan is designed to be flexible and adaptable to changing circumstances. Whether you experience a job change, a growing family, or unexpected medical expenses, a solid plan can be adjusted to accommodate these shifts while keeping you on track towards your financial goals.

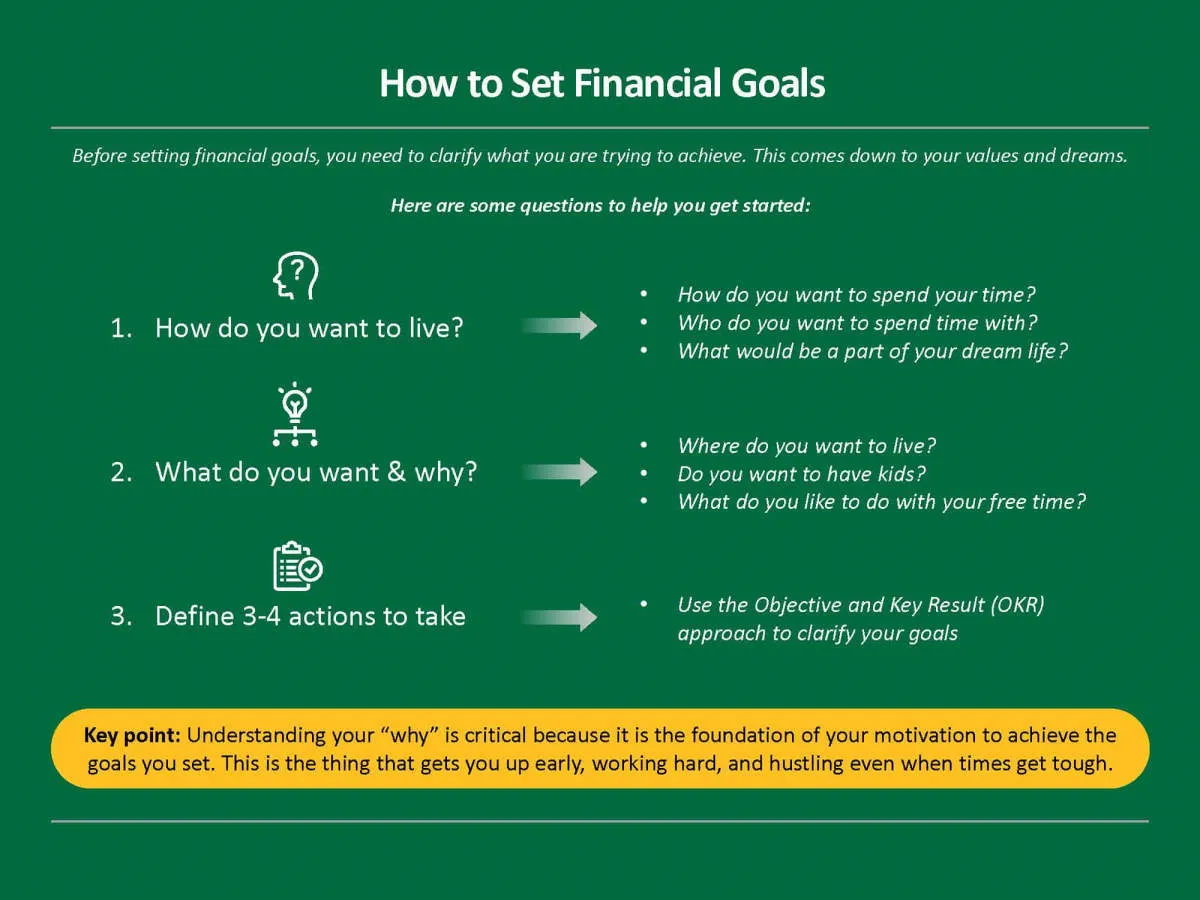

Setting Financial Goals

A sustainable financial plan begins with a clear vision of your aspirations. What are you ultimately saving for and working towards? These aspirations form the foundation of your financial goals. Whether it’s buying a home, early retirement, funding your child’s education, or starting a business, having well-defined goals is essential for several reasons:

- Motivation: Clearly defined goals provide a powerful incentive to stay disciplined with your finances. Knowing what you’re working towards can keep you motivated during challenging times.

- Direction: Goals give your financial plan a clear direction. They help you prioritize saving and spending habits, ensuring your financial resources are allocated effectively.

- Measurement: Setting concrete goals allows you to track your progress. You can celebrate milestones and make adjustments to your plan as needed, ensuring you stay on track.

Types of Financial Goals

Financial goals can be categorized by their timeframe:

- Short-Term Goals (within 1 year): These are immediate financial objectives, such as building an emergency fund, paying off credit card debt, or saving for a vacation.

- Mid-Term Goals (1-5 years): These goals require more planning and saving, such as making a down payment on a house, buying a car, or funding a major home renovation.

- Long-Term Goals (5+ years): These are your most significant financial aspirations, often requiring consistent savings and investment strategies. Examples include retirement planning, funding your children’s education, or achieving financial independence.

SMART Goals

To ensure your financial goals are effective, make them SMART:

- Specific: Define your goals clearly and precisely. Instead of “save more money,” aim for “save $5,000 for a down payment.”

- Measurable: Quantify your goals to track progress. How much do you need to save each month to reach your target?

- Achievable: Set realistic goals that align with your income and expenses. Avoid setting goals that are overly ambitious and discouraging.

- Relevant: Choose goals that truly matter to you and align with your values and life goals.

- Time-Bound: Set a clear timeframe for achieving each goal. This adds a sense of urgency and helps you stay on track.

Creating a Budget and Saving Plan

A sustainable financial plan hinges on two pillars: understanding where your money goes and allocating it strategically to meet both current and future needs. This is where budgeting and saving come into play.

Budgeting: Tracking Your Cash Flow

Budgeting isn’t about restricting your spending, but rather about making informed choices. It begins with understanding your cash flow:

- Income: Track all sources of income, including salary, wages, side hustles, and investments.

- Expenses: Categorize and monitor your spending. Differentiate between essential expenses (housing, food, utilities) and discretionary expenses (entertainment, dining out).

Numerous budgeting methods exist, from the simple 50/30/20 rule (allocating 50% to needs, 30% to wants, and 20% to savings and debt repayment) to more detailed approaches. Find a method that suits your style and allows for flexibility.

Saving: Building Your Financial Cushion

Saving is crucial for both short-term goals (like a vacation or a down payment) and long-term security (retirement, emergencies). It involves setting aside a portion of your income regularly:

- Emergency Fund: Aim for 3-6 months’ worth of living expenses in an easily accessible account to cover unexpected events like job loss or medical bills.

- Goal-Oriented Savings: Define your financial goals and determine the amount needed. Set up separate savings accounts for each goal and automate regular contributions.

- Investment for the Future: Once you have a handle on short-term savings, consider investing to grow your wealth over time. Explore options like retirement accounts (401k, IRA) or other investment vehicles.

Remember, consistency is key. Even small, regular contributions can accumulate significantly over time thanks to the power of compound interest.

Investing for Long-Term Growth

A sustainable financial plan isn’t just about managing expenses; it’s also about growing your wealth over time. This is where long-term investing plays a crucial role. By putting your money to work in the market, you harness the power of compounding to build a more secure financial future.

Understanding Your Risk Tolerance and Time Horizon

Before diving into investment options, it’s essential to assess your risk tolerance and time horizon. Your risk tolerance refers to your comfort level with market fluctuations. Are you comfortable with the possibility of short-term losses in exchange for potentially higher returns, or do you prefer more stable, albeit potentially slower, growth? Your time horizon, on the other hand, refers to the length of time you plan to invest. Longer time horizons generally allow for greater risk-taking, as you have more time to recover from potential market downturns.

Diversifying Your Investments

Diversification is a cornerstone of long-term investing. This strategy involves spreading your investments across different asset classes, such as stocks, bonds, and real estate. The goal is to reduce the impact of volatility on your portfolio. When one asset class is performing poorly, others may be doing well, which helps cushion your overall returns.

Considering Index Funds and ETFs

For many investors, particularly those new to the market, index funds and exchange-traded funds (ETFs) offer a simple and effective way to invest for long-term growth. These funds track a specific market index, such as the S&P 500, providing broad market exposure with relatively low fees.

Staying the Course

It’s natural to feel tempted to react to market fluctuations, but it’s crucial to remember that investing is a marathon, not a sprint. Trying to time the market is generally not a sustainable strategy. Instead, focus on maintaining a disciplined approach, regularly contributing to your investments, and riding out any short-term volatility.

Managing Debt Effectively

Debt is a fact of life for many, but it doesn’t have to control your finances. Managing debt effectively is crucial for creating a sustainable financial plan that allows you to achieve your goals. Here’s how:

1. Create a Debt Inventory

Start by listing all your debts, including credit cards, loans, and any outstanding balances. Note down the interest rates, minimum payments, and loan terms. This inventory provides a clear picture of your debt landscape.

2. Prioritize Your Debts

Not all debts are created equal. Prioritize high-interest debts like credit cards, as they can quickly accumulate and hinder your progress. Allocate more funds toward these while making minimum payments on lower-interest debts.

3. Explore Debt Consolidation

If you have multiple debts, consider consolidating them into a single loan with a lower interest rate. This simplifies payments and can save you money on interest over the long run.

4. Negotiate with Creditors

Don’t hesitate to contact your creditors and negotiate lower interest rates or explore hardship plans if you’re facing financial difficulties. They may be willing to work with you to find a manageable solution.

5. Implement the Debt Snowball or Avalanche Method

The debt snowball method involves tackling the smallest debts first, regardless of interest rates, for a psychological boost. Alternatively, the debt avalanche method focuses on paying off the highest-interest debt first to save money in the long run.

6. Make Consistent and Timely Payments

Set reminders and automate payments to avoid late fees and negative impacts on your credit score. Consistent and timely payments demonstrate responsible financial behavior.

7. Seek Professional Advice

If you’re overwhelmed or need personalized guidance, consider consulting a financial advisor. They can provide expert insights and develop a customized debt management strategy tailored to your situation.

Protecting Your Financial Future

Creating a sustainable financial plan isn’t just about building wealth for today, it’s about safeguarding your future. Unexpected events and life’s inevitable transitions can significantly impact your financial well-being. That’s why incorporating protective measures is crucial.

Building a Safety Net:

A solid financial plan begins with a strong safety net. This typically includes:

- Emergency Fund: Aim for 3-6 months’ worth of living expenses in an easily accessible account. This will cover unexpected job loss, medical emergencies, or urgent home repairs.

- Insurance Coverage: Adequate insurance is non-negotiable. Evaluate your needs for health, life, disability, and property insurance to protect against catastrophic financial burdens.

Planning for the Long Term:

Protecting your future also means preparing for long-term goals and potential challenges:

- Retirement Planning: Start saving for retirement early and consistently. Explore different retirement account options (like 401(k)s or IRAs) to maximize tax advantages and build a comfortable nest egg.

- Estate Planning: Consider creating or updating your will, establishing trusts if needed, and designating beneficiaries for your assets. This ensures your wishes are honored and minimizes potential complications for your loved ones.

- Debt Management: High levels of debt can jeopardize your financial security. Prioritize paying down high-interest debts and develop a strategy for managing debt responsibly. This will free up more financial resources in the future.

Regularly Review and Adjust:

Life is constantly evolving, and your financial plan should too. Regularly review your plan, assess your risk tolerance, and make adjustments as your circumstances change. This might involve reevaluating insurance needs, adjusting retirement contributions, or revisiting your investment strategy.

Reviewing and Adjusting Your Plan

Creating a financial plan is not a “set it and forget it” endeavor. Life is dynamic, and your financial plan needs to adapt to changes in your circumstances, goals, and the economic environment. Regularly reviewing and adjusting your plan is crucial to staying on track and achieving your financial aspirations.

Frequency of Review

The frequency of your review depends on your comfort level and life stage. However, it’s generally recommended to review your plan at least annually. Major life events such as marriage, childbirth, job change, or receiving an inheritance warrant a more immediate review.

Areas to Review

During each review, consider the following:

- Budget: Analyze your income and expenses. Are you sticking to your budget? Do you need to adjust your spending or saving habits?

- Emergency Fund: Do you have 3-6 months of living expenses saved? Replenish your emergency fund if it’s been tapped into.

- Debt Management: Track your progress on paying down debt. Are there opportunities to refinance for a lower interest rate?

- Investments: Review your investment portfolio’s performance. Are your investments aligned with your risk tolerance and time horizon?

- Retirement Savings: Are you contributing enough to reach your retirement goals? Adjust your contributions if needed.

- Insurance Coverage: Ensure your insurance policies (health, life, disability, etc.) still meet your current needs.

- Estate Planning: Have you updated your will, beneficiaries, and power of attorney documents?

Making Adjustments

Based on your review, make the necessary adjustments to your plan. This might involve:

- Modifying your budget

- Rebalancing your investment portfolio

- Increasing your retirement contributions

- Seeking professional financial advice

Staying Motivated and Focused

Creating and sticking to a financial plan can feel like a marathon, not a sprint. There will be moments of excitement, challenges, and perhaps even some boredom along the way. So how do you stay motivated and focused on your financial goals, especially when life throws distractions your way?

1. Make it Tangible and Personal:

Abstract goals like “achieving financial security” can be difficult to connect with emotionally. Instead, break down your big goals into smaller, more tangible milestones. Do you want to buy a house? Take a dream vacation? Retire early? Visualize these goals – literally! Create a vision board, make it your phone background, or keep a reminder note in your wallet. When you have a clear picture of what you’re working towards, staying motivated becomes much easier.

2. Track Your Progress and Celebrate Wins:

Tracking your progress isn’t just about watching numbers grow in your bank account, it’s about acknowledging your efforts and celebrating the small victories. Did you stick to your budget this month? Pay off a credit card? That’s worth celebrating! Recognizing your achievements, big or small, reinforces positive financial habits and keeps you motivated for the long haul. Consider using a budgeting app, a spreadsheet, or even a simple notebook to visualize your progress.

3. Find an Accountability Partner or System:

Sharing your goals with someone you trust can make a world of difference. Find a friend, family member, or financial advisor who can act as your accountability partner. Regular check-ins, even if they’re informal, can provide the encouragement and support you need to stay on track. If a person isn’t an option, consider joining an online community or using an app with built-in accountability features.

4. Embrace the Long Game and Be Kind to Yourself:

Building a sustainable financial plan is a journey, not a race. There will be setbacks and unexpected expenses. The key is to view these challenges as learning opportunities, not failures. Don’t beat yourself up if you slip up – it happens to the best of us. What matters most is that you acknowledge the misstep, adjust your plan if necessary, and keep moving forward.

Conclusion

In conclusion, creating a sustainable financial plan is crucial for long-term financial stability and success. By setting clear goals, budgeting wisely, and investing smartly, individuals can pave the way for a secure financial future.