Teaching kids about money and saving at a young age is crucial for their financial literacy. Discover effective strategies and creative ways to educate children on the importance of managing money wisely in this comprehensive guide.

Importance of Financial Education for Kids

Teaching kids about money and saving from a young age is crucial for setting them up for a financially responsible future. Early financial education provides numerous benefits, equipping children with essential skills and knowledge to navigate the complexities of personal finance.

Develops Responsible Financial Habits: By introducing financial concepts early on, children are more likely to develop positive money habits that will stay with them throughout their lives. They learn the importance of budgeting, saving, and making informed spending decisions.

Promotes Financial Independence: Financial literacy empowers children to become financially independent adults. They gain the confidence to manage their own money, make sound financial choices, and avoid common pitfalls such as debt and overspending.

Encourages Goal Setting: When children understand the value of saving and have financial goals, they develop a sense of purpose and learn the importance of delayed gratification. They are more likely to work towards and achieve their financial aspirations.

Prepares for the Future: In today’s increasingly complex financial world, it’s essential for children to have a solid understanding of money management. Financial education equips them with the tools they need to navigate challenges such as budgeting for college, managing loans, and investing wisely.

Teaching Basic Money Concepts

Before your child can grasp the importance of saving, they need to understand the basics of money. Here’s how to break it down:

1. What is Money?

Explain that money is a tool we use to get the things we need and want, like food, clothes, and toys. Show them different denominations of coins and bills and explain their values.

2. Earning Money

Introduce the concept of work and earning money. Explain that people work to earn money to pay for the things they need. You can use age-appropriate examples like chores or small tasks they can do to “earn” a small reward.

3. Spending and Saving

Explain that when we spend money, we use it to buy things. Conversely, saving money means keeping it safe to use later for something special. You can visually demonstrate this with clear jars labeled “Spend,” “Save,” and “Share” (for donations).

4. Needs vs. Wants

Help your child understand the difference between needs and wants. Explain that needs are essential for living (food, shelter, clothing) while wants are things we’d like to have but aren’t necessary (toys, candy, etc.).

5. Making Choices

Teach your child about making choices with money. Present them with scenarios where they have a limited amount of money and need to decide what to buy. This helps them understand the concept of opportunity cost – what they give up by choosing one thing over another.

Setting Up a Savings Plan

Once your child understands the basic concept of saving, it’s time to introduce the idea of a savings plan. This will help them set goals and develop healthy financial habits.

1. Choose a Savings Goal

Help your child choose a specific savings goal, such as a new toy, a special outing, or even a long-term goal like a bike. Having a tangible goal in mind can make saving more exciting and motivating.

2. Set a Realistic Timeline

Work together to determine how much they can realistically save each week or month. Discuss different ways they can earn money, such as doing chores around the house or completing small tasks for neighbors. Encourage them to be consistent with their savings habits.

3. Provide a Visual Aid

For younger children, using a clear jar or piggy bank to store their savings can make the process more tangible. As they see their savings grow, it reinforces the concept of delayed gratification and the value of saving.

4. Consider a Matching Program

To further incentivize saving, consider implementing a “matching program” where you contribute a small amount for every dollar they save. This can teach them about the power of compound interest and encourage them to save even more.

5. Make it a Habit

Encourage your child to make saving a regular habit, whether it’s setting aside a portion of their allowance each week or saving a portion of any monetary gifts they receive.

Using Allowances as a Teaching Tool

Giving your child an allowance is a practical and effective way to introduce them to fundamental financial concepts. It provides a controlled environment where they can learn about earning, spending, saving, and even basic budgeting.

Here’s how to utilize allowances as a teaching tool:

1. Link It to Chores:

Instead of giving an allowance freely, tie it to age-appropriate chores. This helps children understand that money is earned through work and effort.

2. Set Clear Expectations:

Establish a regular allowance schedule (weekly or monthly) and define the amount. Communicate clearly what the allowance covers. For instance, it might be for toys, snacks, or outings, helping them understand needs versus wants.

3. Encourage Goal Setting:

Help your child set financial goals, such as saving for a coveted toy or a special outing. This teaches them the value of delayed gratification and planning for future purchases.

4. Introduce Budgeting:

Provide your child with tools like a piggy bank or a simple budgeting app. Encourage them to divide their allowance for spending, saving, and even donating, fostering responsible money management.

5. Resist the Urge to Bail Them Out:

Allow your child to experience the natural consequences of their financial decisions. If they spend all their allowance at once, resist the urge to bail them out immediately. Let them learn from their mistakes and adjust their spending habits accordingly.

6. Open Communication:

Regularly discuss finances with your child in an age-appropriate way. Talk about your own financial decisions, savings goals, and the importance of budgeting. This helps normalize conversations about money and provides them with real-life context.

Encouraging Smart Spending Habits

Teaching children how to spend wisely is just as crucial as teaching them to save. Here’s how to nurture responsible spending habits:

1. The Needs vs. Wants Discussion:

Help your children understand the difference between “needs” (essentials like food, clothing, shelter) and “wants” (things they desire but can live without, like toys or candy). Encourage them to prioritize needs over wants.

2. Delayed Gratification:

Teach the value of patience and planning. If your child wants something expensive, encourage them to save for it. This helps them learn about goal setting, budgeting, and the satisfaction of earning their rewards.

3. Opportunity Cost:

Introduce the concept of opportunity cost. Explain that spending money on one thing means they won’t have it for something else. Help them weigh their options and make informed decisions.

4. Comparison Shopping:

Involve your children in comparing prices and looking for deals when you shop. This shows them that being a thoughtful consumer can save money and make their budget go further.

5. The “Giving” Allowance:

Consider incorporating a “giving” allowance. Encourage your child to set aside a portion of their allowance or earnings for charitable donations. This cultivates empathy and a sense of social responsibility.

Involving Kids in Family Budgeting

One of the most effective ways to teach children about money management is to involve them in family budgeting. This hands-on experience allows them to see firsthand how financial decisions are made and the importance of planning and saving.

Start by having age-appropriate conversations about the family’s income and expenses. Explain the basic concept of a budget, where the money comes from, and where it needs to go. You can use visual aids like charts or graphs to make it easier for them to understand.

Age-Appropriate Ways to Involve Kids:

- Younger children can help with tasks like making a grocery list, looking for coupons, or choosing less expensive items at the store.

- Older children can be involved in discussions about wants versus needs, setting savings goals as a family, or even researching different options for family outings or purchases.

When children are involved in the family budget, they gain a better understanding of financial responsibility, learn to make informed decisions about money, and develop valuable skills that will benefit them throughout their lives.

Using Games and Activities

Learning about money doesn’t have to be boring! Games and activities can make financial literacy fun and engaging for kids of all ages. Here are a few ideas:

1. Play “Grocery Store”

Set up a pretend grocery store with items and prices. Let your child be the shopper with a budget, and you can be the cashier. This helps them understand the concept of budgeting and making choices.

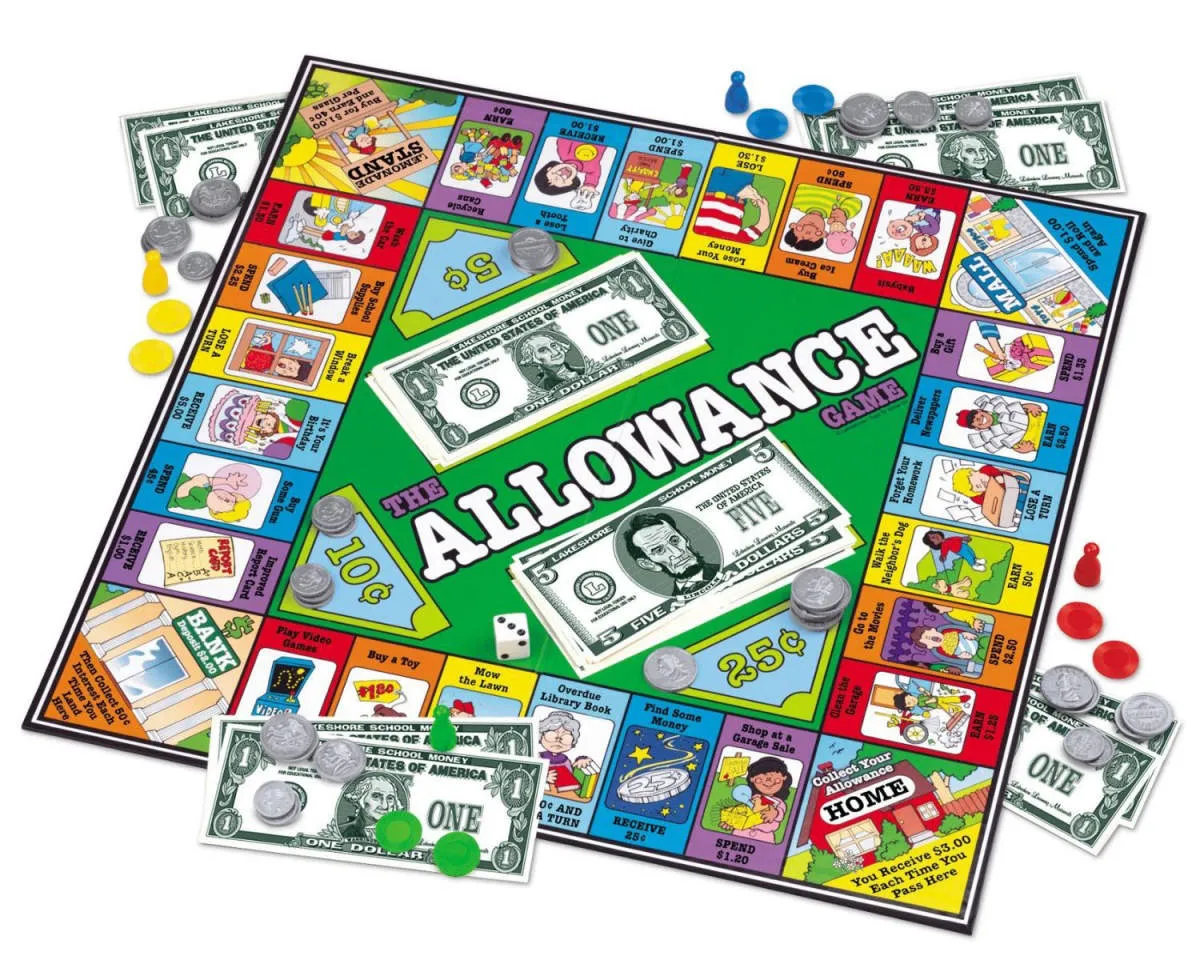

2. Board Games

Many classic board games, like Monopoly or The Game of Life, teach kids about money management, investing, and decision-making in a fun and interactive way.

3. Savings Jar Challenge

Decorate jars together for different savings goals. Make it visual! Every time they receive allowance or earn money, encourage them to divide it among spending, saving, and perhaps even donating.

4. Online Games and Apps

Numerous websites and apps offer educational games specifically designed to teach kids about money. Explore options together and choose ones that match your child’s age and interests.

5. Role-Playing

Engage in pretend play scenarios like “going to the bank” or “paying bills.” This helps them understand the roles money plays in everyday life.

Remember to keep the activities age-appropriate and adjust the complexity as they grow. The key is to make learning about money enjoyable so they develop positive financial habits early on.

Continuing Financial Education as They Grow

As children mature, so should their understanding of money. What works for a five-year-old won’t cut it for a teenager. It’s crucial to adapt your financial education strategies as they navigate new milestones:

Tweens (Ages 9-12)

- Delayed Gratification: Introduce the concept of saving for larger purchases. Help them set a savings goal and track their progress.

- Needs vs. Wants: Differentiating between necessities and desires becomes increasingly important. Discuss the value of prioritizing needs and making informed spending choices.

- Earning Money: Encourage age-appropriate ways to earn money, such as chores beyond regular responsibilities, helping neighbors with yard work, or starting small ventures like lemonade stands or crafting.

Teenagers (Ages 13-18)

- Budgeting: Teach them how to create and stick to a budget. Online budgeting apps or spreadsheets can be helpful tools. Allow them to manage a portion of their own money (like an allowance or earnings) to practice budgeting skills.

- Banking: Open a checking and/or savings account in their name. Explain how to use a debit card responsibly and the importance of tracking their balance.

- Investing: Introduce the concept of investing and how it can grow their money over time. Consider starting with a small investment account where they can learn about different asset classes and track their portfolio’s performance.

- Credit and Debt: Discuss the responsible use of credit cards and the potential pitfalls of debt. Explain credit scores and how they can impact future financial opportunities.

Open Communication: Maintain an open dialogue about money matters. Encourage them to ask questions and share their financial goals. Family dinners or car rides can be great opportunities for casual financial conversations.

Conclusion

Teaching kids about money and saving is crucial for their financial literacy. By starting early and incorporating practical lessons, children can develop smart money habits that will benefit them throughout their lives.